Exam 20: Uncertainty, Risk, and Private Information

Exam 1: First Principles199 Questions

Exam 2: Economic Models: Trade-Offs and Trade299 Questions

Exam 4: Consumer and Producer Surplus229 Questions

Exam 3: Supply and Demand265 Questions

Exam 5: Price Controls and Quotas: Meddling With Markets216 Questions

Exam 6: Elasticity226 Questions

Exam 7: Taxes286 Questions

Exam 8: International Trade260 Questions

Exam 9: Decision Making by Individuals and Firms186 Questions

Exam 10: The Rational Consumer182 Questions

Exam 11: Behind the Supply Curve: Inputs and Costs317 Questions

Exam 12: Perfect Competition and the Supply Curve341 Questions

Exam 13: Monopoly317 Questions

Exam 14: Oligopoly271 Questions

Exam 15: Monopolistic Competition and Product Differentiation245 Questions

Exam 16: Externalities193 Questions

Exam 17: Public Goods and Common Resources208 Questions

Exam 18: The Economics of the Welfare State126 Questions

Exam 19: Factor Markets and the Distribution of Income316 Questions

Exam 20: Uncertainty, Risk, and Private Information192 Questions

Exam 21: Graphs in Economics60 Questions

Exam 22: Consumer Preferences and Consumer Choice135 Questions

Select questions type

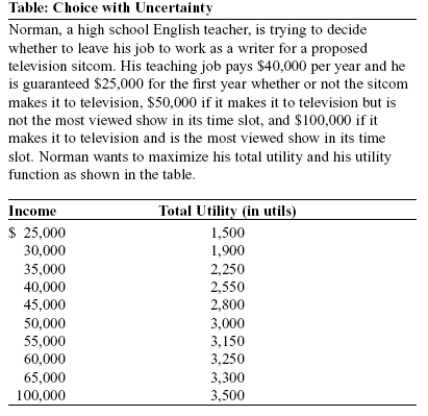

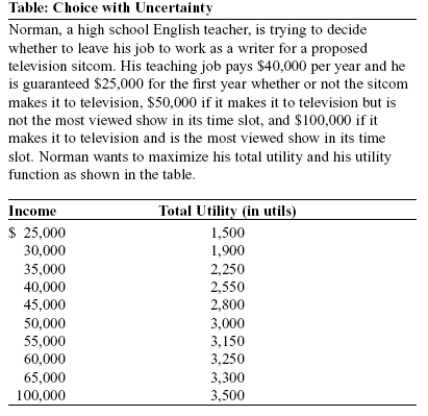

Use the following to answer question:  -(Table: Choice with Uncertainty)Use Table: Choice with Uncertainty.Suppose that the probability that the sitcom does not make it to television is 30%,that it makes it to television but is not the most viewed show in its time slot is 50%,and that it makes it to television and is the most viewed show in its time slot is 20%.Given this information,Norman's expected income is:

-(Table: Choice with Uncertainty)Use Table: Choice with Uncertainty.Suppose that the probability that the sitcom does not make it to television is 30%,that it makes it to television but is not the most viewed show in its time slot is 50%,and that it makes it to television and is the most viewed show in its time slot is 20%.Given this information,Norman's expected income is:

(Multiple Choice)

5.0/5  (39)

(39)

As a result of frequent flooding,the insurance market has noted a positive correlation between flooding and the amount of insurance monies paid out for such floods.Moreover,the probability of such flooding has been increasing.As a result,homeowners in flood plains will find that flood insurance:

(Multiple Choice)

4.7/5  (38)

(38)

Through insurance and other devices,the modern economy offers many ways for individuals to reduce their exposure to risk.

(True/False)

5.0/5  (39)

(39)

(Scenario: Diversification)Use Scenario: Diversification.If Morris invests half of his money in the sunglass company and half in the rain poncho company,what is his expected gain or loss? Scenario: Diversification

Morris is considering investing $10,000 in a sunglass company or a rain poncho company.If it is a rainy year and he invests only in the sunglass company,he will lose $5,000.However,if it is a rainy year and he invests only in the rain poncho company,he will earn $10,000.If it is a sunny year and he invests only in the sunglass company,he will earn $10,000;if he invests only in the rain poncho company,he will lose $5,000 in a sunny year.There is a 50% chance of a sunny year and a 50% chance of a rainy year.

(Multiple Choice)

4.8/5  (37)

(37)

The marginal utility of income for a risk-averse individual will be:

(Multiple Choice)

4.8/5  (33)

(33)

Use the following to answer question:  -(Table: Choice with Uncertainty)Use Table: Choice with Uncertainty.Suppose that the probability that the sitcom does not make it to television is 30%,that it makes it to television but is not the most viewed show in its time slot is 50%,and that it makes it to television and is the most viewed show in its time slot is 20%.Given this information,Norman's expected total utility is _____ utils.

-(Table: Choice with Uncertainty)Use Table: Choice with Uncertainty.Suppose that the probability that the sitcom does not make it to television is 30%,that it makes it to television but is not the most viewed show in its time slot is 50%,and that it makes it to television and is the most viewed show in its time slot is 20%.Given this information,Norman's expected total utility is _____ utils.

