Exam 1: Introduction to Accounting and Business

Exam 1: Introduction to Accounting and Business190 Questions

Exam 2: Analyzing Transactions224 Questions

Exam 3: The Adjusting Process179 Questions

Exam 4: Completing the Accounting Cycle194 Questions

Exam 5: Accounting Systems160 Questions

Exam 6: Accounting for Merchandising Businesses215 Questions

Exam 7: Inventories165 Questions

Exam 8: Sarbanes-Oxley, Internal Control, and Cash176 Questions

Exam 9: Receivables140 Questions

Exam 10: Fixed Assets and Intangible Assets170 Questions

Exam 11: Current Liabilities and Payroll169 Questions

Exam 12: Accounting for Partnerships and Limited Liability Companies190 Questions

Exam 13: Corporations: Organization, Stock Transactions, and Dividends165 Questions

Exam 14: Long-Term Liabilities: Bonds and Notes185 Questions

Exam 15: Investments and Fair Value Accounting133 Questions

Exam 16: Statement of Cash Flows160 Questions

Exam 17: Financial Statement Analysis185 Questions

Exam 18: Managerial Accounting Concepts and Principles173 Questions

Exam 19: Job Order Costing173 Questions

Exam 20: Process Cost Systems177 Questions

Exam 21: Cost Behavior and Cost-Volume-Profit Analysis215 Questions

Exam 22: Budgeting188 Questions

Exam 23: Performance Evaluation Using Variances From Standard Costs161 Questions

Exam 24: Performance Evaluation for Decentralized Operations200 Questions

Exam 25: Differential Analysis and Product Pricing162 Questions

Exam 26: Capital Investment Analysis179 Questions

Select questions type

On April 25, Gregg Repair Service extended an offer of $115,000 for land that had been priced for sale at $140,000. On May 3, Gregg Repair Service accepted the seller's counteroffer of $125,000. On June 20, the land was assessed at a value of $95,000 for property tax purposes. On August 4, Gregg Repair Service was offered $150,000 for the land by a national retail chain. At what value should the land be recorded in Gregg Repair Service's records?

(Multiple Choice)

4.8/5  (28)

(28)

Receiving a bill or otherwise being notified that an amount is owed is recorded until the amount is paid.

(True/False)

4.8/5  (32)

(32)

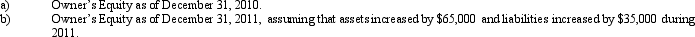

Doug Miller is the owner and operator of Miller's Arcade. At the end of its accounting period, December 31, 2010, Miller's Arcade has assets of $450,000 and liabilities of $125,000. Using the accounting equation, determine the following amounts:

(Essay)

4.8/5  (31)

(31)

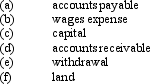

Indicate whether each of the following represents an asset, liability, or owner's equity:

(Essay)

4.8/5  (31)

(31)

Equipment with an estimated market value of $30,000 is offered for sale at $45,000. The equipment is acquired for $15,000 in cash and a note payable of $20,000 due in 30 days. The amount used in the buyer's accounting records to record this acquisition is

(Multiple Choice)

4.7/5  (39)

(39)

The following are examples of external users of accounting information except:

(Multiple Choice)

4.8/5  (34)

(34)

A business paid $7,000 to a creditor in payment of an amount owed. The effect of the transaction on the accounting equation was to

(Multiple Choice)

4.7/5  (40)

(40)

Financial accounting provides information to all users, while the main focus for managerial accounting is to provide information to the management.

(True/False)

4.9/5  (31)

(31)

Which of the following is not a certification for accountants?

(Multiple Choice)

4.9/5  (31)

(31)

About 90% of the businesses in the United States are organized as corporations.

