Exam 7: An Introduction to Portfolio Management

Exam 1: The Investment Setting78 Questions

Exam 2: The Asset Allocation Decision80 Questions

Exam 3: Selecting Investments in a Global Market80 Questions

Exam 4: Organization and Functioning of Securities Markets91 Questions

Exam 5: Security-Market Indexes84 Questions

Exam 6: Efficient Capital Markets90 Questions

Exam 7: An Introduction to Portfolio Management97 Questions

Exam 8: An Introduction to Asset Pricing Models119 Questions

Exam 9: Multifactor Models of Risk and Return59 Questions

Exam 10: Analysis of Financial Statements89 Questions

Exam 11: Introduction to Security Valuation86 Questions

Exam 12: Macroanalysis and Microvaluation of the Stock Market119 Questions

Exam 13: Industry Analysis90 Questions

Exam 14: Company Analysis and Stock Valuation133 Questions

Exam 15: Technical Analysis83 Questions

Exam 16: Equity Portfolio Management Strategies58 Questions

Exam 17: Bond Fundamentals89 Questions

Exam 18: The Analysis and Valuation of Bonds108 Questions

Exam 19: Bond Portfolio Management Strategies87 Questions

Exam 20: An Introduction to Derivative Markets and Securities108 Questions

Exam 21: Forward and Futures Contracts99 Questions

Exam 22: Option Contracts106 Questions

Exam 23: Swap Contracts, Convertible Securities, and Other Embedded Derivatives87 Questions

Exam 24: Professional Money Management, Alternative Assets, and Industry Ethics102 Questions

Exam 25: Evaluation of Portfolio Performance96 Questions

Select questions type

Between 1994 and 2004, the standard deviation of the returns for the S&P 500 and the NYSE indexes were 0.27 and 0.14, respectively, and the covariance of these index returns was 0.03. What was the correlation coefficient between the two market indicators?

(Multiple Choice)

4.8/5  (27)

(27)

Exhibit 7.12

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

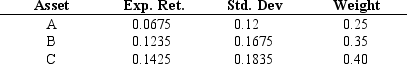

-Calculate the expected return for a three asset portfolio with the following

-Calculate the expected return for a three asset portfolio with the following

(Multiple Choice)

4.8/5  (42)

(42)

Combining assets that are not perfectly correlated does affect both the expected return of the portfolio as well as the risk of the portfolio.

(True/False)

4.8/5  (35)

(35)

Which of the following statements about the correlation coefficient is false?

(Multiple Choice)

4.9/5  (40)

(40)

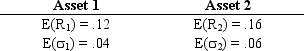

Exhibit 7A.1

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

The general equation for the weight of the first security to achieve the minimum variance (in a two stock portfolio) is given by:

W1 = [E( 2)2 - r1.2 E( 1)E( 2)] /[E( 1)2 + E( 2)2 - 2 r1.2E( 1)E( 2)]

-Prior to the work of Markowitz in the late 1950's and early 1960's, portfolio managers did not have a well-developed, quantitative means of measuring risk.

(True/False)

4.8/5  (40)

(40)

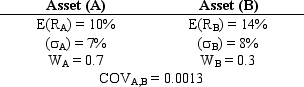

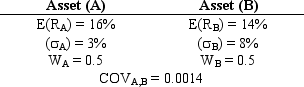

Exhibit 7.8

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 7.8. What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation ( i), covariance (COVi,j), and asset weight (Wi) are as shown above?

-Refer to Exhibit 7.8. What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation ( i), covariance (COVi,j), and asset weight (Wi) are as shown above?

(Multiple Choice)

4.8/5  (44)

(44)

If the covariance of two stocks is positive, these stocks tend to move together over time.

(True/False)

4.8/5  (38)

(38)

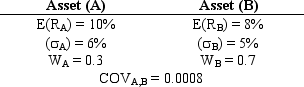

Exhibit 7.4

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 7.4. What is the standard deviation of this portfolio?

