Exam 12: Alternative Minimum Tax

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law195 Questions

Exam 2: Working With the Tax Law86 Questions

Exam 3: Tax Formula and Tax Determination;an Overview of Property Transactions188 Questions

Exam 4: Gross Income: Concepts and Inclusions124 Questions

Exam 5: Gross Income: Exclusions114 Questions

Exam 6: Deductions and Losses: in General142 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses120 Questions

Exam 8: Depreciation, cost Recovery, amortization, and Depletion115 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses177 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions104 Questions

Exam 11: Investor Losses110 Questions

Exam 12: Alternative Minimum Tax119 Questions

Exam 13: Tax Credits and Payment Procedures124 Questions

Exam 14: Property Transactions: Determination of Gain or Loss and Basis Considerations142 Questions

Exam 15: Property Transactions: Nontaxable Exchanges120 Questions

Exam 16: Property Transactions: Capital Gains and Losses72 Questions

Exam 17: Property Transactions: 1231 and Recapture Provisions70 Questions

Exam 18: Accounting Periods and Methods108 Questions

Exam 19: Deferred Compensation102 Questions

Exam 20: Corporations and Partnerships207 Questions

Select questions type

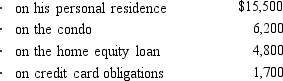

Ted,who is single,owns a personal residence in the city.He also owns a condo near the ocean.He uses the condo as a vacation home.In March 2014,he borrowed $50,000 on a home equity loan and used the proceeds to acquire a luxury automobile.During 2014,he paid the following amounts of interest:  What amount,if any,must Ted recognize as an AMT adjustment in 2014?

What amount,if any,must Ted recognize as an AMT adjustment in 2014?

(Multiple Choice)

5.0/5  (32)

(32)

How can the positive AMT adjustment for research and experimental expenditures be avoided?

(Essay)

4.9/5  (41)

(41)

Omar acquires used 7-year personal property for $100,000 to use in his business in February 2014.Omar does not elect § 179 expensing,but does take the maximum regular cost recovery deduction.He elects not to take additional first-year depreciation.As a result,Omar will have a positive AMT adjustment in 2014 of what amount?

(Multiple Choice)

4.9/5  (30)

(30)

Bianca and David have the following for 2014:

Regular income tax before credits $32,000

Tentative AMT before credits 45,000

a.Calculate Bianca and David's AMT if they qualify for the adoption expense credit of $11,000.

b.Calculate Bianca and David's AMT if they qualify for the adoption expense credit of $13,190.

(Essay)

4.7/5  (40)

(40)

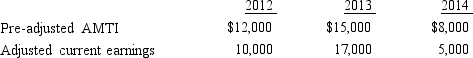

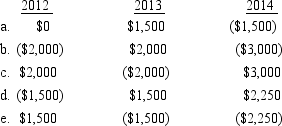

Mauve,Inc. ,has the following for 2012,2013,and 2014 and no prior ACE adjustments.  What is the ACE adjustment for each of the three years?

What is the ACE adjustment for each of the three years?

(Short Answer)

4.7/5  (40)

(40)

The AMT exemption for a corporation with $225,000 of AMTI is $18,750.

(True/False)

4.8/5  (44)

(44)

The deduction for personal and dependency exemptions is allowed for regular income tax purposes,but is disallowed for AMT purposes.This results in a positive AMT adjustment.

(True/False)

4.7/5  (34)

(34)

What tax rates apply in calculating the tentative AMT for an individual taxpayer?

(Essay)

4.9/5  (37)

(37)

If Jessica exercises an ISO and disposes of the option in the same tax year,are any AMT adjustments required?

(Essay)

4.8/5  (26)

(26)

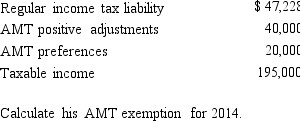

Ashby,who is single and age 30,provides you with the following information from his financial records for 2014.

(Multiple Choice)

4.8/5  (35)

(35)

Benita expensed mining exploration and development costs of $500,000 incurred in the current tax year.She will be required to make negative AMT adjustments for each of the next ten years and a positive AMT adjustment in the current tax year.

(True/False)

4.8/5  (39)

(39)

Negative AMT adjustments for the current year caused by timing differences are offset by the positive AMT adjustments for prior tax years also caused by timing differences.

(True/False)

4.9/5  (36)

(36)

A taxpayer who expenses circulation expenditures in the year incurred for regular income tax purposes will have a positive AMT adjustment in the following year.

(True/False)

4.9/5  (47)

(47)

Elmer exercises an incentive stock option (ISO)in 2014 for $6,000 (fair market value of the stock on the exercise date is $7,600).If Elmer sells the stock later in 2014 for $8,000,the AMT positive adjustment is $1,600 and the AMT negative adjustment is $2,000.

(True/False)

4.9/5  (34)

(34)

For regular income tax purposes,Yolanda,who is single,is in the 35% tax bracket.Her AMT base is $220,000.Her tentative AMT is:

(Multiple Choice)

4.8/5  (33)

(33)

For individual taxpayers,the AMT credit is applicable for the AMT that results from timing differences,but it is not available for the AMT that results from the adjustment for itemized deductions or exclusion preferences.

(True/False)

4.9/5  (32)

(32)

Will all AMT adjustments reverse? That is,do they relate to timing differences?

(Essay)

5.0/5  (51)

(51)

Kay,who is single,had taxable income of $0 in 2014.She has positive timing adjustments of $206,300 and exclusion items of $100,000 for the year.What is the amount of her alternative minimum tax credit for carryover to 2015?

(Multiple Choice)

4.9/5  (27)

(27)

Showing 81 - 100 of 119

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)