Exam 6: Deductions and Losses: in General

Exam 1: An Introduction to Taxation and Understanding Federal Tax Law194 Questions

Exam 2: Working With the Tax Law86 Questions

Exam 3: Tax Formula and Tax Determination; an Overview of Property Transactions187 Questions

Exam 4: Gross Income: Concepts and Inclusions124 Questions

Exam 5: Gross Income: Exclusions114 Questions

Exam 6: Deductions and Losses: in General155 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses124 Questions

Exam 8: Depreciation, Cost Recovery, Amortization, and Depletion103 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses178 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions106 Questions

Exam 11: Investor Losses111 Questions

Exam 12: Alternative Minimum Tax134 Questions

Exam 13: Tax Credits and Payment Procedures120 Questions

Exam 14: Property Transactions: Determination of Gain or Loss and Basis Considerations148 Questions

Exam 15: Property Transactions: Nontaxable Exchanges138 Questions

Exam 16: Property Transactions: Capital Gains and Losses78 Questions

Exam 17: Property Transactions: 1231 and Recapture Provisions74 Questions

Exam 18: Accounting Periods and Methods110 Questions

Exam 19: Deferred Compensation101 Questions

Exam 20: Corporations and Partnerships198 Questions

Select questions type

Max opened his dental practice (a sole proprietorship) in March 2017. At the end of the year, he has unpaid accounts receivable of $62,000 and no unpaid accounts payable. Should Max use the accrual method or the cash method for his dental practice?

(Essay)

4.8/5  (35)

(35)

Mitch is in the 28% tax bracket. He may receive a different tax benefit for a $2,000 expenditure that is classified as a deduction from AGI than he will receive for a $1,000 expenditure that is classified as a deduction for AGI.

(True/False)

4.8/5  (28)

(28)

The income of a sole proprietorship is reported on Schedule C (Profit or Loss from Business).

(True/False)

4.9/5  (39)

(39)

If a taxpayer can satisfy the three-out-of-five year presumption test associated with hobby losses, then expenses from the activity can be deducted in excess of the gross income from the activity.

(True/False)

4.8/5  (43)

(43)

Isabella owns two business entities. She may be able to use the cash method for one and the accrual method for the other.

(True/False)

4.8/5  (32)

(32)

All domestic bribes (i.e., to a U.S. official) are disallowed as deductions.

(True/False)

4.8/5  (30)

(30)

If a taxpayer operated an illegal business (not drug trafficking), what expenses can be deducted and what expenses are disallowed?

(Essay)

4.8/5  (39)

(39)

If a taxpayer operates an illegal business, no deductions are permitted.

(True/False)

4.8/5  (38)

(38)

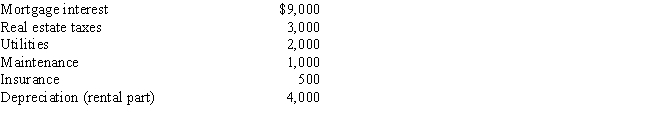

Robyn rents her beach house for 60 days and uses it for personal use for 30 days during the year. The rental income is $6,000 and the expenses are as follows:

Using the IRS approach, total expenses that Robyn can deduct on her tax return associated with the beach house are:

Using the IRS approach, total expenses that Robyn can deduct on her tax return associated with the beach house are:

(Multiple Choice)

4.7/5  (38)

(38)

The period in which an accrual basis taxpayer can deduct an expense is determined by applying the economic performance and all events tests.

(True/False)

4.9/5  (31)

(31)

Payments by a cash basis taxpayer of capital expenditures:

(Multiple Choice)

4.8/5  (38)

(38)

Which of the following is not relevant in determining whether an activity is profit-seeking or a hobby?

(Multiple Choice)

4.7/5  (34)

(34)

If part of a shareholder/employee's salary is classified as unreasonable, determine the effect on the:

a.Shareholder/employee's gross income.

b.Corporation's taxable income.

(Essay)

4.8/5  (45)

(45)

Which of the following legal expenses are deductible for AGI?

(Multiple Choice)

4.7/5  (32)

(32)

Terry and Jim are both involved in operating illegal businesses. Terry operates a gambling business and Jim operates a drug running business. Both businesses have gross revenues of $500,000. The businesses incur the following expenses. Which of the following statements is correct?

(Multiple Choice)

4.8/5  (32)

(32)

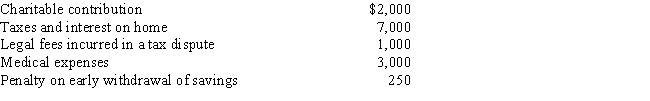

Marsha is single, had gross income of $50,000, and incurred the following expenses:

Her AGI is:

Her AGI is:

(Multiple Choice)

4.7/5  (42)

(42)

A vacation home at the beach which is rented for 200 days and used personally for 16 days is classified in the personal/rental use category.

(True/False)

4.8/5  (39)

(39)

A taxpayer's note or promise to pay satisfies the "actually paid" requirement for the cash basis method of accounting.

(True/False)

4.9/5  (31)

(31)

In a related party transaction where realized loss is disallowed, when can the disallowed loss be used by the buyer on the subsequent sale of the property? In the case of a related party disallowed loss transaction, can the related party seller's disallowed loss be used by a taxpayer other than the related party buyer?

(Essay)

4.8/5  (34)

(34)

Janet is the CEO for Silver, Inc., a closely held corporation. Her total compensation for 2017 is $5 million. Of this amount, $2 million is a salary and $3 million is a bonus. The bonus was calculated as 5% of Silver's net income before the bonus and before taxes ($60 million × 5% = $3 million). The bonus provision has been in effect since Janet became CEO five years ago and is related to Silver's performance. It is approved annually by the entire board of directors (1 of the 5 directors is an outside director) of Silver. How much of Janet's compensation can Silver deduct for 2017?

(Essay)

4.8/5  (37)

(37)

Showing 121 - 140 of 155

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)