-Refer to Exhibit 7.4. What is the standard deviation of this portfolio?

(Multiple Choice)

4.8/5  (30)

(30)

Exhibit 7A.1

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

The general equation for the weight of the first security to achieve the minimum variance (in a two stock portfolio) is given by:

W1 = [E( 2)2 - r1.2 E( 1)E( 2)] /[E( 1)2 + E( 2)2 - 2 r1.2E( 1)E( 2)]

-Refer to Exhibit 7A.1. What weight of security 1 gives the minimum portfolio variance when r1.2 = .60, E( 1) = .10 and E( 2) = .16?

(Multiple Choice)

4.9/5  (41)

(41)

Exhibit 7.10

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 7.10. What is the standard deviation of this portfolio?

-Refer to Exhibit 7.10. What is the standard deviation of this portfolio?

(Multiple Choice)

4.8/5  (38)

(38)

Between 1980 and 1990, the standard deviation of the returns for the NIKKEI and the DJIA indexes were 0.19 and 0.06, respectively, and the covariance of these index returns was 0.0014. What was the correlation coefficient between the two market indicators?

(Multiple Choice)

4.9/5  (32)

(32)

Between 1975 and 1985, the standard deviation of the returns for the NYSE and the S&P 500 indexes were 0.06 and 0.07, respectively, and the covariance of these index returns was 0.0008. What was the correlation coefficient between the two market indicators?

(Multiple Choice)

4.8/5  (38)

(38)

For a two stock portfolio containing Stocks i and j, the correlation coefficient of returns (rij) is equal to the square root of the covariance (covij).

(True/False)

4.7/5  (37)

(37)

The expected return and standard deviation of a portfolio of risky assets is equal to the weighted average of the individual asset's expected returns and standard deviation.

(True/False)

4.8/5  (43)

(43)

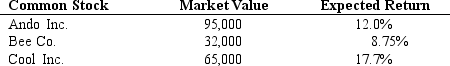

What is the expected return of the three stock portfolio described below?

(Multiple Choice)

4.7/5  (33)

(33)

If equal risk is added moving along the envelope curve containing the best possible combinations the return will

(Multiple Choice)

4.9/5  (34)

(34)

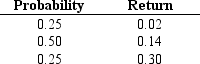

Exhibit 7.16

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Based on the economic outlook for the industry a financial analyst covering Top Choice Corporation has determined the following three possible returns given three different states of the economy over the next period.

-Refer to Exhibit 7.16. What is the expected return for Top Choice Corporation?

-Refer to Exhibit 7.16. What is the expected return for Top Choice Corporation?

(Multiple Choice)

4.7/5  (39)

(39)

The purpose of calculating the covariance between two stocks is to provide a(n) ____ measure of their movement together.

(Multiple Choice)

4.9/5  (41)

(41)

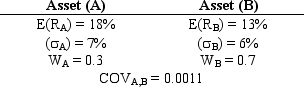

Exhibit 7.9

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 7.9. What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation ( i), covariance (COVi,j), and asset weight (Wi) are as shown above?

-Refer to Exhibit 7.9. What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation ( i), covariance (COVi,j), and asset weight (Wi) are as shown above?

(Multiple Choice)

4.7/5  (39)

(39)

Exhibit 7.14

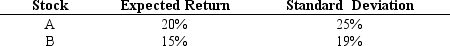

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Stocks A and B have a correlation coefficient of -0.8. The stocks' expected returns and standard deviations are in the table below. A portfolio consisting of 40% of stock A and 60% of stock B is constructed.

-Refer to Exhibit 7.14. What is the expected return of the stock A and B portfolio?

-Refer to Exhibit 7.14. What is the expected return of the stock A and B portfolio?

(Multiple Choice)

4.9/5  (35)

(35)

Showing 41 - 60 of 97

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)