Exam 6: Deductions and Losses: in General

Exam 1: An Introduction to Taxation and Understanding Federal Tax Law194 Questions

Exam 2: Working With the Tax Law86 Questions

Exam 3: Tax Formula and Tax Determination; an Overview of Property Transactions187 Questions

Exam 4: Gross Income: Concepts and Inclusions124 Questions

Exam 5: Gross Income: Exclusions114 Questions

Exam 6: Deductions and Losses: in General155 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses124 Questions

Exam 8: Depreciation, Cost Recovery, Amortization, and Depletion103 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses178 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions106 Questions

Exam 11: Investor Losses111 Questions

Exam 12: Alternative Minimum Tax134 Questions

Exam 13: Tax Credits and Payment Procedures120 Questions

Exam 14: Property Transactions: Determination of Gain or Loss and Basis Considerations148 Questions

Exam 15: Property Transactions: Nontaxable Exchanges138 Questions

Exam 16: Property Transactions: Capital Gains and Losses78 Questions

Exam 17: Property Transactions: 1231 and Recapture Provisions74 Questions

Exam 18: Accounting Periods and Methods110 Questions

Exam 19: Deferred Compensation101 Questions

Exam 20: Corporations and Partnerships198 Questions

Select questions type

Petal, Inc. is an accrual basis taxpayer. Petal uses the aging approach to calculate the reserve for bad debts. During 2017, the following occur associated with bad debts. The amount of the deduction for bad debt expense for Petal for 2017 is:

(Multiple Choice)

4.8/5  (37)

(37)

Bobby operates a drug trafficking business. Because he has an accounting background, he keeps detailed financial records. What expenses can Bobby deduct on his Federal income tax return?

(Essay)

4.8/5  (38)

(38)

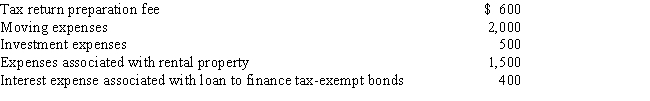

Cory incurred and paid the following expenses:

Calculate the amount that Cory can deduct (before any percentage limitations).

Calculate the amount that Cory can deduct (before any percentage limitations).

(Multiple Choice)

4.7/5  (37)

(37)

Describe the circumstances under which a taxpayer can receive rent income from a personal residence, but does not have to report it as gross income.

(Essay)

4.8/5  (33)

(33)

Marge sells land to her adult son, Jason, for its $20,000 appraised value. Her adjusted basis for the land is $25,000. Marge's recognized loss is $5,000 and Jason's adjusted basis for the land is $25,000 ($20,000 cost + $5,000 recognized gain of Marge).

(True/False)

4.9/5  (43)

(43)

Briefly explain why interest on money borrowed to buy tax-exempt municipal bonds is disallowed as a deduction.

(Essay)

4.7/5  (33)

(33)

Investigation of a business unrelated to one's present business never results in a current period deduction of the entire amount if the amount of the investigation expenses exceeds $5,000.

(True/False)

4.9/5  (34)

(34)

For a taxpayer who is engaged in a trade or business, the cost of investigating a business in the same field is deductible only if the taxpayer acquires the business.

(True/False)

4.8/5  (37)

(37)

Which of the following can be claimed as a deduction for AGI?

(Multiple Choice)

4.8/5  (37)

(37)

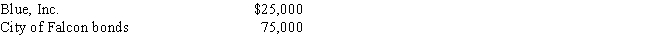

Tracy invested in the following stocks and bonds during 2017.

To finance the investments, she borrowed $100,000 from Swan Bank. Interest expense paid on the loan during 2017 was $5,000. During 2017, Tracy received $1,250 of dividend income from Blue, Inc. and $3,000 of interest income on the municipal bonds.

a.Determine the amount of Tracy's gross income.

b.Determine the maximum amount of Tracy's deductible interest expense.

a.Determine the amount of Tracy's gross income.

b.Determine the maximum amount of Tracy's deductible interest expense.

(Essay)

4.8/5  (40)

(40)

Generally, a closely-held family corporation is not permitted to take a deduction for a salary paid to a family member in calculating corporate taxable income.

(True/False)

4.8/5  (34)

(34)

Purchased goodwill must be capitalized, but can be amortized over a 60-month period.

(True/False)

4.9/5  (41)

(41)

A hobby activity can result in all of the hobby income being included in AGI and no deductions being allowed.

(True/False)

4.9/5  (33)

(33)

If a vacation home is a personal/rental residence, no maintenance and utility expenses can be claimed as a deduction.

(True/False)

4.9/5  (47)

(47)

In applying the $1 million limit on deducting executive compensation, what corporations are subject to the deduction limit? What executives are covered?

(Essay)

4.8/5  (37)

(37)

Legal expenses incurred in connection with rental property are deductions from AGI.

(True/False)

4.8/5  (39)

(39)

The portion of a shareholder-employee's salary that is classified as unreasonable has no effect on the amount of a shareholder-employee's gross income, but results in an increase in the taxable income of the corporation.

(True/False)

4.8/5  (31)

(31)

Martha rents part of her personal residence in the summer for 3 weeks for $3,000. Anne rents all of her personal residence for one week in December for $2,500. Anne is not required to include the $2,500 in her gross income whereas Martha is required to include the $3,000 in her gross income.

(True/False)

4.8/5  (39)

(39)

Showing 61 - 80 of 155

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)