(True/False)

4.9/5  (28)

(28)

a. A vacant lot acquired for $83,000 cash is sold for $127,000 in cash. What is the effect of the sale on the total amount of the seller's (1) assets, (2) liabilities, and (3) owner's equity?

b. Assume that the seller owes $52,000 on a loan for the land. After receiving the $127,000 cash in (a), the seller pays the $52,000 owed. What is the effect of the payment on the total amount of the seller's (1) assets, (2) liabilities, and (3) owner's equity?

(Essay)

4.9/5  (34)

(34)

Managerial accountants would be responsible for providing the following information:

(Multiple Choice)

4.9/5  (35)

(35)

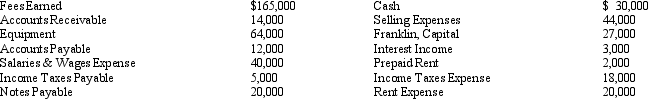

The accountant for Franklin Company prepared the following list of account balances from the company's records for the year ended December 31, 2011:

Based on this information, is Franklin Company profitable? Explain your answer.

Based on this information, is Franklin Company profitable? Explain your answer.

(Essay)

4.8/5  (42)

(42)

Kim Hsu is the owner of Hsu's Financial Services. At the end of its accounting period, December 31, 2011, Hsu's has assets of $575,000 and owner's equity of $335,000. Using the accounting equation and considering each case independently, determine the following amounts.

a. Hsu's liabilities as of December 31, 2011.

b. Hsu's liabilities as of December 31, 2012, assuming that assets increased by $56,000 and owner's equity decreased by $32,000.

c. Net income or net loss during 2012, assuming that as of December 31, 2012, assets were $592,000, liabilities were $450,000, and there were no additional investments or withdrawals.

(Essay)

4.9/5  (41)

(41)

The monetary value charged to customers for the performance of services sold is called a(n)

(Multiple Choice)

4.9/5  (33)

(33)

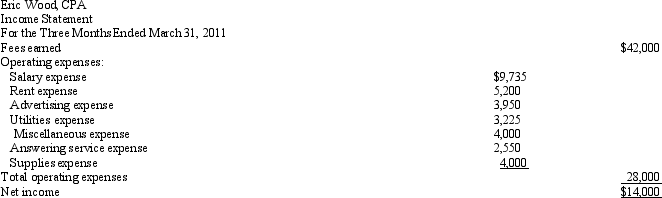

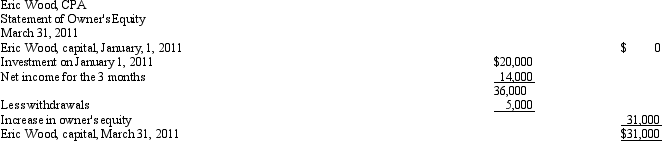

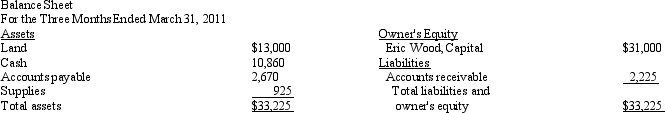

Eric Wood, CPA, was organized on January 1, 2011, as a proprietorship. List the errors that you find in the following financial statements and prepare the corrected statements for the three months ended March 31, 2011.

(Essay)

4.9/5  (38)

(38)

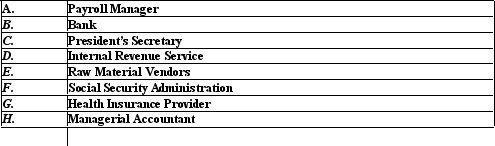

Identify each of the following as either internal or external users of accounting information.

(Essay)

4.8/5  (40)

(40)

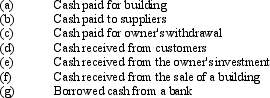

Indicate whether each of the following activities would be reported on the Statement of Cash Flows as an Operating Activity, an Investing Activity, a Financing Activity, or does not appear on the Cash Flow Statement.

(Essay)

5.0/5  (27)

(27)

Showing 81 - 100 of 190

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)