Exam 14: Decision Analysis

Exam 1: Introduction to Modeling and Decision Analysis74 Questions

Exam 2: Introduction to Optimization and Linear Programming73 Questions

Exam 3: Modeling and Solving Lp Problems in a Spreadsheet75 Questions

Exam 4: Sensitivity Analysis and the Simplex Method77 Questions

Exam 5: Network Modeling84 Questions

Exam 6: Integer Linear Programming88 Questions

Exam 7: Goal Programming and Multiple Objective Optimization65 Questions

Exam 8: Nonlinear Programming and Evolutionary Optimization69 Questions

Exam 9: Regression Analysis82 Questions

Exam 10: Data Mining102 Questions

Exam 11: Time Series Forecasting81 Questions

Exam 12: Introduction to Simulation Using Analytic Solver Platform70 Questions

Exam 13: Queuing Theory87 Questions

Exam 14: Decision Analysis116 Questions

Exam 15: Project Management Online65 Questions

Select questions type

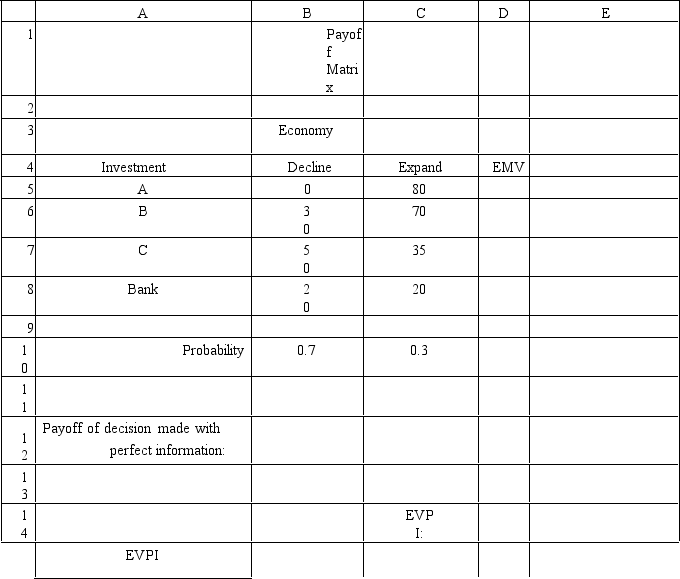

Exhibit 14.4

The following questions are based on the information below.

-Refer to Exhibit 14.4.What is the expected value with perfect information for the investor?

-Refer to Exhibit 14.4.What is the expected value with perfect information for the investor?

(Multiple Choice)

4.9/5  (42)

(42)

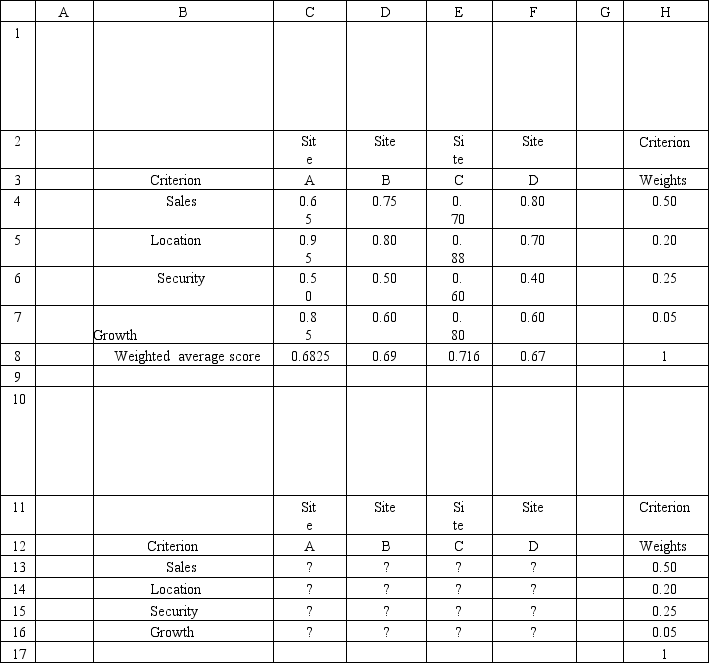

A convenience store chain is considering opening a new store at one of four locations.They have developed the following multi-criteria scoring model for this problem.What formulas must be placed in cells C13:F16 to compute the weighted scores for use in generating a Weighted Score radar chart?

