Exam 6: Deductions and Losses: in General

Exam 1: An Introduction to Taxation and Understanding Federal Tax Law194 Questions

Exam 2: Working With the Tax Law86 Questions

Exam 3: Tax Formula and Tax Determination; an Overview of Property Transactions187 Questions

Exam 4: Gross Income: Concepts and Inclusions124 Questions

Exam 5: Gross Income: Exclusions114 Questions

Exam 6: Deductions and Losses: in General155 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses124 Questions

Exam 8: Depreciation, Cost Recovery, Amortization, and Depletion103 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses178 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions106 Questions

Exam 11: Investor Losses111 Questions

Exam 12: Alternative Minimum Tax134 Questions

Exam 13: Tax Credits and Payment Procedures120 Questions

Exam 14: Property Transactions: Determination of Gain or Loss and Basis Considerations148 Questions

Exam 15: Property Transactions: Nontaxable Exchanges138 Questions

Exam 16: Property Transactions: Capital Gains and Losses78 Questions

Exam 17: Property Transactions: 1231 and Recapture Provisions74 Questions

Exam 18: Accounting Periods and Methods110 Questions

Exam 19: Deferred Compensation101 Questions

Exam 20: Corporations and Partnerships198 Questions

Select questions type

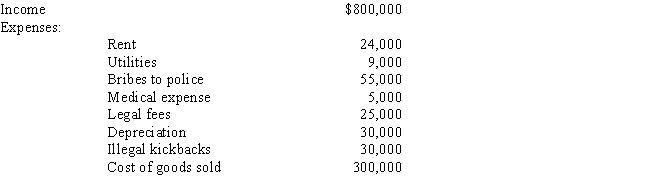

Albie operates an illegal drug-running business and has the following items of income and expense. What is Albie's adjusted gross income from this operation?

(Essay)

4.8/5  (33)

(33)

Walt wants to give his daughter $1,800 for Christmas. As an alternative, she suggests that he pay the property taxes on her residence. If Ralph pays the property taxes, he can deduct them.

(True/False)

4.8/5  (31)

(31)

Nikeya sells land (adjusted basis of $120,000) to her adult son, Shamed, for its appraised value of $95,000. Which of the following statements is correct?

(Multiple Choice)

4.8/5  (29)

(29)

The stock of Eagle, Inc. is owned as follows:

Tom sells land and a building to Eagle, Inc. for $212,000. His adjusted basis for these assets is $225,000. Calculate Tom's realized and recognized loss associated with the sale.

(Essay)

4.8/5  (41)

(41)

The cash method can be used even if inventory and cost of goods sold are an income producing factor in the business.

(True/False)

4.8/5  (37)

(37)

LD Partnership, a cash basis taxpayer, purchases land and a building for $200,000 with $150,000 of the cost being allocated to the building. The gross receipts of the partnership are less than $100,000. LD must capitalize the $50,000 paid for the land, but can deduct the $150,000 paid for the building in the current tax year.

(True/False)

4.8/5  (37)

(37)

Under what circumstances may a taxpayer deduct the expenses of investigating a possible business acquisition, if (1) the business is not acquired; and (2) the business is acquired?

(Essay)

4.9/5  (37)

(37)

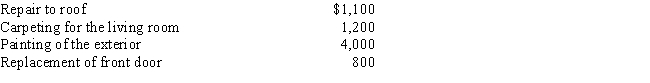

Marvin spends the following amounts on a house he owns:

a.How much of these expenses can Marvin deduct if the house is his principal residence?

b.How much of these expenses can Marvin deduct if he rents the house to a tenant?

c.Classify any deductible expenses as deductions for AGI or as deductions from AGI.

a.How much of these expenses can Marvin deduct if the house is his principal residence?

b.How much of these expenses can Marvin deduct if he rents the house to a tenant?

c.Classify any deductible expenses as deductions for AGI or as deductions from AGI.

(Essay)

4.9/5  (43)

(43)

A baseball team that pays a star player an annual salary of $25 million can deduct the entire $25 million as salary expense. If the same amount is paid to the CEO of IBM, only $1 million is deductible.

(True/False)

4.8/5  (39)

(39)

Salaries are considered an ordinary and necessary expense of a trade or business if they meet what other requirement? What are the tax consequences if this requirement is not met?

(Essay)

4.8/5  (29)

(29)

Iris, a calendar year cash basis taxpayer, owns and operates several TV rental outlets in Florida, and wants to expand to other states. During 2017, she spends $14,000 to investigate TV rental stores in South Carolina and $9,000 to investigate TV rental stores in Georgia. She acquires the South Carolina operations, but not the outlets in Georgia. As to these expenses, Iris should:

(Multiple Choice)

4.9/5  (36)

(36)

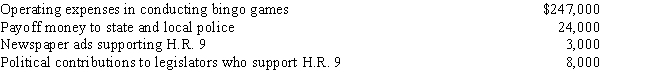

Rex, a cash basis calendar year taxpayer, runs a bingo operation which is illegal under state law. During 2017, a bill designated H.R. 9 is introduced into the state legislature which, if enacted, would legitimize bingo games. In 2017, Rex had the following expenses: Of these expenditures, Rex may deduct:

(Multiple Choice)

4.7/5  (33)

(33)

Discuss the application of the "one-year rule" on prepayments by a cash basis taxpayer.

(Essay)

4.7/5  (38)

(38)

Under the "one-year rule" for the current period deduction of prepaid expenses of cash basis taxpayers, the asset must expire or be consumed by the end of the tax year following the year of payment.

(True/False)

4.7/5  (45)

(45)

If an activity involves horses, a profit in at least two of seven consecutive years meets the presumptive rule of § 183.

(True/False)

4.9/5  (36)

(36)

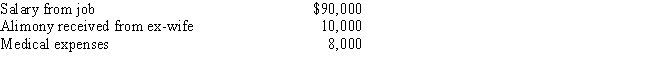

Sammy, a calendar year cash basis taxpayer who is age 66, has the following transactions in 2017:

Based on this information, Sammy has:

Based on this information, Sammy has:

(Multiple Choice)

4.7/5  (40)

(40)

Ordinary and necessary business expenses, other than cost of goods sold, of an illegal drug trafficking business do not reduce taxable income.

(True/False)

4.8/5  (43)

(43)

Showing 41 - 60 of 155

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)