Exam 3: Partially Owned Created Subsidiaries & Variable Interest Entities

Exam 1: Wholly Owned Subsidiaries: at Date of Creation87 Questions

Exam 2: Wholly Owned Subsidiaries: Postcreation Periods110 Questions

Exam 3: Partially Owned Created Subsidiaries & Variable Interest Entities138 Questions

Exam 4: Introduction to Business Combinations105 Questions

Exam 5: The Purchase Method: at Date of Acquisition-100 Ownership135 Questions

Exam 6: The Purchase Method: Postacquisition Periods and Partial Ownerships74 Questions

Exam 7: New Basis of Accounting52 Questions

Exam 8: Introduction to Intercompany Transactions42 Questions

Exam 9: Intercompany Inventory Transfers66 Questions

Exam 10: Intercompany Fixed Asset Transfers & Bond Holdings31 Questions

Exam 12: Reporting Segment and Related Information90 Questions

Exam 13: International Accounting Standards & Translating Foreign Currency Transactions103 Questions

Exam 14: Using Derivatives to Manage Foreign Currency Exposures256 Questions

Exam 15: Translating Foreign Currency Statements: The Current Rate Method99 Questions

Exam 16: Translating Foreign Currency Statements: The Temporal Method and the Functional Currency Concept231 Questions

Exam 17: Interim Period Reporting49 Questions

Exam 18: Securities and Exchange Commission Reporting55 Questions

Exam 19: Bankruptcy Reorganizations and Liquidations51 Questions

Exam 20: Partnerships: Formation and Operation45 Questions

Exam 21: Partnerships: Changes in Ownership37 Questions

Exam 22: Partnerships: Liquidations35 Questions

Exam 23: Estates and Trusts40 Questions

Exam 24: Governmental Accounting: Basic Principles and the General Fund138 Questions

Exam 25: Governmental Accounting: The Special-Purpose Funds and Special General Ledger232 Questions

Exam 26: Not-For-Profit Organizations: Introduction and Private Npos218 Questions

Select questions type

When a parent and a domestic subsidiary file separate income tax returns, the provision of the U.S. tax code that allows dividend income from the subsidiary to not be taxed at the parent level is the ___________________________________.

(Short Answer)

4.8/5  (31)

(31)

_____ The parent-level tax on a subsidiary's earnings is essentially an issue for

(Multiple Choice)

4.9/5  (39)

(39)

Both the parent company concept and the economic unit concept are full consolidation approaches.

(True/False)

5.0/5  (42)

(42)

A parent may file a consolidated income tax return with domestic subsidiaries and foreign subsidiaries.

(True/False)

4.9/5  (39)

(39)

An 80% owned subsidiary is not consolidated because control has been lost. The cost method cannot be used to account for the investment in the subsidiary.

(True/False)

4.8/5  (35)

(35)

The three allowable methods of valuing an investment in an unconsolidated subsidiary are the _________________________ method, the _________________________ method, and the __________________________ method.

(Short Answer)

4.8/5  (36)

(36)

In preparing a consolidated income tax return, all intercompany transactions are eliminated.

(True/False)

4.8/5  (48)

(48)

The concept of legal control encompasses the concept of effective control.

(True/False)

4.9/5  (46)

(46)

_____ Which of the following statements is false concerning the economic unit concept?

(Multiple Choice)

4.9/5  (37)

(37)

_____ What would be the effect on parent-company-only financial statements-not the consolidated statements-if an unconsolidated subsidiary is accounted for under the cost method?

(Multiple Choice)

4.7/5  (34)

(34)

The rationale of the economic unit concept is that the reporting entity does change as a result of the consolidation process.

(True/False)

4.7/5  (40)

(40)

The intent of the U.S. Internal Revenue Code is to tax only twice (in the United States) at the corporate level the earnings of a subsidiary.

(True/False)

4.7/5  (40)

(40)

An 80% owned subsidiary is not consolidated because control has been lost. The cost method cannot be used to account for the investment in the subsidiary if the subsidiary's common stock has a readily determinable fair value.

(True/False)

4.8/5  (34)

(34)

_____ Paxel owns 80% of Saxel's outstanding common stock. For 2006, Saxel reported $60,000 of net income and declared dividends of $10,000. What amount appears in Paxel's 2006 income statement if Paxel accounts for its investment using the equity method?

(Multiple Choice)

4.9/5  (36)

(36)

The company that must consolidate a variable interest entity is called the __________________________________ .