(Essay)

4.7/5  (27)

(27)

In a graphical representation of decision trees the decision nodes are represented by

(Multiple Choice)

4.9/5  (40)

(40)

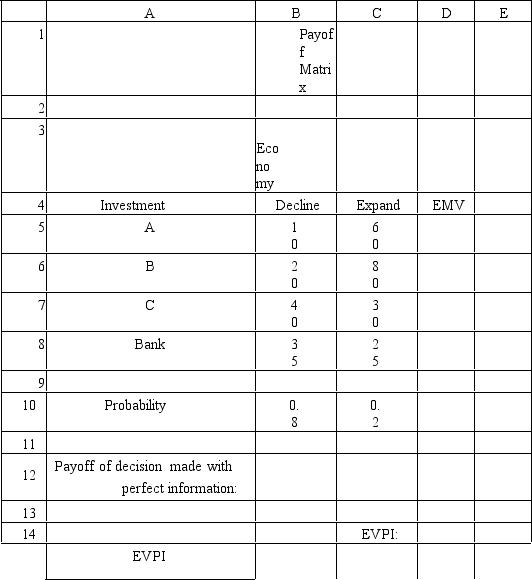

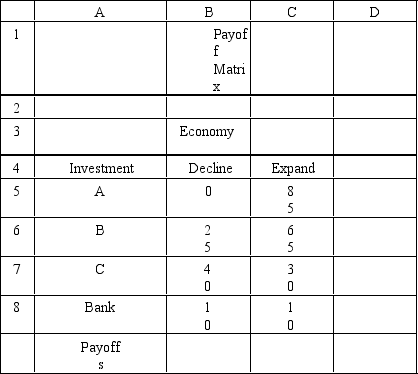

Exhibit 14.3

The following questions are based on the information below.

An investor is considering 4 investments,A,B,C and leaving his money in the bank.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.The investor has estimated the probability of a declining economy at 70% and an expanding economy at 30%.

-Refer to Exhibit 14.3.What is the expected monetary value of Investment A?

-Refer to Exhibit 14.3.What is the expected monetary value of Investment A?

(Multiple Choice)

4.7/5  (38)

(38)

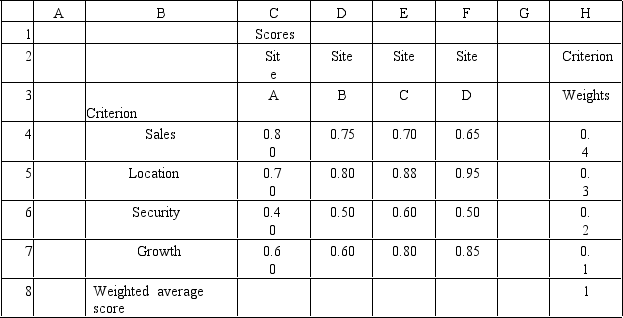

A fast food restaurant is considering opening a new store at one of four locations.They have developed the following multi-criteria scoring model for this problem.What location should they choose based on this information?

(Multiple Choice)

4.9/5  (42)

(42)

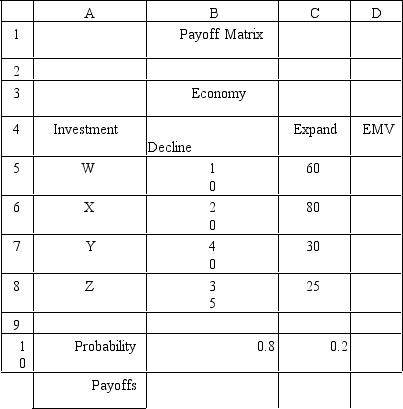

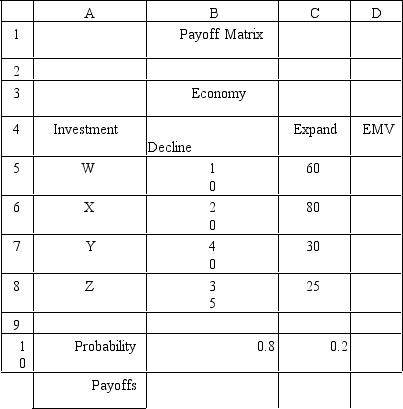

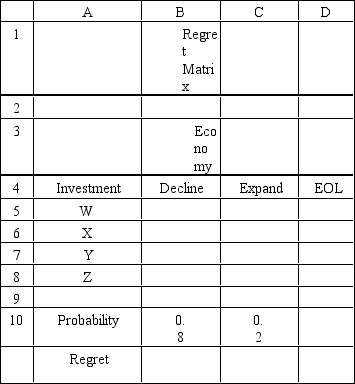

Exhibit 14.10

The following questions are based on the information below.

