Exam 14: Decision Analysis

Exam 1: Introduction to Modeling and Decision Analysis74 Questions

Exam 2: Introduction to Optimization and Linear Programming73 Questions

Exam 3: Modeling and Solving Lp Problems in a Spreadsheet75 Questions

Exam 4: Sensitivity Analysis and the Simplex Method77 Questions

Exam 5: Network Modeling84 Questions

Exam 6: Integer Linear Programming88 Questions

Exam 7: Goal Programming and Multiple Objective Optimization65 Questions

Exam 8: Nonlinear Programming and Evolutionary Optimization69 Questions

Exam 9: Regression Analysis82 Questions

Exam 10: Data Mining102 Questions

Exam 11: Time Series Forecasting81 Questions

Exam 12: Introduction to Simulation Using Analytic Solver Platform70 Questions

Exam 13: Queuing Theory87 Questions

Exam 14: Decision Analysis116 Questions

Exam 15: Project Management Online65 Questions

Select questions type

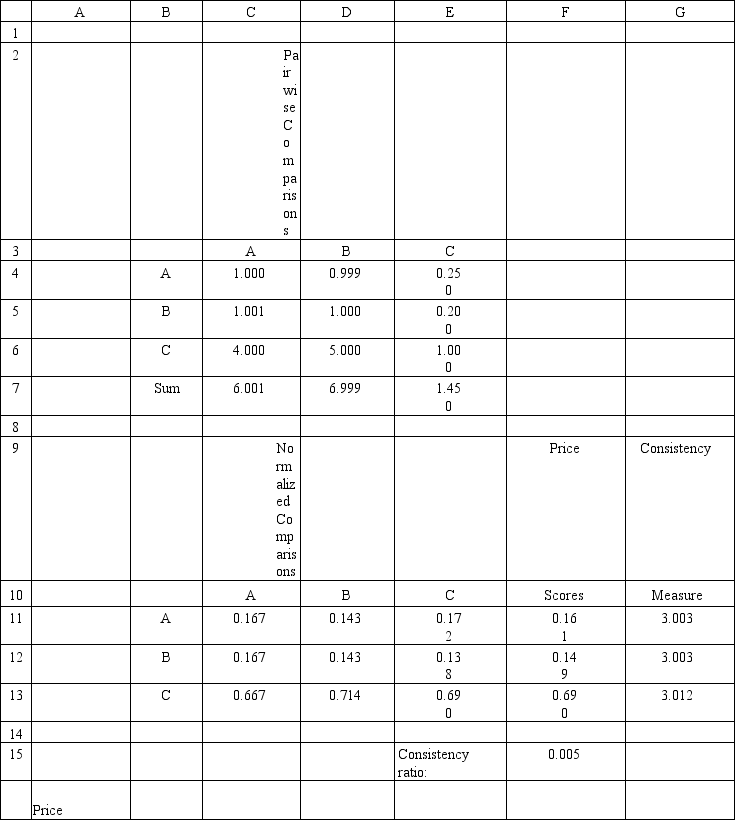

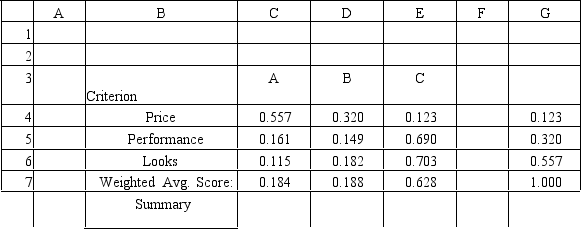

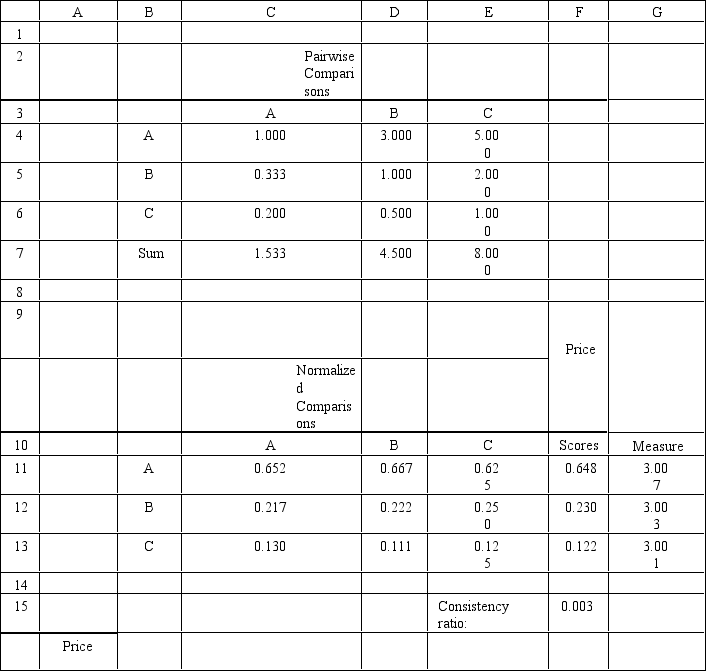

Exhibit 14.13

The following questions use the information below.

