Exam 20: Uncertainty, Risk, and Private Information

Exam 1: First Principles199 Questions

Exam 2: Economic Models: Trade-Offs and Trade299 Questions

Exam 4: Consumer and Producer Surplus229 Questions

Exam 3: Supply and Demand265 Questions

Exam 5: Price Controls and Quotas: Meddling With Markets216 Questions

Exam 6: Elasticity226 Questions

Exam 7: Taxes286 Questions

Exam 8: International Trade260 Questions

Exam 9: Decision Making by Individuals and Firms186 Questions

Exam 10: The Rational Consumer182 Questions

Exam 11: Behind the Supply Curve: Inputs and Costs317 Questions

Exam 12: Perfect Competition and the Supply Curve341 Questions

Exam 13: Monopoly317 Questions

Exam 14: Oligopoly271 Questions

Exam 15: Monopolistic Competition and Product Differentiation245 Questions

Exam 16: Externalities193 Questions

Exam 17: Public Goods and Common Resources208 Questions

Exam 18: The Economics of the Welfare State126 Questions

Exam 19: Factor Markets and the Distribution of Income316 Questions

Exam 20: Uncertainty, Risk, and Private Information192 Questions

Exam 21: Graphs in Economics60 Questions

Exam 22: Consumer Preferences and Consumer Choice135 Questions

Select questions type

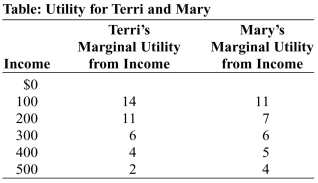

Use the following to answer question:  -(Table: Utility for Terri and Mary)Use Table: Utility for Terri and Mary.Each has an income of $300._____ is more risk-averse because _____ has a _____ drop in total utility if income were to fall by $100.

-(Table: Utility for Terri and Mary)Use Table: Utility for Terri and Mary.Each has an income of $300._____ is more risk-averse because _____ has a _____ drop in total utility if income were to fall by $100.

(Multiple Choice)

4.7/5  (38)

(38)

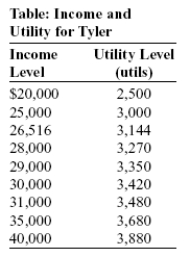

Use the following to answer question:  -(Table: Income and Utility for Tyler)Use Table: Income and Utility for Tyler.The table shows the utility Tyler receives at various income levels,but she does not know what her income will be next year.There is a 40% chance her income will be $20,000,a 40% chance her income will be $30,000,and a 20% chance her income will be $40,000.What is her expected utility in utils?

-(Table: Income and Utility for Tyler)Use Table: Income and Utility for Tyler.The table shows the utility Tyler receives at various income levels,but she does not know what her income will be next year.There is a 40% chance her income will be $20,000,a 40% chance her income will be $30,000,and a 20% chance her income will be $40,000.What is her expected utility in utils?

(Multiple Choice)

4.7/5  (34)

(34)

You insure your car against theft.Consequently,you rarely lock the car.This example illustrates the problem of:

(Multiple Choice)

4.9/5  (42)

(42)

Use the following to answer question:  -(Scenario: Choosing Insurance)Use Scenario: Choosing Insurance.For $900,the Ramirez family can buy insurance that will cover the full cost of repairs.If family members are risk-averse and maximize their expected utility,they will: Scenario: Choosing Insurance

The Ramirez family owns three cars and is considering buying insurance to cover the cost of repairs.They face two possible states: in state 1,their cars need no repairs and their income available for purchasing other goods and services is $50,000;in state 2,their cars need $10,000 worth of repairs and their income available for purchasing other goods and services is reduced to $40,000.The probability of repairs is 10%,while the probability of no repairs is 90%.

-(Scenario: Choosing Insurance)Use Scenario: Choosing Insurance.For $900,the Ramirez family can buy insurance that will cover the full cost of repairs.If family members are risk-averse and maximize their expected utility,they will: Scenario: Choosing Insurance

The Ramirez family owns three cars and is considering buying insurance to cover the cost of repairs.They face two possible states: in state 1,their cars need no repairs and their income available for purchasing other goods and services is $50,000;in state 2,their cars need $10,000 worth of repairs and their income available for purchasing other goods and services is reduced to $40,000.The probability of repairs is 10%,while the probability of no repairs is 90%.

(Multiple Choice)

4.9/5  (39)

(39)

(Scenario: Health Costs)Use Scenario: Health Costs.When Alan's probability of developing a health problem decreases,holding everything else constant,Alan's expected value of health care costs: Scenario: Health Costs

Alan is hoping for a healthy year,meaning that he would have zero health costs.Given his habits,there is a 40% chance that Alan will develop a health issue resulting in $50,000 in health costs.Assume these are the only two conditions that could exist for Alan in the coming year.

