Exam 7: Inventories: Cost Measurement and Flow Assumptions

Exam 1: The Demand for and Supply of Financial Accounting Information89 Questions

Exam 2: Financial Reporting: Its Conceptual Framework87 Questions

Exam 3: Review of a Companys Accounting System146 Questions

Exam 5: The Income Statement and the Statement of Cash Flows151 Questions

Exam 6: Cash and Receivables149 Questions

Exam 7: Inventories: Cost Measurement and Flow Assumptions123 Questions

Exam 8: Inventories: Special Valuation Issues148 Questions

Exam 9: Current Liabilities and Contingencies128 Questions

Exam 10: Property, Plant, and Equipment: Acquisition and Subsequent Investments105 Questions

Exam 11: Depreciation, Depletion, Impairment, and Disposal143 Questions

Exam 12: Intangibles105 Questions

Exam 13: Investments and Long-Term Receivables140 Questions

Exam 14: Financing Liabilities: Bonds and Notes Payable171 Questions

Exam 15: Contributed Capital154 Questions

Exam 17: Advanced Issues in Revenue Recognition113 Questions

Exam 18: Accounting for Income Taxes108 Questions

Exam 19: Accounting for Postretirement Benefits98 Questions

Exam 20: Accounting for Leases149 Questions

Exam 21: The Statement of Cash Flows107 Questions

Exam 22: Accounting for Changes and Errors130 Questions

Exam 23: Time Value of Money Module121 Questions

Select questions type

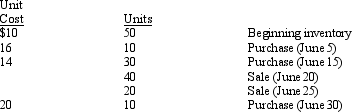

Exhibit 7-4 RJ, Inc. had the following activity for an inventory item during June:  -Refer to Exhibit 7-4. Assuming RJ uses a perpetual moving average cost flow assumption, cost of goods sold for June would be

-Refer to Exhibit 7-4. Assuming RJ uses a perpetual moving average cost flow assumption, cost of goods sold for June would be

(Multiple Choice)

5.0/5  (38)

(38)

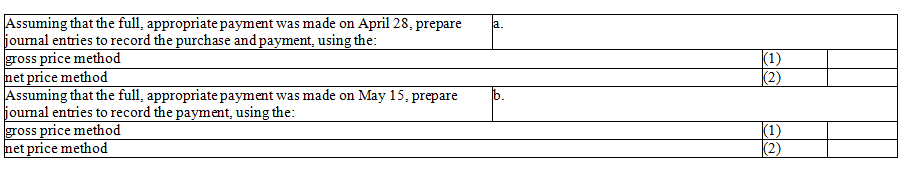

On April 15, Jones, Inc. purchased merchandise inventory at an invoice price of $350,000, with terms of 3/15, n/30.

Required:

(Essay)

4.8/5  (33)

(33)

Match each key term with its appropriate definition

Correct Answer:

Premises:

Responses:

(Matching)

4.9/5  (39)

(39)

The use of dollar-value LIFO follows the same methodology as the LIFO method but reduces the record keeping.

(True/False)

4.9/5  (42)

(42)

Which one of the following is not a disadvantage of the LIFO inventory cost flow assumption?

(Multiple Choice)

4.8/5  (36)

(36)

Which one of the following types of costs should be included in the cost of a manufactured inventory?

(Multiple Choice)

4.9/5  (37)

(37)

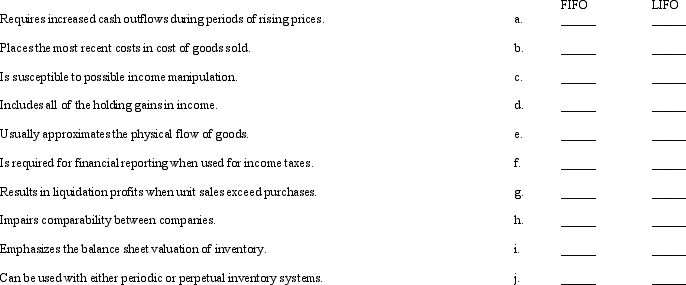

There are many differences between inventory cost flow assumptions. Listed below is a series of descriptive statements.  Required:

For each statement, indicate if it applies to LIFO or FIFO or both by placing an "X" in the appropriate column(s).

