Exam 20: Uncertainty, Risk, and Private Information

Exam 1: First Principles199 Questions

Exam 2: Economic Models: Trade-Offs and Trade299 Questions

Exam 4: Consumer and Producer Surplus229 Questions

Exam 3: Supply and Demand265 Questions

Exam 5: Price Controls and Quotas: Meddling With Markets216 Questions

Exam 6: Elasticity226 Questions

Exam 7: Taxes286 Questions

Exam 8: International Trade260 Questions

Exam 9: Decision Making by Individuals and Firms186 Questions

Exam 10: The Rational Consumer182 Questions

Exam 11: Behind the Supply Curve: Inputs and Costs317 Questions

Exam 12: Perfect Competition and the Supply Curve341 Questions

Exam 13: Monopoly317 Questions

Exam 14: Oligopoly271 Questions

Exam 15: Monopolistic Competition and Product Differentiation245 Questions

Exam 16: Externalities193 Questions

Exam 17: Public Goods and Common Resources208 Questions

Exam 18: The Economics of the Welfare State126 Questions

Exam 19: Factor Markets and the Distribution of Income316 Questions

Exam 20: Uncertainty, Risk, and Private Information192 Questions

Exam 21: Graphs in Economics60 Questions

Exam 22: Consumer Preferences and Consumer Choice135 Questions

Select questions type

If an insurance company insured 100,000 cars across the state against theft,which statement would NOT be true?

(Multiple Choice)

4.7/5  (31)

(31)

Suppose that the probability of a major theft at a hotel is 1%,while the probability of an earthquake hitting the hotel is 2.3%.The probability that both would occur on the same day is therefore:

(Multiple Choice)

4.8/5  (31)

(31)

Insurance companies attempt to minimize moral hazard by imposing:

(Multiple Choice)

4.9/5  (36)

(36)

The Conduire family owns three cars and is considering buying insurance to cover the cost of repairs.They face two possible states: state 1,in which their cars need no repairs and their income available for purchasing other goods and services is equal to $50,000;and state 2,in which their cars need $10,000 worth of repairs and their income available for purchasing other goods and services is reduced to $40,000.The probability of occurrence is 0.5 for each state.They can buy insurance that will cover the full cost of repairs for $5,000.If the Conduires are risk-averse and maximize their expected utility,they will:

(Multiple Choice)

4.8/5  (40)

(40)

By offering a menu of policies with different premiums and deductibles,insurance companies can _____ their customers;for example,a low-risk customer will often buy insurance with a lower _____ but a higher _____ than a high-risk customer.

(Multiple Choice)

4.8/5  (35)

(35)

An individual can almost eliminate risk by taking a small share in many independent events or by taking advantage of the predictability associated with large numbers of independent events.This strategy is known as:

(Multiple Choice)

4.9/5  (36)

(36)

A fair insurance policy is one in which the premium equals the expected value of the claim.

(True/False)

4.8/5  (37)

(37)

Barcelona and Los Angeles are similar,except Barcelona has a good public transportation system and Los Angeles does not.Auto insurance will probably be more expensive in _____ since the _____ for insurance is _____.

(Multiple Choice)

4.8/5  (48)

(48)

On any particular day,the probability that it will rain is 25% and that you will be sick is 10%.The probability that both happen on the same day is _____%.

(Multiple Choice)

4.8/5  (41)

(41)

Buying a warranty on a new television is an example of paying to avoid risk.

(True/False)

4.8/5  (35)

(35)

Common strategies to deal with the problem of adverse selection include screening (using observable information to make inferences about private information),signaling (engaging in actions that reveal one's private information),and establishing a good reputation.

(True/False)

4.8/5  (29)

(29)

(Scenario: Health Costs)Use Scenario: Health Costs.Suppose that Alan decides to change his habits dramatically and,as a result,decreases the probability of his developing a health problem such that he now has a 20% chance of becoming ill.What is the expected value of Alan's health costs now? Scenario: Health Costs

Alan is hoping for a healthy year,meaning that he would have zero health costs.Given his habits,there is a 40% chance that Alan will develop a health issue resulting in $50,000 in health costs.Assume these are the only two conditions that could exist for Alan in the coming year.