A student wants to buy a new car.She has three cars to choose from,A,B and C.The cars differ with respect to price,performance and looks.The student has developed the following AHP tables for price and summary.The other tables are not shown due to space limitations.

-Refer to Exhibit 14.13.What formula should go in cell F11 and copied to cells F12:F13 of the Price worksheet to compute the Price Score?

-Refer to Exhibit 14.13.What formula should go in cell F11 and copied to cells F12:F13 of the Price worksheet to compute the Price Score?

(Essay)

4.8/5  (28)

(28)

Exhibit 14.7

The following questions use the information below.

A decision maker is faced with two alternatives.The decision maker has determined that she is indifferent between the two alternatives when p = 0.45.

Alternative 1: Receive $82,000 with certainty

Alternative 2: Receive $143,000 with probability p and lose $15,000 with probability 1 − p).

-Refer to Exhibit 14.7.What is the decision maker's risk premium for this problem?

(Multiple Choice)

4.8/5  (37)

(37)

Exhibit 14.12

The following questions use the information below.A decision maker is faced with two alternatives.

Alternative 1: Receive $40,000 with certainty

Alternative 2: Receive $80,000 with probability p and lose $5,000 with probability 1 − p).

The decision maker has determined that she is indifferent between the two alternatives when p = 0.7.

-Refer to Exhibit 14.12.What is the decision maker's certainty equivalent for this problem?

(Essay)

4.8/5  (33)

(33)

Exhibit 14.9

The following questions are based on the information below.

An investor is considering 4 investments,W,X,Y,and Z.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the investment decision problem.

E 1 Payoff Matrix 2 3 Economy 4 Investment Decline Expand Choice 5 0 80 6 3 0 70 7 5 0 35 8 z 2 0 20 Payoffs

-Refer to Exhibit 14.9.What formula should go in cell D5 and get copied to D6:D8 to implement the maximax decision rule?

(Essay)

4.9/5  (36)

(36)

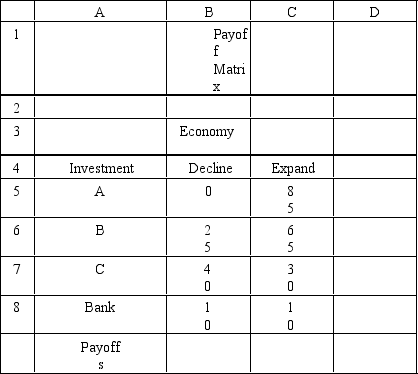

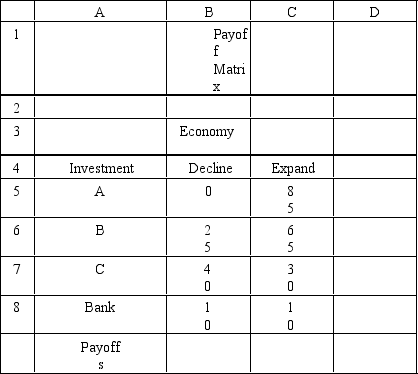

Exhibit 14.1

The following questions are based on the information below.

An investor is considering 4 investments,A,B,C and leaving his money in the bank.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.

-Refer to Exhibit 14.1.What formula should go in cell D5 to implement the maximin decision rule?

-Refer to Exhibit 14.1.What formula should go in cell D5 to implement the maximin decision rule?

(Multiple Choice)

4.9/5  (37)

(37)

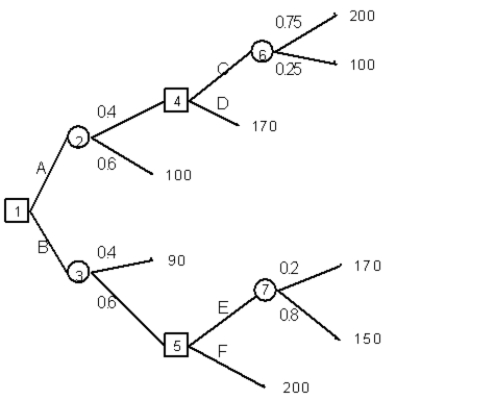

An investor is considering 2 investments,A,B,which can be made now.After these investments are made he can pursue choices C,D,E and F depending on whether he chose A or B originally.He has developed the following decision tree to aid in his selection process.What are the correct original and subsequent decisions based on an expected monetary value criteria?

