Exam 19: Returns, Index Numbers, and Inflation

Exam 1: Statistics and Data102 Questions

Exam 2: Tabular and Graphical Methods123 Questions

Exam 3: Numerical Descriptive Measures152 Questions

Exam 4: Introduction to Probability148 Questions

Exam 5: Discrete Probability Distributions158 Questions

Exam 6: Continuous Probability Distributions143 Questions

Exam 7: Sampling and Sampling Distributions136 Questions

Exam 8: Interval Estimation131 Questions

Exam 9: Hypothesis Testing116 Questions

Exam 10: Statistical Inference Concerning Two Populations131 Questions

Exam 11: Statistical Inference Concerning Variance120 Questions

Exam 12: Chi-Square Tests120 Questions

Exam 13: Analysis of Variance120 Questions

Exam 14: Regression Analysis140 Questions

Exam 15: Inference With Regression Models125 Questions

Exam 16: Regression Models for Nonlinear Relationships118 Questions

Exam 17: Regression Models With Dummy Variables130 Questions

Exam 18: Time Series and Forecasting125 Questions

Exam 19: Returns, Index Numbers, and Inflation120 Questions

Exam 20: Nonparametric Tests120 Questions

Select questions type

As long as an investor does not sell an asset, there is no capital gain or loss involved.

(True/False)

4.8/5  (37)

(37)

An index number is an easy-to-interpret numerical value that reflects a ________ change in price or quantity from a base price.

(Short Answer)

4.8/5  (29)

(29)

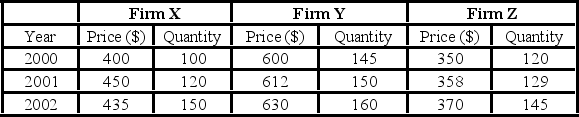

Three firms, X, Y, and Z, operate in the same industry, although their products have different features and are priced differently. The following table provides the prices and the quantities sold (in units) during the period 2000-2002.  Which of the following is the Laspeyres price index for 2002, using 2000 as the base year?

Which of the following is the Laspeyres price index for 2002, using 2000 as the base year?

(Multiple Choice)

4.9/5  (28)

(28)

Which of the following correctly identifies the Fisher equation?

(Multiple Choice)

4.8/5  (24)

(24)

When a given time series is adjusted for changes in prices, it is called a(n) ________.

(Multiple Choice)

4.9/5  (36)

(36)

Three firms, X, Y, and Z, operate in the same industry, although their products have different features and are priced differently. The following table provides the prices and the quantities sold (in units) during the period 2000 to 2002.  Compute the Paasche price index for 2001 if the base period is 2000 and the current period is 2002.

Compute the Paasche price index for 2001 if the base period is 2000 and the current period is 2002.

(Multiple Choice)

4.8/5  (28)

(28)

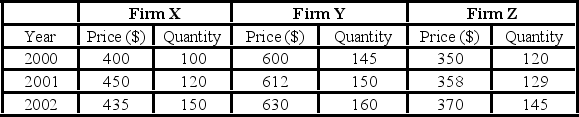

Consider the following information regarding the price and quantity of three brands of a good sold in 1999 and 2010.  a. Compute the weighted aggregate price index using the Laspeyres method with 1999 as the base year.

B) Compute the weighted aggregate price index using the Paasche method with 1999 as the base year.

C) Interpret the result.

a. Compute the weighted aggregate price index using the Laspeyres method with 1999 as the base year.

B) Compute the weighted aggregate price index using the Paasche method with 1999 as the base year.

C) Interpret the result.

(Essay)

4.9/5  (38)

(38)

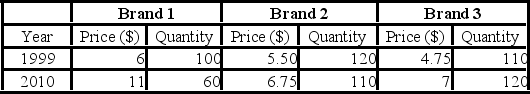

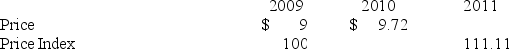

Consider the following information about the price and the price index of a popular book over three years.  If the price index in 2011 was 95 instead of 111.11, it would imply that ________.

If the price index in 2011 was 95 instead of 111.11, it would imply that ________.

(Multiple Choice)

4.8/5  (24)

(24)

The Laspeyres and Paasche indices tend to differ when the length of time between the periods increases since the relative quantities of items adjust to the changes in consumer demand over time.

(True/False)

4.8/5  (36)

(36)

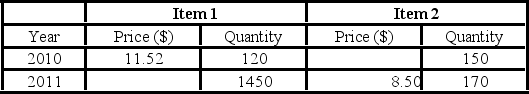

Consider the following price (in dollars) and quantity data for two items during 2010 and 2011.  If the value of the Paasche price index for 2011 is 90.61 (base year 2010), find the price of item 2 in 2010.

If the value of the Paasche price index for 2011 is 90.61 (base year 2010), find the price of item 2 in 2010.

(Short Answer)

4.8/5  (36)

(36)

The weighted aggregate price index assigns a lower weight to the items that are sold in higher quantities.

(True/False)

4.9/5  (42)

(42)

If pt is the price of good X in period t, and p0 is the base period price, which of the following is the equation for a simple price index for good X?

(Multiple Choice)

4.7/5  (34)

(34)

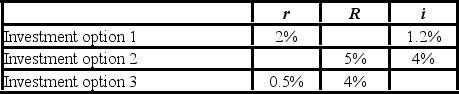

Hugh Wallace has the following information regarding three investment options. Each investment option involves the same one-year period.  What nominal rate of return will Hugh earn if he invested in option 1?

What nominal rate of return will Hugh earn if he invested in option 1?

(Multiple Choice)

4.9/5  (33)

(33)

Price indices are used to remove the effect of inflation so that business and economic time series can be evaluated in a more meaningful way.

(True/False)

4.8/5  (38)

(38)

The only possible income from an investment is the direct cash payment from the underlying asset.

(True/False)

4.9/5  (31)

(31)

Nicole Watson purchased a share of McAllister Inc., a year back when it was trading at $75. She also earned a dividend of $4 on this. The price of the same share has now increased to $87.

A) Compute the annual capital gain from this share.

B) Compute the annual income yield from this share.

(Short Answer)

4.8/5  (31)

(31)

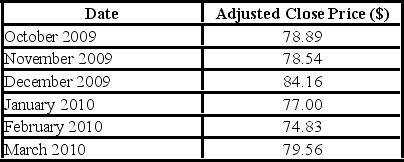

Toyota Motor Corp., once considered a company synonymous with reliability and customer satisfaction, has being engulfed in a perfect storm with millions of cars recalled. The following table shows the monthly adjusted close price per share of Toyota from October 2009 to March 2010.  Which of the following is the simple price index for March 2010 with November 2009 as the base?

Which of the following is the simple price index for March 2010 with November 2009 as the base?

(Multiple Choice)

4.7/5  (34)

(34)

Which of the following are the most commonly used price indices used to deflate economic time series?

(Multiple Choice)

4.9/5  (34)

(34)

Rhea Anderson purchased a corporate bond at $500 a year ago, on which she received a coupon payment of $35. The price of the bond has now gone up to $525.

A) Compute Rhea's capital gains yield.

B) Compute Rhea's income yield.

C) Compute Rhea's investment return.

(Short Answer)

4.8/5  (35)

(35)

Consider the following information about the price and the price index of a popular book over three years.  Which of the following is the correct statement?

Which of the following is the correct statement?

(Multiple Choice)

4.8/5  (37)

(37)

Showing 61 - 80 of 120

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)