Exam 24: Standard Costs and Balanced Scorecard

Exam 1: Accounting in Action243 Questions

Exam 2: The Recording Process195 Questions

Exam 3: Adjusting the Accounts219 Questions

Exam 4: Completing the Accounting Cycle225 Questions

Exam 5: Accounting for Merchandising Operations Perpetual Approach209 Questions

Exam 6: Inventories Periodic Approach203 Questions

Exam 7: Fraud, Internal Control, and Cash229 Questions

Exam 8: Accounting for Receivables238 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets291 Questions

Exam 10: Liabilities267 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Stockholders Equity341 Questions

Exam 12: Statement of Cash Flows161 Questions

Exam 13: Financial Statement Analysis259 Questions

Exam 14: Managerial Accounting213 Questions

Exam 15: Job Order Costing205 Questions

Exam 16: Process Costing182 Questions

Exam 17: Activity-Based Costing185 Questions

Exam 18: Cost-Volume-Profit210 Questions

Exam 19: Cost-Volume-Profit Analysis: Additional Issues102 Questions

Exam 20: Incremental Analysis203 Questions

Exam 21: Pricing144 Questions

Exam 22: Budgetary Planning213 Questions

Exam 23: Budgetary Control and Responsibility Accounting210 Questions

Exam 24: Standard Costs and Balanced Scorecard204 Questions

Exam 25: Planning for Capital Investments192 Questions

Exam 26: Time Value of Money46 Questions

Exam 27: Investments202 Questions

Exam 28: Payroll Accounting38 Questions

Exam 29: Subsidiary Ledgers and Special Journals87 Questions

Exam 30: Other Significant Liabilities40 Questions

Select questions type

Denmark Corporation's variance report for the purchasing department reports 1,000 units of material A purchased and 2,400 units of material B purchased. It also reports standard prices of $2 for Material A and $3 for Material B. Actual prices reported are $2.10 for Material A and $2.80 for Material B. Denmark should report a total price variance of

(Multiple Choice)

4.9/5  (42)

(42)

The predetermined overhead rate for Zane Company is $5, comprised of a variable overhead rate of $3 and a fixed rate of $2. The amount of budgeted overhead costs at normal capacity of $150,000 was divided by normal capacity of 30,000 direct labor hours, to arrive at the predetermined overhead rate of $5. Actual overhead for June was $9,500 variable and $6,050 fixed, and standard hours allowed for the product produced in June was 3,000 hours. The total overhead variance is

(Multiple Choice)

4.7/5  (43)

(43)

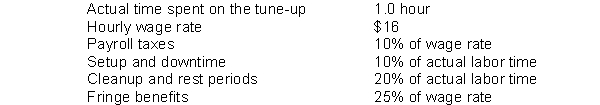

Engines Done Right Co. is trying to establish the standard labor cost of a typical engine tune-up. The following data have been collected from time and motion studies conducted over the past month.  Instructions

(a) Determine the standard direct labor hours per tune-up

(b) Determine the standard direct labor hourly rate.

(c) Determine the standard direct labor cost per tune-up.

(d) If a tune-up took 1.5 hours at the standard hourly rate, what was the direct labor quantity variance?

Instructions

(a) Determine the standard direct labor hours per tune-up

(b) Determine the standard direct labor hourly rate.

(c) Determine the standard direct labor cost per tune-up.

(d) If a tune-up took 1.5 hours at the standard hourly rate, what was the direct labor quantity variance?

(Essay)

4.9/5  (38)

(38)

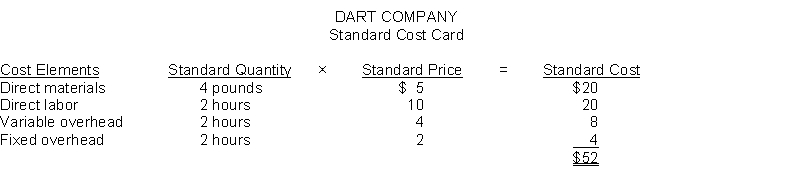

Dart Company developed the following standard costs for its product for 2016:  The company expected to work at the 120,000 direct labor hours level of activity and produce 60,000 units of product.

Actual results for 2016 were as follows:

56,800 units of product were actually produced.

Direct labor costs were $1,092,000 for 112,000 direct labor hours actually worked.

Actual direct materials purchased and used during the year cost $1,108,800 for 231,000 pounds.

Total actual manufacturing overhead costs were $680,000.

Instructions

Compute the following variances for Dart Company for 2016 and indicate whether the variance is favorable or unfavorable.

1. Direct materials price variance.

2. Direct materials quantity variance.

3. Direct labor price variance.

4. Direct labor quantity variance.

5. Overhead controllable variance.

6. Overhead volume variance.

The company expected to work at the 120,000 direct labor hours level of activity and produce 60,000 units of product.

Actual results for 2016 were as follows:

56,800 units of product were actually produced.

Direct labor costs were $1,092,000 for 112,000 direct labor hours actually worked.

Actual direct materials purchased and used during the year cost $1,108,800 for 231,000 pounds.

Total actual manufacturing overhead costs were $680,000.

Instructions

Compute the following variances for Dart Company for 2016 and indicate whether the variance is favorable or unfavorable.

1. Direct materials price variance.

2. Direct materials quantity variance.

3. Direct labor price variance.

4. Direct labor quantity variance.

5. Overhead controllable variance.

6. Overhead volume variance.

(Essay)

4.9/5  (36)

(36)

Showing 201 - 204 of 204

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)