(Multiple Choice)

4.9/5  (38)

(38)

In a particular insurance market,there is a decrease in the degree of risk aversion among suppliers.Holding everything else constant,the equilibrium premium will _____ and the equilibrium quantity of insurance will _____.

(Multiple Choice)

4.9/5  (37)

(37)

Suppose that a person rolls a typical six-sided die.What is the probability that the die will come up with a 1 and then a 2?

(Multiple Choice)

4.8/5  (35)

(35)

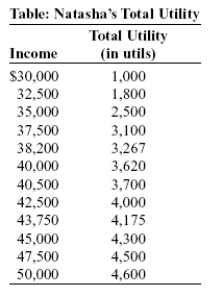

Use the following to answer question:  -(Table: Natasha's Total Utility)Use Table: Natasha's Total Utility.Natasha's marginal utility _____ as her income increases.The marginal utility of income between $30,000 and $32,500 is _____ utils per dollar,while it is _____ utils per dollar between $47,500 and $50,000.

-(Table: Natasha's Total Utility)Use Table: Natasha's Total Utility.Natasha's marginal utility _____ as her income increases.The marginal utility of income between $30,000 and $32,500 is _____ utils per dollar,while it is _____ utils per dollar between $47,500 and $50,000.

(Multiple Choice)

4.8/5  (42)

(42)

(Scenario: Buying Shares)Use Scenario: Buying Shares.The probability that Geordie will sustain a loss is _____% if he invests $1,000 in either Apple or Microsoft and _____% if he invests $500 apiece in Apple and in Microsoft. Scenario: Buying Shares

Geordie is considering buying shares in two companies,Apple and Microsoft.If he invests $1,000 in Apple,there is a 40% probability that his investment will be worth only $800 and a 60% probability that it will be worth $1,200 at the end of a year.If he invests $500 in Apple,there is a 40% probability that his investment will be worth $400 and a 60% probability that it will be worth $600 at the end of a year.The corresponding numbers for investment in Microsoft are identical.

(Multiple Choice)

4.8/5  (40)

(40)

People faced with adverse selection use _____ to deal with it.

(Multiple Choice)

4.8/5  (26)

(26)

(Scenario: Diversification)Use Scenario: Diversification.If Morris invests half of his money in the sunglass company and half in the rain poncho company,he will earn _____ in a sunny year and _____ in a rainy year. Scenario: Diversification

Morris is considering investing $10,000 in a sunglass company or a rain poncho company.If it is a rainy year and he invests only in the sunglass company,he will lose $5,000.However,if it is a rainy year and he invests only in the rain poncho company,he will earn $10,000.If it is a sunny year and he invests only in the sunglass company,he will earn $10,000;if he invests only in the rain poncho company,he will lose $5,000 in a sunny year.There is a 50% chance of a sunny year and a 50% chance of a rainy year.

(Multiple Choice)

4.7/5  (31)

(31)

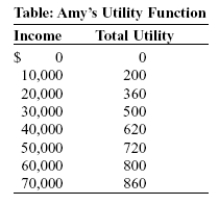

Use the following to answer question:  -(Table: Amy's Utility Function)Use Table: Amy's Utility Function.Amy is an entrepreneur with current income equal to $40,000.Amy is considering development of a new product.The probability that her new product earns Amy $10,000 in additional income is 0.5,and the probability that Amy incurs a reduction of $10,000 from her current income is also 0.5.Suppose Amy can buy a fair insurance policy that will compensate her for any losses.Amy's premium will be _____,her guaranteed income will be _____,and her expected utility will be _____ utils.

-(Table: Amy's Utility Function)Use Table: Amy's Utility Function.Amy is an entrepreneur with current income equal to $40,000.Amy is considering development of a new product.The probability that her new product earns Amy $10,000 in additional income is 0.5,and the probability that Amy incurs a reduction of $10,000 from her current income is also 0.5.Suppose Amy can buy a fair insurance policy that will compensate her for any losses.Amy's premium will be _____,her guaranteed income will be _____,and her expected utility will be _____ utils.

(Multiple Choice)

4.8/5  (38)

(38)

Showing 101 - 120 of 192

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)