(Short Answer)

4.8/5  (44)

(44)

matching

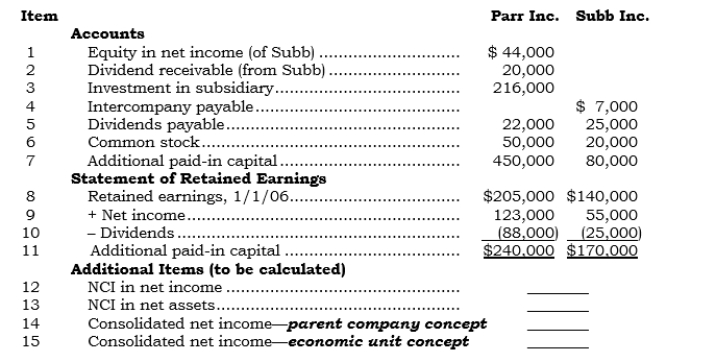

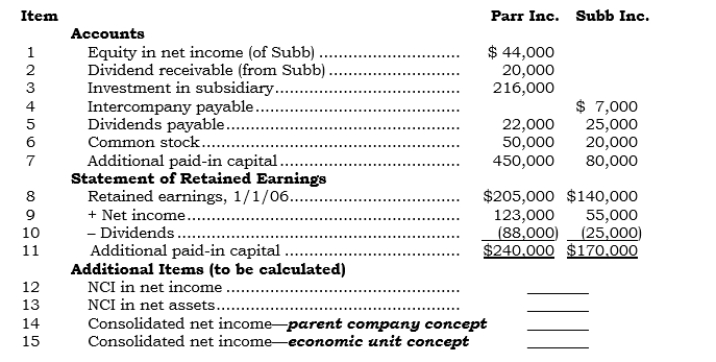

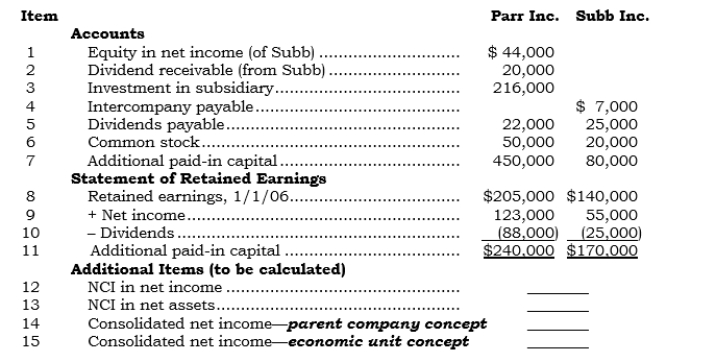

based on the information given.

The following (a) seven account balances and (b) statements of retained earnings were obtained from the separate company statements of Parr Inc. and its 80%-owned created sub-sidiary, Subb Inc. (Parr's only subsidiary), at the end of 2006:

When Subb was created (in 2004, 20% of the common shares it issued were sold to private investors.

Requirement 1:

How is each of the first 11 preceding items reported in Parr's 2006 consolidated statements? Use the following list of possible answer codes in the answer columns:

-_____(item 5)

When Subb was created (in 2004, 20% of the common shares it issued were sold to private investors.

Requirement 1:

How is each of the first 11 preceding items reported in Parr's 2006 consolidated statements? Use the following list of possible answer codes in the answer columns:

-_____(item 5)

(Multiple Choice)

4.8/5  (33)

(33)

based on the information given.

The following (a) seven account balances and (b) statements of retained earnings were obtained from the separate company statements of Parr Inc. and its 80%-owned created sub-sidiary, Subb Inc. (Parr's only subsidiary), at the end of 2006:

When Subb was created (in 2004, 20% of the common shares it issued were sold to private investors.

Requirement 2:

For items 12-15, calculate the amount that would appear in the 2006 consolidated statements

-_____(item 12)

When Subb was created (in 2004, 20% of the common shares it issued were sold to private investors.

Requirement 2:

For items 12-15, calculate the amount that would appear in the 2006 consolidated statements

-_____(item 12)

(Short Answer)

4.8/5  (32)

(32)

matching

based on the information given.

The following (a) seven account balances and (b) statements of retained earnings were obtained from the separate company statements of Parr Inc. and its 80%-owned created sub-sidiary, Subb Inc. (Parr's only subsidiary), at the end of 2006:

When Subb was created (in 2004, 20% of the common shares it issued were sold to private investors.

Requirement 1:

How is each of the first 11 preceding items reported in Parr's 2006 consolidated statements? Use the following list of possible answer codes in the answer columns:

-_____(item 11)

When Subb was created (in 2004, 20% of the common shares it issued were sold to private investors.

Requirement 1:

How is each of the first 11 preceding items reported in Parr's 2006 consolidated statements? Use the following list of possible answer codes in the answer columns:

-_____(item 11)

(Multiple Choice)

4.8/5  (38)

(38)

_____ Paxel owns 80% of Saxel's outstanding common stock. For 2006, Saxel reported $60,000 of net income and declared dividends of $10,000. What is the carrying value of Paxel's investment using the equity method at 12/31/06 if the investment's carrying value on 1/1/06 was $200,000?

(Multiple Choice)

4.7/5  (36)

(36)

_____ Which of the following valuation techniques could not be used to value an investment in an unconsolidated 100%-owned subsidiary?

(Multiple Choice)

4.8/5  (33)

(33)

Showing 81 - 100 of 138

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)