Required:

For each statement, indicate if it applies to LIFO or FIFO or both by placing an "X" in the appropriate column(s).

(Essay)

4.9/5  (32)

(32)

Revolution Hardware reported $475,000 of inventory on December 31, 2014, based on a physical count.

Additional information is as follows:

•Included in the 2014 physical count were machines billed to a customer FOB shipping point on December 31. These machines had a cost of $12,000 and had been billed at $30,000. The shipment was on Revolution's loading dock waiting to be picked up by the carrier.

•Goods were in transit from a vendor to Revolution. The invoice cost was $85,000 and the goods were shipped FOB shipping point on December 29, 2014.

•Work in process inventory (not included in the physical count) costing $7,850 was sent to an outside processor for finishing on December 30, 2014.

•Goods out on consignment amounted to $26,500 (sales price) with shipping costs of $590 (not included in sales price). Markup is 15% on cost.

Required:

Compute the correct amount of December 31, 2014, ending inventory for Revolution Hardware.

(Essay)

4.8/5  (33)

(33)

Exhibit 7-2 Edwards Co. purchased raw materials with a cost of $95,000 on March 2, 2014. Credit terms of 3/20, n/60 applied.

-Refer to Exhibit 7-2. If Edwards uses the net method and pays for the purchase on March 31, 2014, what amount is recorded in the Purchase Discounts Lost account?

(Multiple Choice)

4.8/5  (34)

(34)

Which one of the following types of costs is excluded from the cost of inventory that is routinely manufactured?

(Multiple Choice)

4.9/5  (40)

(40)

Stansbury Company determined its December 31, 2014 inventory to be $1,000,000 based on a physical count priced at cost. It then determined the following additional information:

Merchandise costing $90,000 was shipped FOB shipping point from a vendor on December 30, 2014. This merchandise was received and recorded on January 5, 2015.

Goods costing $120,000 were staged on the shipping dock and excluded from inventory although shipment was not made until January 4, 2015. The goods were billed to the customer FOB shipping point on December 30, 2014.

What is Stansbury's ending inventory for its December 31, 2014 balance sheet?

(Multiple Choice)

4.9/5  (33)

(33)

Which one of the following types of costs is most likely to be included in determining the cost of inventory?

(Multiple Choice)

4.9/5  (35)

(35)

Which one of the following is not an advantage of using the FIFO cost flow assumption?

(Multiple Choice)

4.9/5  (37)

(37)

A perpetual inventory system provides management with valuable tools in which to plan and control inventory levels because the amount of inventory is known at any point in time.

(True/False)

4.9/5  (37)

(37)

What are the cost flow assumptions available to record costs associated with inventory?

(Essay)

4.7/5  (32)

(32)

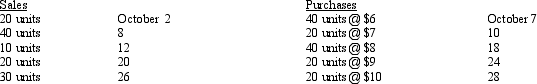

La Grange, Inc. reported sales of $1,200 in October and a gross profit of $370. The company had an October 1 inventory of 60 units that had a total cost of $300. October purchases and sales were as follows:  La Grange, Inc., must use

La Grange, Inc., must use

(Multiple Choice)

4.8/5  (41)

(41)

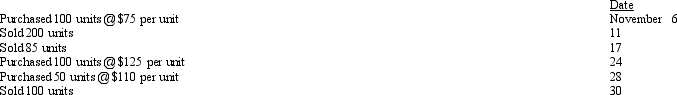

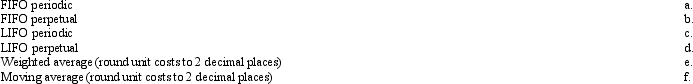

On November 1, Lacy Company began business with the purchase of 250 units of inventory for $21,625. During the month, Lacy had the following inventory transactions:  Required:

Compute the cost of the inventory at the end of November under the following alternatives:

Required:

Compute the cost of the inventory at the end of November under the following alternatives:

(Essay)

4.9/5  (33)

(33)

Showing 81 - 100 of 123

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)