(Multiple Choice)

4.9/5  (48)

(48)

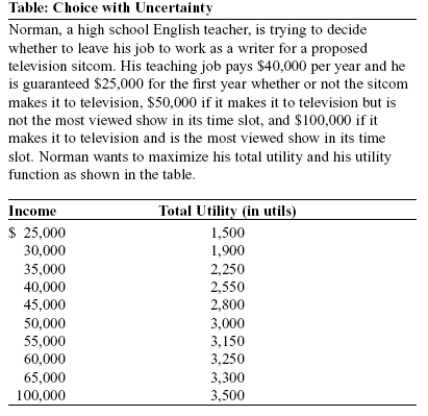

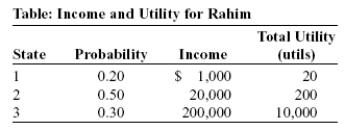

Use the following to answer question:  -(Table: Income and Utility for Rahim)Use Table: Income and Utility for Rahim.Rahim's expected utility from income is _____ utils.

-(Table: Income and Utility for Rahim)Use Table: Income and Utility for Rahim.Rahim's expected utility from income is _____ utils.

(Multiple Choice)

4.8/5  (35)

(35)

(Scenario: Diversification)Use Scenario: Diversification.If Morris invests all of his money in the sunglass company,what is his expected gain or loss? Scenario: Diversification

Morris is considering investing $10,000 in a sunglass company or a rain poncho company.If it is a rainy year and he invests only in the sunglass company,he will lose $5,000.However,if it is a rainy year and he invests only in the rain poncho company,he will earn $10,000.If it is a sunny year and he invests only in the sunglass company,he will earn $10,000;if he invests only in the rain poncho company,he will lose $5,000 in a sunny year.There is a 50% chance of a sunny year and a 50% chance of a rainy year.

(Multiple Choice)

4.8/5  (31)

(31)

Suppose that the wealth of buyers in the insurance market falls.We would expect insurance premiums to _____ as the _____ curve shifts _____.

(Multiple Choice)

4.8/5  (36)

(36)

Risk-averse individuals will always buy insurance,regardless of the premiums charged.

(True/False)

4.9/5  (42)

(42)

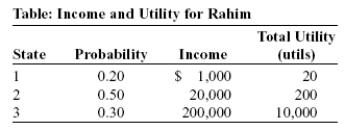

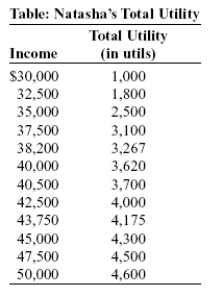

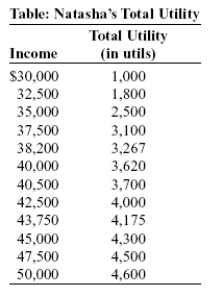

Use the following to answer question:  -(Table: Natasha's Total Utility)Use Table: Natasha's Total Utility.Natasha earns $50,000 per year but faces losing $20,000 of it if she is late with her work.If there is a 25% probability that Natasha will be late with her work and her income will then equal $30,000,her expected income is:

-(Table: Natasha's Total Utility)Use Table: Natasha's Total Utility.Natasha earns $50,000 per year but faces losing $20,000 of it if she is late with her work.If there is a 25% probability that Natasha will be late with her work and her income will then equal $30,000,her expected income is:

(Multiple Choice)

4.7/5  (42)

(42)

Which pair of events is likely to be positively correlated?

(Multiple Choice)

4.9/5  (43)

(43)

A life insurance company will often require an applicant to submit to a brief physical exam to assess that person's basic level of health.This practice is a form of _____ to lessen the problem of _____.

(Multiple Choice)

4.8/5  (38)

(38)

Use the following to answer question:  -(Table: Income and Utility for Rahim)Use Table: Income and Utility for Rahim.The expected value of Rahim's income is:

-(Table: Income and Utility for Rahim)Use Table: Income and Utility for Rahim.The expected value of Rahim's income is:

(Multiple Choice)

4.8/5  (44)

(44)

Which statement is TRUE if the insurance market is efficient?

(Multiple Choice)

4.8/5  (34)

(34)

Use the following to answer question:  -(Table: Natasha's Total Utility)Use Table: Natasha's Total Utility.Natasha earns $50,000 per year but faces losing $20,000 of it if she is late with her work.If there is a 25% probability that Natasha will be late with her work and her income will equal $30,000,To guarantee an income of $50,000,Natasha would be willing to pay _____ for insurance.

-(Table: Natasha's Total Utility)Use Table: Natasha's Total Utility.Natasha earns $50,000 per year but faces losing $20,000 of it if she is late with her work.If there is a 25% probability that Natasha will be late with her work and her income will equal $30,000,To guarantee an income of $50,000,Natasha would be willing to pay _____ for insurance.

(Multiple Choice)

4.9/5  (34)

(34)

In a particular insurance market,there is a decrease in the degree of risk aversion among buyers.Holding everything else constant,the equilibrium premium will _____ and the equilibrium quantity of insurance will _____.

(Multiple Choice)

4.9/5  (37)

(37)

Use the following to answer question:  -(Table: Choice with Uncertainty)Use Table: Choice with Uncertainty.Suppose that the probability that the sitcom does not make it to television is 50%,that it makes it to television but is not the most viewed show in its time slot is 30%,and that it makes it to television and is the most viewed show in its time slot is 20%.Given this information,Norman,as a utility maximizer:

-(Table: Choice with Uncertainty)Use Table: Choice with Uncertainty.Suppose that the probability that the sitcom does not make it to television is 50%,that it makes it to television but is not the most viewed show in its time slot is 30%,and that it makes it to television and is the most viewed show in its time slot is 20%.Given this information,Norman,as a utility maximizer:

(Multiple Choice)

4.8/5  (38)

(38)

Showing 121 - 140 of 192

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)