Exam 1: Introduction to Accounting and Business

Exam 1: Introduction to Accounting and Business190 Questions

Exam 2: Analyzing Transactions224 Questions

Exam 3: The Adjusting Process179 Questions

Exam 4: Completing the Accounting Cycle194 Questions

Exam 5: Accounting Systems160 Questions

Exam 6: Accounting for Merchandising Businesses215 Questions

Exam 7: Inventories165 Questions

Exam 8: Sarbanes-Oxley, Internal Control, and Cash176 Questions

Exam 9: Receivables140 Questions

Exam 10: Fixed Assets and Intangible Assets170 Questions

Exam 11: Current Liabilities and Payroll169 Questions

Exam 12: Accounting for Partnerships and Limited Liability Companies190 Questions

Exam 13: Corporations: Organization, Stock Transactions, and Dividends165 Questions

Exam 14: Long-Term Liabilities: Bonds and Notes185 Questions

Exam 15: Investments and Fair Value Accounting133 Questions

Exam 16: Statement of Cash Flows160 Questions

Exam 17: Financial Statement Analysis185 Questions

Exam 18: Managerial Accounting Concepts and Principles173 Questions

Exam 19: Job Order Costing173 Questions

Exam 20: Process Cost Systems177 Questions

Exam 21: Cost Behavior and Cost-Volume-Profit Analysis215 Questions

Exam 22: Budgeting188 Questions

Exam 23: Performance Evaluation Using Variances From Standard Costs161 Questions

Exam 24: Performance Evaluation for Decentralized Operations200 Questions

Exam 25: Differential Analysis and Product Pricing162 Questions

Exam 26: Capital Investment Analysis179 Questions

Select questions type

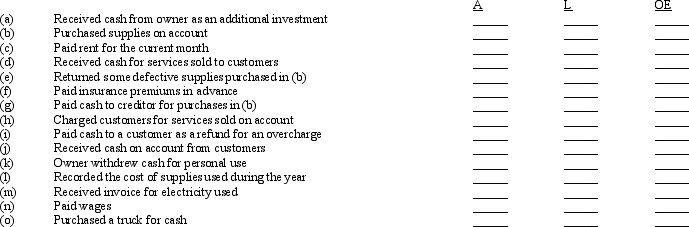

Selected transactions completed by a proprietorship are described below. Indicate the effects of each transaction on assets, liabilities, and owner's equity by inserting "+" for increase and "-" for decrease in the appropriate columns at the right. If appropriate, you may insert more than one symbol in a column.

(Essay)

4.8/5  (39)

(39)

Within the United States, the dominant body in the primary development of accounting principles is the

(Multiple Choice)

4.9/5  (35)

(35)

On July 1 of the current year, the assets and liabilities of John Wong, DVM, are as follows: Cash, $27,000; Accounts Receivable, $12,300; Supplies, $3,100; Land, $35,000; Accounts Payable, $13,900. What is the amount of owner's equity (John Wong's capital) as of July 1 of the current year?

(Essay)

4.7/5  (39)

(39)

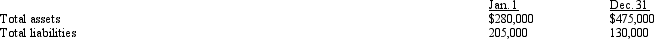

The total assets and total liabilities of Paul's Pools, a proprietorship, at the beginning and at the end of the current fiscal year are as follows:

(Essay)

4.8/5  (37)

(37)

If total assets decreased by $88,000 during a period of time and owner's equity increased by $71,000 during the same period, then the amount and direction (increase or decrease) of the period's change in total liabilities is

(Multiple Choice)

4.9/5  (36)

(36)

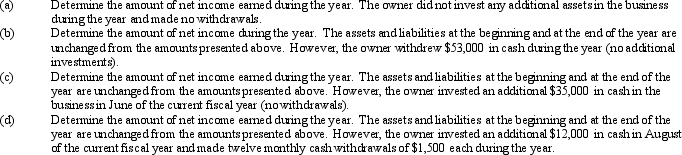

Selected transaction data of a business for September are summarized below. Determine the following amounts for September: (a) total revenue, (b) total expenses, (c) net income.

(Essay)

4.9/5  (33)

(33)

Allen Marks is the sole owner and operator of Great Marks Company. As of the end of its accounting period, December 31, 2013, Great Marks Company has assets of $940,000 and liabilities of $300,000. During 2014, Allen Marks invested an additional $73,000 and withdrew $33,000 from the business. What is the amount of net income during 2014, assuming that as of December 31, 2014, assets were $995,000, and liabilities were $270,000?

(Multiple Choice)

4.8/5  (27)

(27)

The role of accounting is to provide many different users with financial information to make economic decisions.

(True/False)

4.9/5  (30)

(30)

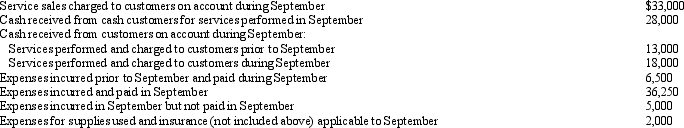

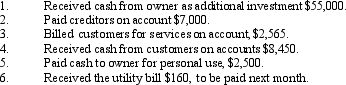

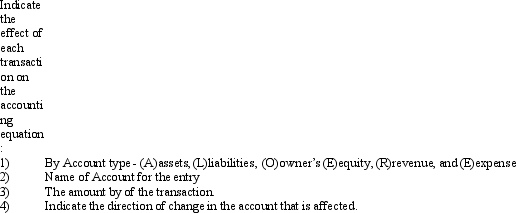

Daniels Company is owned and operated by Thomas Daniels. The following selected transactions were completed by Daniels Company during May:

Note: Each transaction has two entries.

Note: Each transaction has two entries.

(Essay)

4.8/5  (30)

(30)

The main objective of a not-for-profit business is to make a profit.

(True/False)

4.9/5  (31)

(31)

An example of an external user of accounting information is the federal government.

(True/False)

4.7/5  (34)

(34)

Give the major disadvantage of disregarding the cost concept and constantly revaluing assets based on appraisals and opinions.

(Essay)

4.8/5  (40)

(40)

The asset created by a business when it makes a sale on account is termed

(Multiple Choice)

4.9/5  (35)

(35)

There are four transactions that affect Owner's equity.

(a) What are the two types of transactions that increase Owner's equity?

(b) What are the two types of transactions that decrease Owner's equity?

(Essay)

4.7/5  (30)

(30)

Managerial accounting information is used by external and internal users equally.

(True/False)

4.8/5  (28)

(28)

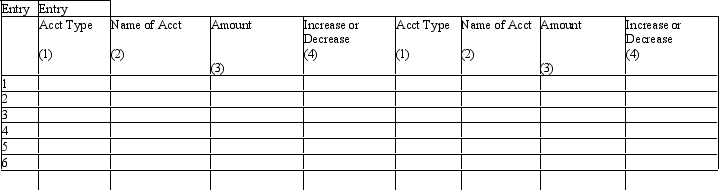

The assets and liabilities of S&P Day Spa at December 31, 2014 and expenses for the year are listed below. The capital of the owner was $68,000 at January 1, 2014. The owner invested an additional $10,000 during the year. Net income for 2014 is $45,625.

Prepare an income statement for the current year ended December 31, 2014.

Prepare an income statement for the current year ended December 31, 2014.

(Essay)

4.8/5  (28)

(28)

Showing 21 - 40 of 190

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)