Exam 20: Uncertainty, Risk, and Private Information

Exam 1: First Principles199 Questions

Exam 2: Economic Models: Trade-Offs and Trade299 Questions

Exam 4: Consumer and Producer Surplus229 Questions

Exam 3: Supply and Demand265 Questions

Exam 5: Price Controls and Quotas: Meddling With Markets216 Questions

Exam 6: Elasticity226 Questions

Exam 7: Taxes286 Questions

Exam 8: International Trade260 Questions

Exam 9: Decision Making by Individuals and Firms186 Questions

Exam 10: The Rational Consumer182 Questions

Exam 11: Behind the Supply Curve: Inputs and Costs317 Questions

Exam 12: Perfect Competition and the Supply Curve341 Questions

Exam 13: Monopoly317 Questions

Exam 14: Oligopoly271 Questions

Exam 15: Monopolistic Competition and Product Differentiation245 Questions

Exam 16: Externalities193 Questions

Exam 17: Public Goods and Common Resources208 Questions

Exam 18: The Economics of the Welfare State126 Questions

Exam 19: Factor Markets and the Distribution of Income316 Questions

Exam 20: Uncertainty, Risk, and Private Information192 Questions

Exam 21: Graphs in Economics60 Questions

Exam 22: Consumer Preferences and Consumer Choice135 Questions

Select questions type

Sellers of used cars may have private information to which buyers are not privy.This knowledge of private information does NOT lead to:

(Multiple Choice)

4.8/5  (38)

(38)

(Scenario: Flood Area)Use Scenario: Flood Area.Suppose that an insurance company offers you flood insurance.MOST likely,this insurance would require a premium payment: Scenario: Flood Area

Suppose that you own a home that is estimated to be worth $250,000.You live in a flood plain;as a result,the probability that you will lose your home to a flood is 30%.

(Multiple Choice)

5.0/5  (40)

(40)

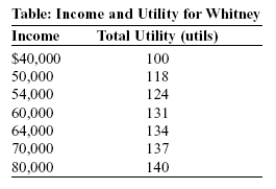

Use the following to answer question:  -(Table: Income and Utility for Whitney)Use Table: Income and Utility for Whitney.Whitney's income next year is uncertain: there is a 40% probability she will make $40,000 and a 60% probability she will make $80,000.What certain income leaves Whitney as well off as her uncertain income?

-(Table: Income and Utility for Whitney)Use Table: Income and Utility for Whitney.Whitney's income next year is uncertain: there is a 40% probability she will make $40,000 and a 60% probability she will make $80,000.What certain income leaves Whitney as well off as her uncertain income?

(Multiple Choice)

4.8/5  (35)

(35)

At the end of the 1980s,Lloyd's of London was in severe financial trouble because of:

(Multiple Choice)

4.8/5  (36)

(36)

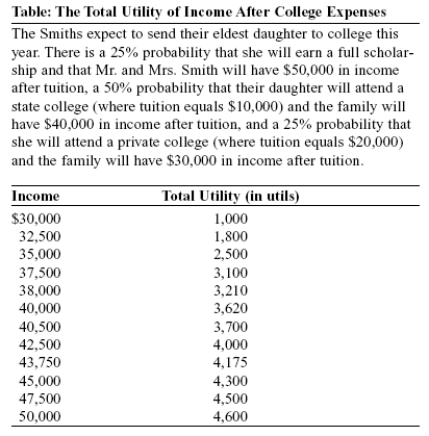

Use the following to answer question:  -(Table: The Total Utility of Income After College Expenses)Use Table: The Total Utility of Income After College Expenses.The Smith family's expected total utility is _____ utils.

-(Table: The Total Utility of Income After College Expenses)Use Table: The Total Utility of Income After College Expenses.The Smith family's expected total utility is _____ utils.

(Multiple Choice)

4.7/5  (38)

(38)

You are about to have a meeting with your manager about a raise in your salary.You are going to request an increase of $5,000,but you believe the probability of success to be only 25%.You believe there is a 25% probability your boss will counter with a $3,000 raise and a 25% probability that your boss will offer a $1,000 raise.Finally,there is a 25% probability that you will receive no increase in your salary.What is the expected value of the outcome of your meeting?

(Multiple Choice)

4.9/5  (38)

(38)

Assume that flood insurance premiums are determined in the competitive market.Suppose that devastating floods along the Mississippi River have increased the degree of risk aversion among the insurance investors in this market.The _____ insurance shifts _____,leading to a(n)_____ in equilibrium premiums and a(n)_____ in the quantity of insurance bought and sold.

(Multiple Choice)

4.9/5  (39)

(39)

In practice,insurance companies faced with adverse selection use _____ to deal with it.

(Multiple Choice)

4.9/5  (45)

(45)

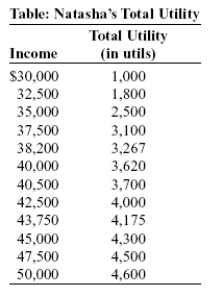

Use the following to answer question:  -(Table: Natasha's Total Utility)Use Table: Natasha's Total Utility.Natasha earns $50,000 per year but faces losing $20,000 of it if she is late with her work.If there is a 25% probability that Natasha will be late with her work and her income will equal $30,000,the premium for a fair insurance policy to eliminate the uncertainty in her income would equal:

-(Table: Natasha's Total Utility)Use Table: Natasha's Total Utility.Natasha earns $50,000 per year but faces losing $20,000 of it if she is late with her work.If there is a 25% probability that Natasha will be late with her work and her income will equal $30,000,the premium for a fair insurance policy to eliminate the uncertainty in her income would equal:

(Multiple Choice)

4.8/5  (36)

(36)

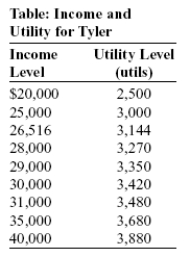

Use the following to answer question:  -(Table: Income and Utility for Tyler)Use Table: Income and Utility for Tyler.The table shows the utility Tyler receives at various income levels,but she does not know what her income will be next year.There is a 40% chance her income will be $20,000,a 40% chance her income will be $30,000,and a 20% chance her income will be $40,000.We know that Tyler is risk-averse because:

-(Table: Income and Utility for Tyler)Use Table: Income and Utility for Tyler.The table shows the utility Tyler receives at various income levels,but she does not know what her income will be next year.There is a 40% chance her income will be $20,000,a 40% chance her income will be $30,000,and a 20% chance her income will be $40,000.We know that Tyler is risk-averse because:

(Multiple Choice)

4.8/5  (37)

(37)

Showing 181 - 192 of 192

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)