Exam 6: Deductions and Losses: in General

Exam 1: An Introduction to Taxation and Understanding Federal Tax Law194 Questions

Exam 2: Working With the Tax Law86 Questions

Exam 3: Tax Formula and Tax Determination; an Overview of Property Transactions187 Questions

Exam 4: Gross Income: Concepts and Inclusions124 Questions

Exam 5: Gross Income: Exclusions114 Questions

Exam 6: Deductions and Losses: in General155 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses124 Questions

Exam 8: Depreciation, Cost Recovery, Amortization, and Depletion103 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses178 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions106 Questions

Exam 11: Investor Losses111 Questions

Exam 12: Alternative Minimum Tax134 Questions

Exam 13: Tax Credits and Payment Procedures120 Questions

Exam 14: Property Transactions: Determination of Gain or Loss and Basis Considerations148 Questions

Exam 15: Property Transactions: Nontaxable Exchanges138 Questions

Exam 16: Property Transactions: Capital Gains and Losses78 Questions

Exam 17: Property Transactions: 1231 and Recapture Provisions74 Questions

Exam 18: Accounting Periods and Methods110 Questions

Exam 19: Deferred Compensation101 Questions

Exam 20: Corporations and Partnerships198 Questions

Select questions type

Alice incurs qualified moving expenses of $12,000. If she is reimbursed by her employer, the deduction is classified as a deduction for AGI. If not reimbursed, the deduction is classified as an itemized deduction.

(True/False)

4.7/5  (44)

(44)

During 2016, the first year of operations, Silver, Inc., pays salaries of $175,000. At the end of the year, employees have earned salaries of $20,000, which are not paid by Silver until early in 2017. What is the amount of the deduction for salary expense?

(Multiple Choice)

4.8/5  (47)

(47)

During the year, Jim rented his vacation home for 200 days and lived in it for 19 days. During the remaining days, the vacation home was available for rental use. Is the vacation home subject to the limitation on the deductions of a personal/rental vacation home?

(Essay)

4.8/5  (34)

(34)

Depending on the nature of the expenditure, expenses incurred in a trade or business may be deductible for or from AGI.

(True/False)

4.9/5  (35)

(35)

Fines and penalties paid for violations of the law (e.g., illegal dumping of hazardous waste) are deductible only if they relate to a trade or business.

(True/False)

4.8/5  (45)

(45)

While she was a college student, Angel lived by a bookstore located near campus. She thinks a bookstore located on the other side of campus would be successful. She incurs expenses of $42,800 (legal fees, accounting fees, marketing survey, etc.) in exploring its business potential. Her parents have agreed to loan her the money required to start the business. What amount of these investigation costs can Angel deduct if:

a.She opens the bookstore on August 1, 2017.

b.She decides not to open the bookstore.

(Essay)

4.9/5  (32)

(32)

Jacques, who is not a U.S. citizen, makes a contribution to the campaign of a candidate for governor. Cassie, a U.S. citizen, also makes a contribution to the same campaign fund. If contributions by noncitizens are illegal under state law, the contribution by Cassie is deductible, while that by Jacques is not.

(True/False)

4.8/5  (40)

(40)

Graham, a CPA, has submitted a proposal to do the annual audit for a municipality. Owen, the city treasurer, tells Graham that for a $1,000 fee, he will use his influence to have the audit awarded to Graham. What factors are relevant in determining if Graham can deduct the $1,000 payment assuming he pays the fee to Owen?

(Essay)

4.9/5  (39)

(39)

For purposes of the § 267 loss disallowance provision, a taxpayer's aunt is a related party.

(True/False)

4.8/5  (37)

(37)

If a vacation home is classified as primarily personal use (i.e., rented for fewer than 15 days), none of the related expenses can be deducted.

(True/False)

4.8/5  (31)

(31)

If a residence is used primarily for personal use (rented for fewer than 15 days per year), which of the following is correct?

(Multiple Choice)

4.8/5  (36)

(36)

For a president of a publicly held corporation, which of the following are not subject to the $1 million limit on executive compensation?

(Multiple Choice)

4.9/5  (34)

(34)

Because Scott is three months delinquent on the mortgage payments for his personal residence, Jeanette (his sister) is going to cover the arrearage. Based on past experience, she does not expect to be repaid by Scott. Which of the following statements is correct?

(Multiple Choice)

4.8/5  (41)

(41)

Susan is a sales representative for a U.S. weapons manufacturer. She makes a $100,000 "grease" payment to a U.S. government official associated with a weapons purchase by the U.S. Army. She makes a similar payment to a Saudi Arabian government official associated with a similar sale. Neither of these payments is deductible by Susan's employer.

(True/False)

4.7/5  (30)

(30)

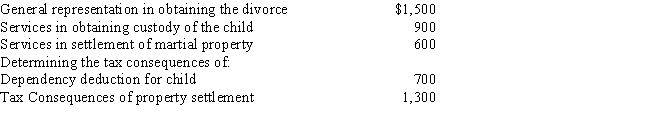

Velma and Bud divorced. Velma's attorney fee of $5,000 is allocated as follows:

Of the $5,000 Velma pays to her attorney, the amount she may deduct as an itemized deduction is:

Of the $5,000 Velma pays to her attorney, the amount she may deduct as an itemized deduction is:

(Multiple Choice)

4.9/5  (39)

(39)

If a vacation home is rented for less than 15 days during a year, the only expenses that can be deducted are mortgage interest, property taxes, and personal casualty losses.

(True/False)

4.8/5  (41)

(41)

On January 2, 2017, Fran acquires a business from Chuck. Among the assets purchased are the following intangibles: patent with a 7-year remaining life, a covenant not to compete for 10 years, and goodwill.

Of the purchase price, $140,000 was paid for the patent and $60,000 for the covenant. The amount of the excess of the purchase price over the identifiable assets was $100,000. What is the amount of the amortization deduction for 2017?

(Multiple Choice)

4.8/5  (38)

(38)

In distinguishing whether an activity is a hobby or a trade or business, discuss the presumptive rule.

(Essay)

4.7/5  (42)

(42)

The cost of legal advice associated with the preparation of an individual's Federal income tax return is not deductible because it is a personal expense.

(True/False)

4.9/5  (36)

(36)

Showing 21 - 40 of 155

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)