An investor is considering 4 investments,W,X,Y,and Z.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.The investor has estimated the probability of a declining economy at 80% and an expanding economy at 20%.

-Refer to Exhibit 14.10.What formulas should go in cell D5:D14 and B12:C12 of the spreadsheet to compute the EVPI?

-Refer to Exhibit 14.10.What formulas should go in cell D5:D14 and B12:C12 of the spreadsheet to compute the EVPI?

(Essay)

4.8/5  (42)

(42)

The amount of opportunity lost in making a decision is called

(Multiple Choice)

4.8/5  (37)

(37)

The scores in a scoring model can be thought of as subjective assessments of

(Multiple Choice)

4.9/5  (37)

(37)

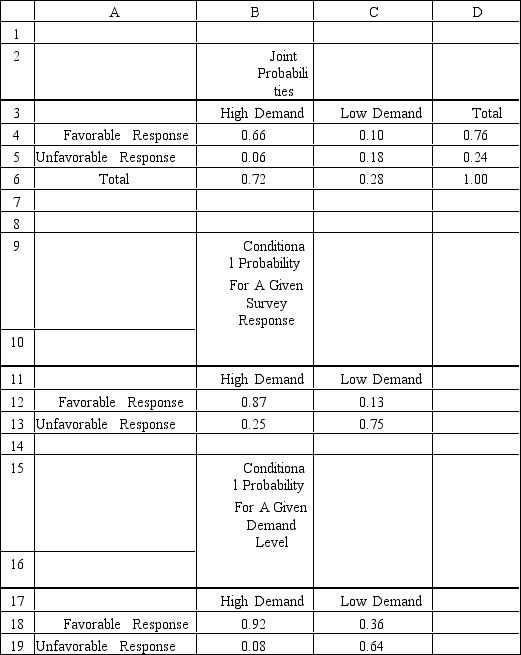

Exhibit 14.11

The following questions use the information below.

A company is planning a plant expansion.They can build a large or small plant.The payoffs for the plant depend on the level of consumer demand for the company's products.The company believes that there is an 72% chance that demand for their products will be high and a 28% chance that it will be low.The company can pay a market research firm to survey consumer attitudes towards the company's products.There is a 76% chance that the customers will like the products and a 24% chance that they won't.The payoff matrix and costs of the two plants are listed below.The company believes that if the survey is favorable there is an 87% chance that demand will be high for the products.If the survey is unfavorable there is only a 25% chance that the demand will be high.

Demand Factory Size High Low Plant Cost \millian ) Large 90 40 5 Small 55 20 1 The company has developed the following conditional probability table for their decision problem.

-Refer to Exhibit 14.11.What is PF?H),where F = favorable response and H = high demand?

-Refer to Exhibit 14.11.What is PF?H),where F = favorable response and H = high demand?

(Essay)

4.8/5  (32)

(32)

A course of action intended to solve a problem is called an)

(Multiple Choice)

5.0/5  (35)

(35)

Exhibit 14.7

The following questions use the information below.

A decision maker is faced with two alternatives.The decision maker has determined that she is indifferent between the two alternatives when p = 0.45.

Alternative 1: Receive $82,000 with certainty

Alternative 2: Receive $143,000 with probability p and lose $15,000 with probability 1 − p).

-Refer to Exhibit 14.7.What is the decision maker's certainty equivalent for this problem?