(Multiple Choice)

4.8/5  (38)

(38)

Which of the following summarizes the final outcome for each decision alternative?

(Multiple Choice)

4.8/5  (28)

(28)

An investor is considering 2 investments,A,B,which can be purchased now for $10.There is a 40% chance that investment A will grow rapidly in value and a 60% chance that it will grow slowly.If A grows rapidly the investor can cash it in for $80 or trade it for investment C which has a 25% chance of growing to $100 and a 75% chance of reaching $80.If A grows slowly it is sold for $50.There is a 70% chance that investment B will grow rapidly in value and a 30% chance that it will grow slowly.If B grows rapidly the investor can cash it in for $100 or trade it for investment D which has a 20% chance of growing to $95 and an 80% chance of reaching $80.If B grows slowly it is sold for $45.Draw the decision tree for this problem.

(Essay)

4.8/5  (29)

(29)

In a graphical representation of decision trees the event nodes are represented by

(Multiple Choice)

4.9/5  (33)

(33)

Exhibit 14.1

The following questions are based on the information below.

An investor is considering 4 investments,A,B,C and leaving his money in the bank.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.

-Refer to Exhibit 14.1.What decision should be made according to the maximax decision rule?

-Refer to Exhibit 14.1.What decision should be made according to the maximax decision rule?

(Multiple Choice)

4.8/5  (31)

(31)

The decision rule which determines the maximum payoff for each alternative and then selects the alternative associated with the largest payoff is the

(Multiple Choice)

4.7/5  (28)

(28)

Exhibit 14.8

The following questions use the information below.

A company needs to buy a new insurance policy.They have three policies to choose from,A,B and C.The policies differ with respect to price,coverage and ease of billing.The company has developed the following AHP tables for price and summary.The other tables are not shown due to space limitations.

A B C D E F G 1 2 3 Criterion A B C 4 Price 0.648 0.230 0.122 0.123 5 Coverage 0.213 0.701 0.085 0.320 7 Billing 0.120 0.272 0.608 0.557 7 Weighted Avg Score: 0.215 0.404 0.381 1.000 Summary

-Refer to Exhibit 14.8.What formula should go in cell C7 and get copied to D7:E7 of the Summary worksheet to compute the Weighted Average Score?

A B C D E F G 1 2 3 Criterion A B C 4 Price 0.648 0.230 0.122 0.123 5 Coverage 0.213 0.701 0.085 0.320 7 Billing 0.120 0.272 0.608 0.557 7 Weighted Avg Score: 0.215 0.404 0.381 1.000 Summary

-Refer to Exhibit 14.8.What formula should go in cell C7 and get copied to D7:E7 of the Summary worksheet to compute the Weighted Average Score?

(Multiple Choice)

4.9/5  (37)

(37)

Exhibit 14.9

The following questions are based on the information below.

An investor is considering 4 investments,W,X,Y,and Z.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the investment decision problem.

E 1 Payoff Matrix 2 3 Economy 4 Investment Decline Expand Choice 5 0 80 6 3 0 70 7 5 0 35 8 z 2 0 20 Payoffs

-Refer to Exhibit 14.9.What decision should be made according to the minimax regret decision rule?

(Short Answer)

4.8/5  (39)

(39)

An investor is considering 4 investments,A,B,C,D.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can be weak or strong.The investor has estimated the probability of a declining economy at 30% and an expanding economy at 70%.Draw the decision tree for this problem and determine the correct decision for this investor based on the expected monetary value criteria.

Payoff Matrix Economy

Investment Weak Strong A -30 120 B 20 60 C 30 35 D 15 30

(Essay)

4.9/5  (32)

(32)

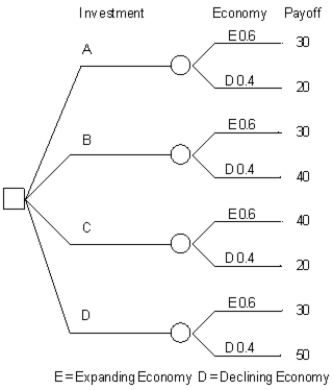

Exhibit 14.5

The following questions are based on the information below.

An investor is considering 4 investments,A,B,C,D.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following decision tree has been developed for the problem.The investor has estimated the probability of a declining economy at 40% and an expanding economy at 60%.  -Refer to Exhibit 14.5.What is the expected monetary value for the investor's problem?

-Refer to Exhibit 14.5.What is the expected monetary value for the investor's problem?

(Multiple Choice)

4.8/5  (44)

(44)

Showing 41 - 60 of 116

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)