Exam 1: Introduction to Accounting and Business

Exam 1: Introduction to Accounting and Business190 Questions

Exam 2: Analyzing Transactions224 Questions

Exam 3: The Adjusting Process179 Questions

Exam 4: Completing the Accounting Cycle194 Questions

Exam 5: Accounting Systems160 Questions

Exam 6: Accounting for Merchandising Businesses215 Questions

Exam 7: Inventories165 Questions

Exam 8: Sarbanes-Oxley, Internal Control, and Cash176 Questions

Exam 9: Receivables140 Questions

Exam 10: Fixed Assets and Intangible Assets170 Questions

Exam 11: Current Liabilities and Payroll169 Questions

Exam 12: Accounting for Partnerships and Limited Liability Companies190 Questions

Exam 13: Corporations: Organization, Stock Transactions, and Dividends165 Questions

Exam 14: Long-Term Liabilities: Bonds and Notes185 Questions

Exam 15: Investments and Fair Value Accounting133 Questions

Exam 16: Statement of Cash Flows160 Questions

Exam 17: Financial Statement Analysis185 Questions

Exam 18: Managerial Accounting Concepts and Principles173 Questions

Exam 19: Job Order Costing173 Questions

Exam 20: Process Cost Systems177 Questions

Exam 21: Cost Behavior and Cost-Volume-Profit Analysis215 Questions

Exam 22: Budgeting188 Questions

Exam 23: Performance Evaluation Using Variances From Standard Costs161 Questions

Exam 24: Performance Evaluation for Decentralized Operations200 Questions

Exam 25: Differential Analysis and Product Pricing162 Questions

Exam 26: Capital Investment Analysis179 Questions

Select questions type

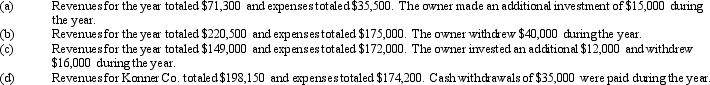

For each of the following, determine the amount of net income or net loss for the year.

(Essay)

4.9/5  (30)

(30)

If total liabilities decreased by $46,000 during a period of time and owner's equity increased by $60,000 during the same period, the amount and direction (increase or decrease) of the period's change in total assets is

(Multiple Choice)

4.8/5  (39)

(39)

If the liabilities owed by a business total $300,000 and owners equity is equal to $300,000, then the assets also total $300,000.

(True/False)

4.9/5  (41)

(41)

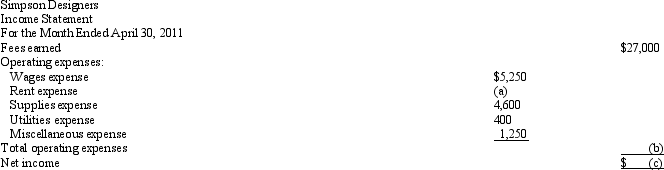

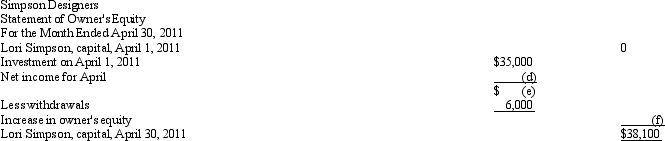

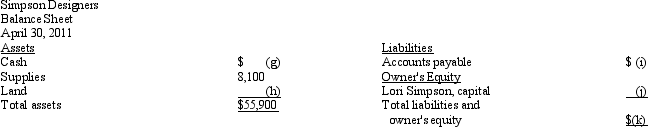

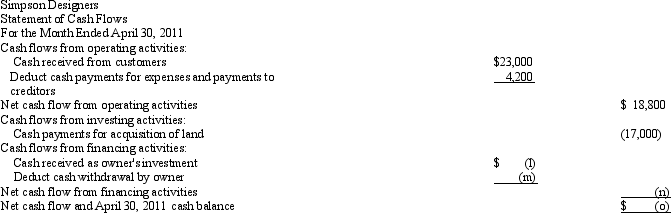

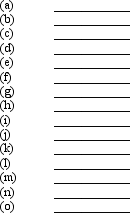

Simpson Designers began operations on April 1, 2011. The financial statements for Simpson Designers are shown below for the month ended April 30, 2011 (the first month of operations). Determine the missing amounts for letters (a) through (o).

