Exam 18: Accounting for Share-Based Payments

Exam 1: An Overview of the Australian External Reporting Environment50 Questions

Exam 2: The Conceptual Framework of Accounting and Its Relevance to Financ62 Questions

Exam 3: Theories of Financial Accounting61 Questions

Exam 4: An Overview of Accounting for Assets62 Questions

Exam 5: Depreciation of Property, plant and Equipment62 Questions

Exam 6: Revaluation and Impairment Testing of Non-Current Assets59 Questions

Exam 7: Inventory61 Questions

Exam 8: Accounting for Intangibles61 Questions

Exam 9: Accounting for Heritage Assets and Biological Assets61 Questions

Exam 10: An Overview of Accounting for Liabilities58 Questions

Exam 11: Accounting for Lease78 Questions

Exam 12: Set-Off and Extinguishment of Debt47 Questions

Exam 13: Accounting for Employee Benefits67 Questions

Exam 15: Accounting for Financial Instruments72 Questions

Exam 16: Revenue Recognition Issues64 Questions

Exam 17: The Statement of Comprehensive Income and Statement of Changes in E62 Questions

Exam 19: Accounting for Income Taxes56 Questions

Exam 20: Cash-Flow Statements60 Questions

Exam 21: Accounting for the Extractive Industries60 Questions

Exam 22: Accounting for General Insurance Contracts58 Questions

Exam 23: Accounting for Superannuation Plans62 Questions

Exam 24: Events Occurring After Balance Sheet Date62 Questions

Exam 25: Segment Reporting61 Questions

Exam 26: Related-Party Disclosures59 Questions

Exam 28: Accounting for Group Structures69 Questions

Exam 29: Further Consolidation Issues I: Accounting for Intragroup Transact46 Questions

Exam 30: Further Consolidation Issues II: Accounting for Minority Interests34 Questions

Exam 31: Further Consolidation Issues III: Accounting for Indirect Ownershi38 Questions

Exam 32: Further Consolidation Issues Iv: Accounting for Changes in the Deg39 Questions

Exam 33: Accounting for Equity Investments67 Questions

Exam 33: Accounting for Equity Investments59 Questions

Exam 35: Accounting for Foreign Currency Transactions58 Questions

Exam 36: Translation of the Accounts of Foreign Operations41 Questions

Exam 37: Accounting for Corporate Social Responsibility59 Questions

Select questions type

What is/are the journal entry(ies)to recognise salary expense for Southport Ltd.related to the share appreciation rights issued 1 July 2009 for the year ended 30 June 2013?

(Multiple Choice)

4.9/5  (43)

(43)

When good or services are acquired in a share-based payment transaction and it does qualify as an asset,the transaction must be expensed.

(True/False)

4.9/5  (41)

(41)

North Terraces Ltd issued share options to its executives two years ago.The options did not vest and has now expired.The cumulative salary benefits expense related to this option issue before its expiry amounts to $150,000.What is the appropriate course of action to take for North Terraces Ltd that is in accordance with AASB 2?

(Multiple Choice)

4.8/5  (44)

(44)

In accordance with AASB 2,how much Employee benefits expense related to the share option issue should Wigan Ltd recognise for the year ended 30 June 2010?

(Multiple Choice)

4.8/5  (34)

(34)

If the fair value of the equity instruments granted in a share-based payment transaction cannot be estimated,the entity shall measure the fair value of the goods received.

(True/False)

4.9/5  (38)

(38)

Which of the following statements is incorrect of cash-settled share-based payment transactions?

(Multiple Choice)

4.8/5  (37)

(37)

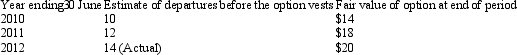

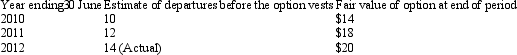

Mission Beach Ltd grants 100 options to each of its 50 employees on 1 July 2009.Each grant is conditional on the employee working for the company for 3 years.The fair value of each option at grant date is $15. The following information is available:

What is the employee benefits expense of Mission Beach Ltd related to this share option for the year ended 30 June 2011?

What is the employee benefits expense of Mission Beach Ltd related to this share option for the year ended 30 June 2011?

(Multiple Choice)

5.0/5  (41)

(41)

On 1 July 2009 Lancaster Ltd grants 100 share options to each of its 50 employees conditional upon the employee working for the entity for the next three years.The entity estimates the fair value of each share option at $13.Based on probability estimates,25 employees are expected to leave the entity before the options vests.In accordance with AASB 2,how much remuneration expense related to the share option issue should Lancaster Ltd recognise for the year ended 30 June 2010?

(Multiple Choice)

4.9/5  (34)

(34)

Which of the following items are not considered share-based payment transactions within the scope of AASB 2?

(Multiple Choice)

4.9/5  (26)

(26)

AASB 2 requires that good and services received in an equity-settled share based transactions be measured in reference to fair value of equity instruments granted.

(True/False)

4.9/5  (30)

(30)

In accordance with AASB 2,how much Employee benefits expense related to the share option issue should Wigan Ltd recognise for the year ended 30 June 2011?

(Multiple Choice)

4.8/5  (38)

(38)

AASB 2 requires all share-based payment transactions to be measured at grant date:

(True/False)

4.8/5  (41)

(41)

Equity instruments granted to employees of the acquiree in their capacity as employees in a business combination is within the scope of AASB 2.

(True/False)

4.9/5  (33)

(33)

Issue of shares in exchange for shares of another entity in a purchase transaction of the net assets of an entity in a business combination is within the scope of AASB 2 "Share-based Payment".

(True/False)

4.8/5  (34)

(34)

What is the Employee benefits expense of Liverpool Ltd related to this share option for the year ended 30 June 2010?

(Multiple Choice)

4.7/5  (32)

(32)

Which of the following is an acceptable measure of fair value of the equity instruments granted?

(Multiple Choice)

4.7/5  (41)

(41)

Winton Ltd grants 100 options to each of its 50 employees on 1 July 2009.Each grant is conditional on the employee working for the company for 3 years.The fair value of each option at grant date is $15. The following information is available:

What is the employee benefits expense of Winton Ltd related to this share option for the year ended 30 June 2010,2011 and 2012,respectively?

What is the employee benefits expense of Winton Ltd related to this share option for the year ended 30 June 2010,2011 and 2012,respectively?

(Multiple Choice)

4.8/5  (36)

(36)

AASB 2 requires the re-measurement of equity-settled transaction at fair value at reporting date.

(True/False)

4.9/5  (35)

(35)

Which of the following share-based payment transactions are considered cash-settled transactions within the scope of AASB 2?

(Multiple Choice)

4.9/5  (36)

(36)

Market prices for share options granted to employees are typically not available because:

(Multiple Choice)

4.8/5  (40)

(40)

Showing 21 - 40 of 62

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)