Exam 18: Alternative Views in Macroeconomics

Exam 1: The Scope and Method of Economics65 Questions

Exam 2: The Economic Problem: Scarcity and Choice107 Questions

Exam 3: Demand, Supply, and Market Equilibrium86 Questions

Exam 4: Demand and Supply Applications37 Questions

Exam 5: Introduction to Macroeconomics64 Questions

Exam 6: Measuring National Output and National Income84 Questions

Exam 7: Unemployment, Inflation, and Long-Run Growth81 Questions

Exam 8: Aggregate Expenditure and Equilibrium Output58 Questions

Exam 9: The Government and Fiscal Policy71 Questions

Exam 10: The Money Supply and the Federal Reserve System96 Questions

Exam 11: Money Demand and the Equilibrium Interest Rate96 Questions

Exam 12: The Determination of Aggregate Output, the Price Level, and the Interest Rate100 Questions

Exam 13: Policy Effects and Costs Shocks in the Asad Model89 Questions

Exam 14: The Labor Market in the Macroeconomy111 Questions

Exam 15: Financial Crises, Stabilization, and Deficits102 Questions

Exam 16: Household and Firm Behavior in the Macroeconomy: a Further Look92 Questions

Exam 17: Long-Run Growth59 Questions

Exam 18: Alternative Views in Macroeconomics88 Questions

Exam 19: International Trade, Comparative Advantage, and Protectionism63 Questions

Exam 20: Open-Economy Macroeconomics: the Balance of Payments and Exchange Rates105 Questions

Exam 21: Economic Growth in Developing and Transitional Economies48 Questions

Select questions type

If the demand for money depends on the interest rate what can we say is true about the velocity of money and the quantity theory of money.

(Essay)

4.9/5  (40)

(40)

What do nearly all economists believe to be true about the origins of inflation over the long run? What does this imply about the Federal Reserve's involvement?

(Essay)

4.9/5  (31)

(31)

Assume that the economy is represented by the following function Y = $9 Trillion + $500 billion (P - Pe). Furthermore, assume the current price level is 1.0 and policy makers were able to increase the money supply and drive the price level to 1.1 through a secret meeting. What would be the new level of GDP?

(Essay)

4.9/5  (29)

(29)

Why would time lags between changes in the money supply and its effect on nominal GDP be a factor in measuring the velocity of money? Why would it matter when the velocity o money is measured?

(Essay)

4.9/5  (40)

(40)

What is the New Classical theoretical critique of the existing macroeconomic models based on?

(Essay)

4.9/5  (32)

(32)

Consider a continuously increasing level of government spending (G) without any corresponding increase in taxes. The increases in G keep shifting the AD curve to the right, which leads to an increasing price level (P). (You may find it useful to draw a graph now.) With a fixed money supply, the increases in P lead to a higher and higher interest rate. Why is there a limit to how far this can go?

(Essay)

4.8/5  (30)

(30)

After the experience of the 1970s what do most economists believe is true about fiscal and monetary policy tools?

(Essay)

4.7/5  (30)

(30)

Explain the primary argument against the rational-expectations hypothesis. Explain why it is difficult to test whether or not the assumption of rational expectations is valid.

(Essay)

4.8/5  (36)

(36)

Define the rational-expectations hypothesis. Explain the following statement. A rational-expectations theorist argues that all markets, on average, will settle at equilibrium levels.

(Essay)

4.7/5  (33)

(33)

Assume that the rational-expectations theory is a realistic assumption of how people and firms set their expectations. Indicate the effect of each of the following on the price level and aggregate output.

(a) The Fed announces that it will increase the supply of money.

(b) The government unexpectedly increases government spending.

(Essay)

4.9/5  (29)

(29)

Explain the key concepts of Keynesian economics. Why do Keynesians still support monetary and fiscal policy intervention even though it is clearly not capable of perfectly "fine-tuning" the economy? Define and explain the basic equations of Keynesians and Monetarists. Hint: aggregate expenditures.

(Essay)

4.7/5  (31)

(31)

Why is it that an increasingly expansionary fiscal policy with no increase in taxes must eventually be accommodated by the Fed in order for it to continue?

(Essay)

4.9/5  (32)

(32)

What is the equation for the quantity theory of money?

(a) If the velocity of money is constant and the economy is at capacity, what impact will an increase in the money supply have?

(b) If the velocity of money is constant and the economy is operating below capacity, what impact will an increase in the money supply have?

(Essay)

4.8/5  (36)

(36)

Use the quantity theory of money to answer the following questions. We know that for 1994 this small nation had the following economic data: Ms = $200 billion, P = 3, and V = 2. (Assume output = income and GDP = P × Q.)

(a) What is income for 1994? What is nominal GDP?

(b) By how much would the money supply need to change if income were $400 billion?

(c) If annual GDP growth is 5%, by how much will the Ms need to change in 1995? (Use the GDP figure from Part (a).)

(Essay)

4.9/5  (28)

(28)

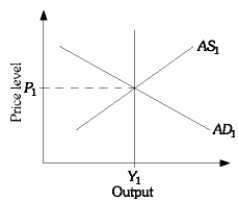

-Refer to the above figure.. According to the new classical economists, what impact on the AD and AS curves would there be under rational expectations of an expected decrease in government spending?

-Refer to the above figure.. According to the new classical economists, what impact on the AD and AS curves would there be under rational expectations of an expected decrease in government spending?

(Short Answer)

4.8/5  (33)

(33)

What did early economists believe to be true about the velocity of money and why?

(Essay)

4.8/5  (33)

(33)

Assume that households and firms have rational expectations. The current unemployment rate is 7%, which is above the full-employment rate of unemployment. Explain how this can happen. Would you expect this unemployment rate to persist for long? Why or why not?

(Essay)

4.9/5  (35)

(35)

The debate between Keynesians and monetarists was perhaps the central controversy in macroeconomics in the 1960s. The leading spokesman for monetarism was Milton Friedman from the University of Chicago. Where did Friedman put the blame and why?

(Essay)

4.9/5  (42)

(42)

Showing 61 - 80 of 88

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)