Exam 7: Inventories: Cost Measurement and Flow Assumptions

Exam 1: The Demand for and Supply of Financial Accounting Information89 Questions

Exam 2: Financial Reporting: Its Conceptual Framework87 Questions

Exam 3: Review of a Companys Accounting System146 Questions

Exam 5: The Income Statement and the Statement of Cash Flows151 Questions

Exam 6: Cash and Receivables149 Questions

Exam 7: Inventories: Cost Measurement and Flow Assumptions123 Questions

Exam 8: Inventories: Special Valuation Issues148 Questions

Exam 9: Current Liabilities and Contingencies128 Questions

Exam 10: Property, Plant, and Equipment: Acquisition and Subsequent Investments105 Questions

Exam 11: Depreciation, Depletion, Impairment, and Disposal143 Questions

Exam 12: Intangibles105 Questions

Exam 13: Investments and Long-Term Receivables140 Questions

Exam 14: Financing Liabilities: Bonds and Notes Payable171 Questions

Exam 15: Contributed Capital154 Questions

Exam 17: Advanced Issues in Revenue Recognition113 Questions

Exam 18: Accounting for Income Taxes108 Questions

Exam 19: Accounting for Postretirement Benefits98 Questions

Exam 20: Accounting for Leases149 Questions

Exam 21: The Statement of Cash Flows107 Questions

Exam 22: Accounting for Changes and Errors130 Questions

Exam 23: Time Value of Money Module121 Questions

Select questions type

Which one of the following sets of inventory cost flow assumptions is not susceptible to profit manipulation by management?

(Multiple Choice)

4.7/5  (40)

(40)

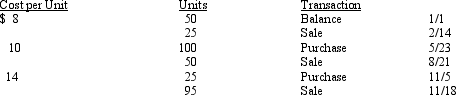

Trooper Company has provided the following inventory data for the year:  Required:

Compute the cost of goods sold and the ending inventory using the periodic inventory system for each of the following cost flow assumptions:

a.FIFO

b.LIFO

c.weighted average

Required:

Compute the cost of goods sold and the ending inventory using the periodic inventory system for each of the following cost flow assumptions:

a.FIFO

b.LIFO

c.weighted average

(Essay)

4.8/5  (43)

(43)

Which of the following inventory cost flow assumptions produces the same ending inventory values under both the periodic and perpetual systems?

(Multiple Choice)

4.9/5  (38)

(38)

For companies that have little change in the characteristics of their inventory items, the most appropriate method for computing a cost index for dollar-value LIFO is the

(Multiple Choice)

4.9/5  (49)

(49)

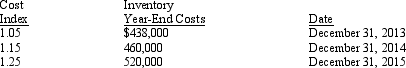

Exhibit 7-5 Sullivan Produce Co. switched from FIFO to LIFO on January 1, 2013, for external reporting and income tax purposes, while retaining FIFO for internal reports. On that date, the FIFO inventory equaled $360,000. The ensuing three-year period resulted in the following:  -Refer to Exhibit 7-5. The ending inventory at December 31, 2015, using the dollar-value LIFO method would be

-Refer to Exhibit 7-5. The ending inventory at December 31, 2015, using the dollar-value LIFO method would be

(Multiple Choice)

4.9/5  (28)

(28)

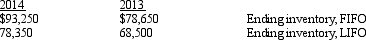

Cabinets for Less uses FIFO for internal reporting purposes and LIFO for financial and income tax purposes. At the end of 2014, the following information was obtained from the inventory records:  Required:

Prepare the necessary entry to convert to LIFO at the end of 2013.

Required:

Prepare the necessary entry to convert to LIFO at the end of 2013.

(Essay)

4.8/5  (45)

(45)

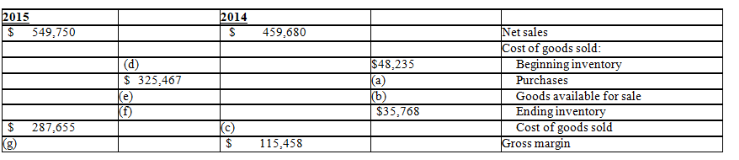

The following information was obtained from the accounting records of Junie Company.

Required:

Compute the missing amounts.

Required:

Compute the missing amounts.

(Essay)

4.8/5  (46)

(46)

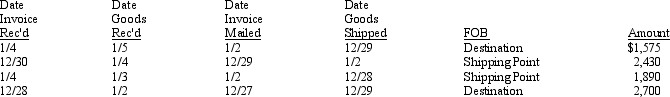

Near the end of 2015, Spruce Co. made the following purchases. The months involved in all cases are December 2015 and January 2016.

What amount of the above purchases should be included in Spruce's inventory at December 31, 2015?

What amount of the above purchases should be included in Spruce's inventory at December 31, 2015?

(Multiple Choice)

4.9/5  (29)

(29)

In a period of falling prices, FIFO produces the lowest cost of goods sold and the highest gross profit.

(True/False)

4.8/5  (36)

(36)

Martins Game Stop began the current quarter with the following inventory: 900 units @ $10 per unit and 250 units @ $12 per unit. During the quarter, Martin purchased 400 units @ $13 per unit and sold 680 units. Martin prepares interim financial statements each quarter.

Required:

a.Determine the amount of LIFO liquidation profit for the quarter.

b.Assume the liquidation is not to be reflected in the current quarter's financial statements. Prepare the necessary adjusting entry.

c.Explain the circumstances when an inventory liquidation is not reported on interim financial statements.

(Essay)

4.8/5  (33)

(33)

Exhibit 7-2 Edwards Co. purchased raw materials with a cost of $95,000 on March 2, 2014. Credit terms of 3/20, n/60 applied.

-Refer to Exhibit 7-2. If Edwards uses the net method and pays for the purchase on March 18, 2014, what amount is recorded in the Purchase Discounts Taken account?

(Multiple Choice)

4.8/5  (44)

(44)

The costs of operating a purchasing department are necessary to the purchasing of inventory therefore those costs incurred should be allocated to inventory.

(True/False)

4.8/5  (35)

(35)

The IFRS disallow the use of LIFO for external financial reporting. Assume a U.S. based company has been using LIFO for financial and tax reporting but now wants to prepare IFRS conforming financial statements to enable its stock to be traded on one of the European stock exchanges.

Required:

(Essay)

4.9/5  (40)

(40)

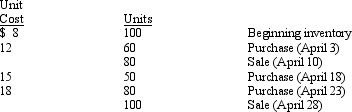

Exhibit 7-3 Davis Co. had the following inventory activity during April:  -Refer to Exhibit 7-3. Assuming Davis uses a periodic LIFO cost flow assumption, ending inventory at April 30 would be

-Refer to Exhibit 7-3. Assuming Davis uses a periodic LIFO cost flow assumption, ending inventory at April 30 would be

(Multiple Choice)

4.8/5  (36)

(36)

Showing 41 - 60 of 123

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)