Exam 20: Uncertainty, Risk, and Private Information

Exam 1: First Principles199 Questions

Exam 2: Economic Models: Trade-Offs and Trade299 Questions

Exam 4: Consumer and Producer Surplus229 Questions

Exam 3: Supply and Demand265 Questions

Exam 5: Price Controls and Quotas: Meddling With Markets216 Questions

Exam 6: Elasticity226 Questions

Exam 7: Taxes286 Questions

Exam 8: International Trade260 Questions

Exam 9: Decision Making by Individuals and Firms186 Questions

Exam 10: The Rational Consumer182 Questions

Exam 11: Behind the Supply Curve: Inputs and Costs317 Questions

Exam 12: Perfect Competition and the Supply Curve341 Questions

Exam 13: Monopoly317 Questions

Exam 14: Oligopoly271 Questions

Exam 15: Monopolistic Competition and Product Differentiation245 Questions

Exam 16: Externalities193 Questions

Exam 17: Public Goods and Common Resources208 Questions

Exam 18: The Economics of the Welfare State126 Questions

Exam 19: Factor Markets and the Distribution of Income316 Questions

Exam 20: Uncertainty, Risk, and Private Information192 Questions

Exam 21: Graphs in Economics60 Questions

Exam 22: Consumer Preferences and Consumer Choice135 Questions

Select questions type

The pooling of risk is a _____ form of diversification that produces a payoff with a very _____ risk.

(Multiple Choice)

4.8/5  (45)

(45)

Suppose that an individual is risk-averse.If this individual's utility function is depicted in a graph,with income measured on the horizontal axis and utils on the vertical axis,the graph will be an upward-sloping:

(Multiple Choice)

4.9/5  (35)

(35)

Private information leads _____ to expect hidden problems in items offered for sale,leading to _____ prices and to the best items being kept off the market.

(Multiple Choice)

4.9/5  (30)

(30)

When an individual knows more about his or her own actions than other people do,incentives are distorted,which causes:

(Multiple Choice)

5.0/5  (35)

(35)

The strategy of investing in several assets so that any possible losses are independent events is:

(Multiple Choice)

4.9/5  (39)

(39)

Companies offering life insurance often require a drug test to determine whether the buyer is a smoker.A smoker must pay a higher premium.This is an example of:

(Multiple Choice)

4.9/5  (44)

(44)

An individual finds that,as their income increases,their total utility also increases,but at a decreasing rate.This occurrence can be attributed to:

(Multiple Choice)

4.8/5  (31)

(31)

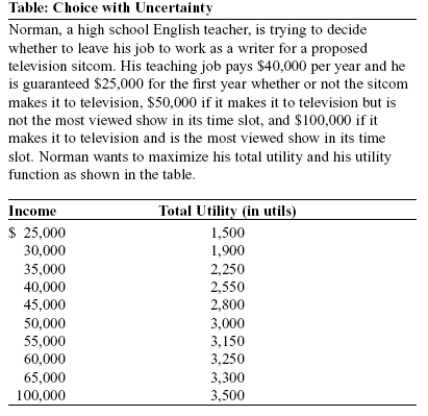

Use the following to answer question:  -(Table: Choice with Uncertainty)Use Table: Choice with Uncertainty.Suppose that the probability that the sitcom does not make it to television is 60%,that it makes it to television but is not the most viewed show in its time slot is 30%,and that it makes it to television and is the most viewed show in its time slot is 10%.As a utility maximizer,Norman:

-(Table: Choice with Uncertainty)Use Table: Choice with Uncertainty.Suppose that the probability that the sitcom does not make it to television is 60%,that it makes it to television but is not the most viewed show in its time slot is 30%,and that it makes it to television and is the most viewed show in its time slot is 10%.As a utility maximizer,Norman:

(Multiple Choice)

4.9/5  (34)

(34)

Insurance premiums often fall substantially if a buyer purchases a policy with a high deductible,and such a policy is often purchased by individuals who self-identify as:

(Multiple Choice)

4.7/5  (35)

(35)

Mary and Bob are trying to decide how much auto insurance to buy.They share the same expectations of an accident,with the same dollar loss.They also have the same income levels.However,Mary would rather buy very little insurance,while Bob would rather buy much more insurance.This suggests that:

(Multiple Choice)

5.0/5  (34)

(34)

Investors in agricultural corporations face many correlated financial risks.Which example does NOT illustrate correlated risks for the agricultural industry?

(Multiple Choice)

4.9/5  (35)

(35)

An efficient allocation of risk occurs when those most willing to bear risk insure those who are least willing to bear risk.

(True/False)

4.8/5  (41)

(41)

The wealthy are generally more risk-averse than the poor,since the wealthy have more to lose.

(True/False)

4.8/5  (35)

(35)

The funds that an insurance company may have to pay out are known as the:

(Multiple Choice)

4.9/5  (26)

(26)

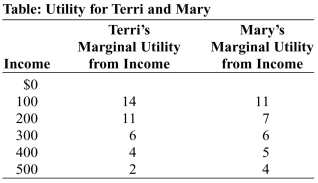

Use the following to answer question:  -(Table: Utility for Terri and Mary)Use Table: Utility for Terri and Mary.Each has an income of $300.If each were offered insurance to offset the risk of falling income,_____ would pay a larger premium because she is the consumer with _____ risk aversion.

-(Table: Utility for Terri and Mary)Use Table: Utility for Terri and Mary.Each has an income of $300.If each were offered insurance to offset the risk of falling income,_____ would pay a larger premium because she is the consumer with _____ risk aversion.

(Multiple Choice)

4.8/5  (43)

(43)

Showing 41 - 60 of 192

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)