(Multiple Choice)

5.0/5  (48)

(48)

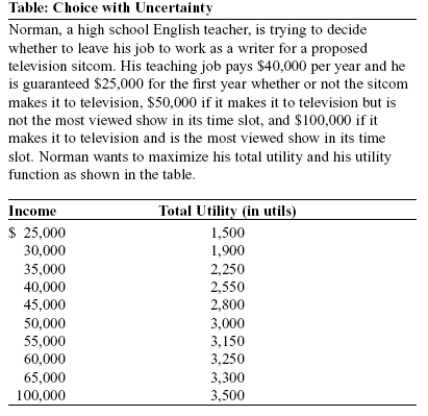

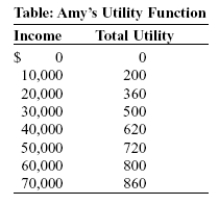

Use the following to answer question:  -(Table: Amy's Utility Function)Use Table: Amy's Utility Function.Amy is an entrepreneur with current income equal to $40,000.Amy is considering development of a new product.The probability that her new product earns Amy $30,000 in additional income is 0.5,and the probability that Amy incurs a reduction of $10,000 from her current income is also 0.5.Amy's expected utility after developing her new product is _____ utils.

-(Table: Amy's Utility Function)Use Table: Amy's Utility Function.Amy is an entrepreneur with current income equal to $40,000.Amy is considering development of a new product.The probability that her new product earns Amy $30,000 in additional income is 0.5,and the probability that Amy incurs a reduction of $10,000 from her current income is also 0.5.Amy's expected utility after developing her new product is _____ utils.

(Multiple Choice)

4.8/5  (36)

(36)

Risk-averse individuals are willing to pay a premium that is _____ their expected claims.

(Multiple Choice)

4.9/5  (38)

(38)

(Scenario: Used-Car Market)Use Scenario: Used-Car Market.Adverse selection in this used-car market occurs because of: Scenario: Used-Car Market

In the used-car market,cars of poor quality are called lemons,while cars of good quality are called plums.Suppose that the probability of obtaining a lemon is 60% and the probability of obtaining a plum is 40%.Also,assume that a plum is worth $15,000 and a lemon is worth $3,000.

(Multiple Choice)

4.7/5  (44)

(44)

_____ of insurance are often risk-averse,and _____ of insurance are interested in reducing their exposure to risk.

(Multiple Choice)

4.7/5  (43)

(43)

Amanda recently graduated from college,and she has a job offer with uncertain income: there is a 70% probability that she will make $10,000 and a 30% probability that she will make $70,000.The expected value of Amanda's income is:

(Multiple Choice)

4.8/5  (34)

(34)

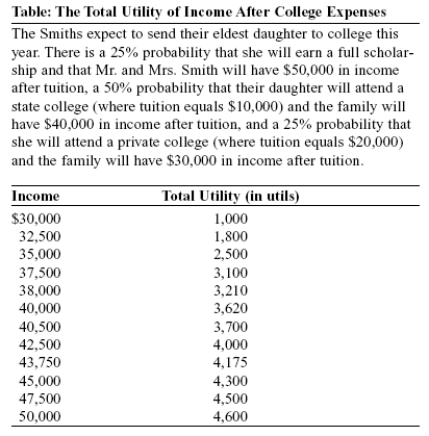

Use the following to answer question:  -(Table: The Total Utility of Income After College Expenses)Use Table: The Total Utility of Income After College Expenses.The Smith family will choose to purchase insurance:

-(Table: The Total Utility of Income After College Expenses)Use Table: The Total Utility of Income After College Expenses.The Smith family will choose to purchase insurance:

(Multiple Choice)

4.9/5  (40)

(40)

Economic growth that is not industry-specific is MOST likely to:

(Multiple Choice)

4.9/5  (42)

(42)

(Scenario: Flood Area)Use Scenario: Flood Area.A flood may occur,causing you to lose your entire home.In this case,your expected loss resulting from the flood would be: Scenario: Flood Area

Suppose that you own a home that is estimated to be worth $250,000.You live in a flood plain;as a result,the probability that you will lose your home to a flood is 30%.

(Multiple Choice)

4.9/5  (31)

(31)

(Scenario: Buying Shares)Use Scenario: Buying Shares.The probability that Geordie will make a gain is _____% if he invests $1,000 in either Apple or Microsoft.The probability that he will make a gain is _____% if he invests $500 apiece in Apple and in Microsoft. Scenario: Buying Shares

Geordie is considering buying shares in two companies,Apple and Microsoft.If he invests $1,000 in Apple,there is a 40% probability that his investment will be worth only $800 and a 60% probability that it will be worth $1,200 at the end of a year.If he invests $500 in Apple,there is a 40% probability that his investment will be worth $400 and a 60% probability that it will be worth $600 at the end of a year.The corresponding numbers for investment in Microsoft are identical.

(Multiple Choice)

4.8/5  (43)

(43)

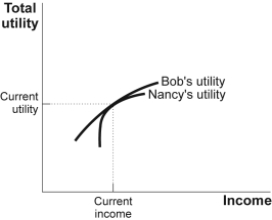

Use the following to answer question:

Figure: Risk Aversion  -(Figure: Risk Aversion)Use Figure: Risk Aversion.Bob and Nancy have the same income and total utility.Nancy will be willing to pay a _____ insurance premium than is Bob because she is _____ risk-averse.

-(Figure: Risk Aversion)Use Figure: Risk Aversion.Bob and Nancy have the same income and total utility.Nancy will be willing to pay a _____ insurance premium than is Bob because she is _____ risk-averse.

(Multiple Choice)

4.7/5  (39)

(39)

Showing 161 - 180 of 192

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)