Place your answers in the space provided below. Hint: Use the interrelationships among the financial statements to solve this problem.

Place your answers in the space provided below. Hint: Use the interrelationships among the financial statements to solve this problem.

(Essay)

4.9/5  (33)

(33)

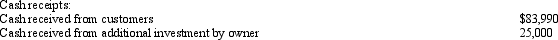

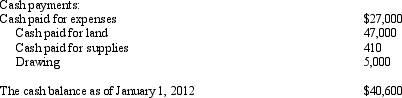

A summary of cash flows for Alex Design Services for the year ended December 31, 2012, is shown below.

Prepare a statement of cash flows for Alex Design Services for the year ended December 31, 2012.

Prepare a statement of cash flows for Alex Design Services for the year ended December 31, 2012.

(Essay)

4.8/5  (32)

(32)

The financial statement that presents a summary of the revenues and expenses of a business for a specific period of time, such as a month or year, is called a(n)

(Multiple Choice)

4.9/5  (24)

(24)

Denzel Jones owns and operates Crystal Cleaning Company. Recently, Denzel withdrew $10,000 from Crystal Cleaning, and he contributed $6,000, in his name, to Habitat for Humanity. The contribution of the $6,000 should be recorded on the accounting records of which of the following entities?

(Multiple Choice)

5.0/5  (39)

(39)

The financial statements of a proprietorship should include the owner's personal assets and liabilities.

(True/False)

4.8/5  (28)

(28)

If total assets decreased by $30,000 during a specific period and owner's equity decreased by $35,000 during the same period, the period's change in total liabilities was an $65,000 increase.

(True/False)

4.7/5  (34)

(34)

Which of the following is true in regards to a Limited Liability Company?

(Multiple Choice)

4.8/5  (36)

(36)

An entity that is organized according to state or federal statutes and in which ownership is divided into shares of stock is a

(Multiple Choice)

4.9/5  (30)

(30)

Krammer Company has liabilities equal to one fourth of the total assets. Krammer's owner's equity is $45,000. Using the accounting equation, what is the amount of liabilities for Krammer?

(Essay)

4.9/5  (27)

(27)

Goods purchased on account for future use in the business, such as supplies, are called

(Multiple Choice)

4.8/5  (33)

(33)

No significant differences exist between the accounting standards issued by the FASB and the IASB.

(True/False)

4.9/5  (34)

(34)

Select the type of business that is most likely to obtain large amounts of resources by issuing stock.

(Multiple Choice)

5.0/5  (38)

(38)

Donner Company is selling a piece of land adjacent to their business premises. An appraisal reported the market value of the land to be $220,000. The Focus Company initially offered to buy the land for $177,000. The companies settled on a purchase price of $212,000. On the same day, another piece of land on the same block sold for $232,000. Under the cost concept, at what amount should the land be recorded in the accounting records of Focus Company?

(Multiple Choice)

4.7/5  (34)

(34)

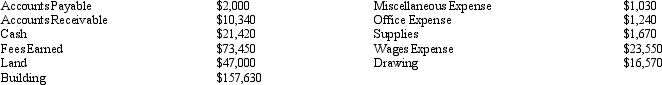

The assets and liabilities of Amos Moving Services at March 31, 2014, the end of the current year, and its revenue and expenses for the year are listed below. The capital of the owner was $180,000 at April 1, 2013, the beginning of the current year. Mr. Amos invested an additional $25,000 in the business during the year.

Prepare an income statement for the current year ended March 31, 2014.

Prepare an income statement for the current year ended March 31, 2014.

(Essay)

4.9/5  (33)

(33)

Showing 161 - 180 of 190

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)