(Multiple Choice)

4.7/5  (40)

(40)

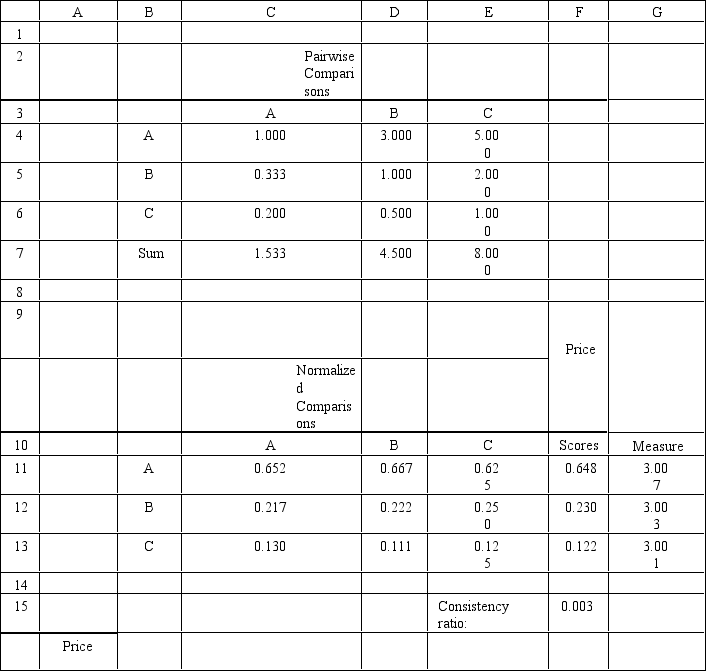

Exhibit 14.8

The following questions use the information below.

A company needs to buy a new insurance policy.They have three policies to choose from,A,B and C.The policies differ with respect to price,coverage and ease of billing.The company has developed the following AHP tables for price and summary.The other tables are not shown due to space limitations.

A B C D E F G 1 2 3 Criterion A B C 4 Price 0.648 0.230 0.122 0.123 5 Coverage 0.213 0.701 0.085 0.320 7 Billing 0.120 0.272 0.608 0.557 7 Weighted Avg Score: 0.215 0.404 0.381 1.000 Summary

-Refer to Exhibit 14.8.What formula should go in cell G15 of the Price worksheet to compute the Consistency Ratio?

A B C D E F G 1 2 3 Criterion A B C 4 Price 0.648 0.230 0.122 0.123 5 Coverage 0.213 0.701 0.085 0.320 7 Billing 0.120 0.272 0.608 0.557 7 Weighted Avg Score: 0.215 0.404 0.381 1.000 Summary

-Refer to Exhibit 14.8.What formula should go in cell G15 of the Price worksheet to compute the Consistency Ratio?

(Multiple Choice)

4.7/5  (42)

(42)

Decision analysis supports all but one of the following goals.Which goal is not supported?

(Multiple Choice)

4.9/5  (40)

(40)

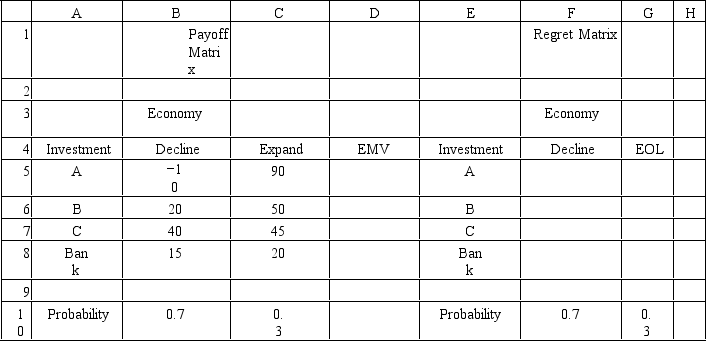

Exhibit 14.1

The following questions are based on the information below.

An investor is considering 4 investments,A,B,C and leaving his money in the bank.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.

-Refer to Exhibit 14.1.What decision should be made according to the minimax regret decision rule?

-Refer to Exhibit 14.1.What decision should be made according to the minimax regret decision rule?

(Multiple Choice)

4.7/5  (41)

(41)

Exhibit 14.10

The following questions are based on the information below.

An investor is considering 4 investments,W,X,Y,and Z.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.The investor has estimated the probability of a declining economy at 80% and an expanding economy at 20%.

-Refer to Exhibit 14.10.The original payoff data is in the worksheet above called "Payoffs".What formula should go in cell B5 of the spreadsheet if the expected regret decision rule is to be used?

-Refer to Exhibit 14.10.The original payoff data is in the worksheet above called "Payoffs".What formula should go in cell B5 of the spreadsheet if the expected regret decision rule is to be used?

(Essay)

4.9/5  (32)

(32)

Showing 101 - 116 of 116

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)