Exam 24: Standard Costs and Balanced Scorecard

Exam 1: Accounting in Action243 Questions

Exam 2: The Recording Process195 Questions

Exam 3: Adjusting the Accounts219 Questions

Exam 4: Completing the Accounting Cycle225 Questions

Exam 5: Accounting for Merchandising Operations Perpetual Approach209 Questions

Exam 6: Inventories Periodic Approach203 Questions

Exam 7: Fraud, Internal Control, and Cash229 Questions

Exam 8: Accounting for Receivables238 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets291 Questions

Exam 10: Liabilities267 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Stockholders Equity341 Questions

Exam 12: Statement of Cash Flows161 Questions

Exam 13: Financial Statement Analysis259 Questions

Exam 14: Managerial Accounting213 Questions

Exam 15: Job Order Costing205 Questions

Exam 16: Process Costing182 Questions

Exam 17: Activity-Based Costing185 Questions

Exam 18: Cost-Volume-Profit210 Questions

Exam 19: Cost-Volume-Profit Analysis: Additional Issues102 Questions

Exam 20: Incremental Analysis203 Questions

Exam 21: Pricing144 Questions

Exam 22: Budgetary Planning213 Questions

Exam 23: Budgetary Control and Responsibility Accounting210 Questions

Exam 24: Standard Costs and Balanced Scorecard204 Questions

Exam 25: Planning for Capital Investments192 Questions

Exam 26: Time Value of Money46 Questions

Exam 27: Investments202 Questions

Exam 28: Payroll Accounting38 Questions

Exam 29: Subsidiary Ledgers and Special Journals87 Questions

Exam 30: Other Significant Liabilities40 Questions

Select questions type

The standard quantity allowed for the units produced was 4,500 pounds, the standard price was $2.50 per pound, and the materials quantity variance was $375 favorable. Each unit uses 1 pound of materials. How many units were actually produced?

(Multiple Choice)

4.9/5  (27)

(27)

The total variance is $35,000. The total materials variance is $14,000. The total labor variance is twice the total overhead variance. What is the total overhead variance?

(Multiple Choice)

4.8/5  (42)

(42)

The total overhead variance is the difference between actual overhead costs and overhead costs applied to work done.

(True/False)

4.9/5  (42)

(42)

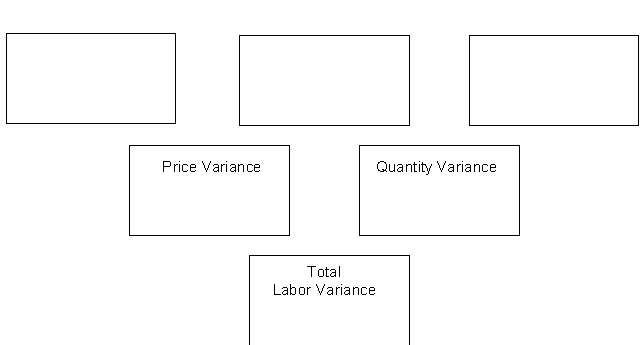

The following direct labor data pertain to the operations of Pearce Corp. for the month of November:

Instructions

Prepare a matrix and calculate the labor variances.

(Essay)

5.0/5  (37)

(37)

If the labor quantity variance is unfavorable and the cause is inefficient use of direct labor, the responsibility rests with the

(Multiple Choice)

4.8/5  (41)

(41)

The direct materials quantity standard would not be expressed in

(Multiple Choice)

4.7/5  (35)

(35)

Which is not one of the four most commonly used perspectives on a balanced scorecard?

(Multiple Choice)

4.7/5  (44)

(44)

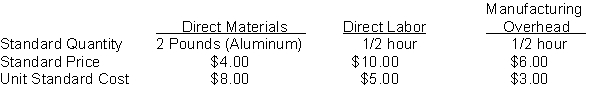

More Hits Company manufactures aluminum baseball bats that it sells to university athletic departments. It has developed the following per unit standard costs for 2016 for each baseball bat:  In 2016, the company planned to produce 120,000 baseball bats at a level of 60,000 hours of direct labor.

Actual results for 2016 are presented below:

1. Direct materials purchases were 246,000 pounds of aluminum which cost $1,020,900.

2. Direct materials used were 220,000 pounds of aluminum.

3. Direct labor costs were $575,260 for 58,700 direct labor hours actually worked.

4. Total manufacturing overhead was $352,000.

5. Actual production was 114,000 baseball bats.

Instructions

(a) Compute the following variances:

In 2016, the company planned to produce 120,000 baseball bats at a level of 60,000 hours of direct labor.

Actual results for 2016 are presented below:

1. Direct materials purchases were 246,000 pounds of aluminum which cost $1,020,900.

2. Direct materials used were 220,000 pounds of aluminum.

3. Direct labor costs were $575,260 for 58,700 direct labor hours actually worked.

4. Total manufacturing overhead was $352,000.

5. Actual production was 114,000 baseball bats.

Instructions

(a) Compute the following variances:

(Short Answer)

4.8/5  (37)

(37)

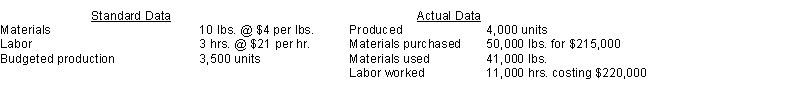

Seacoast Company provided the following information about its standard costing system for 2016:  Instructions

Calculate the labor price variance and the labor quantity variance.

Instructions

Calculate the labor price variance and the labor quantity variance.

(Essay)

5.0/5  (41)

(41)

The final decision as to what standard costs should be is the responsibility of

(Multiple Choice)

4.8/5  (27)

(27)

Edgar, Inc. has a materials price standard of $2.00 per pound. Six thousand pounds of materials were purchased at $2.20 a pound. The actual quantity of materials used was 6,000 pounds, although the standard quantity allowed for the output was 5,400 pounds.

Edgar, Inc.'s materials price variance is

(Multiple Choice)

4.8/5  (39)

(39)

Star Industries computes variances as a basis for evaluating the performance of managers responsible for controlling costs. For several months, the labor quantity variance has been unfavorable. Briefly explain what could be causing the unfavorable labor quantity variance and indicate what type of corrective action, if any, might be taken.

(Essay)

4.8/5  (33)

(33)

Hofburg's standard quantities for 1 unit of product include 2 pounds of materials and 1.5 labor hours. The standard rates are $2 per pound and $7 per hour. The standard overhead rate is $8 per direct labor hour. The total standard cost of Hofburg's product is

(Multiple Choice)

4.9/5  (30)

(30)

The standard number of hours that should have been worked for the output attained is 10,000 direct labor hours and the actual number of direct labor hours worked was 10,500. If the direct labor price variance was $10,500 unfavorable, and the standard rate of pay was $12 per direct labor hour, what was the actual rate of pay for direct labor?

(Multiple Choice)

4.8/5  (40)

(40)

The following direct labor data pertain to the operations of Murray Industries for the month of November:

Standard labor rate $15.00 per hr.

Actual hours incurred 9,000

The standard cost card shows that 2.5 hours are required to complete one unit of product. The actual labor rate incurred exceeded the standard rate by 10%. Four thousand units were manufactured in November.

Instructions

(a) Calculate the price, quantity, and total labor variances.

(b) Journalize the entries to record the labor variances.

(Essay)

4.8/5  (45)

(45)

Showing 81 - 100 of 204

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)