Exam 19: Returns, Index Numbers and Inflation

Exam 1: Statistics and Data68 Questions

Exam 2: Tabular and Graphical Methods99 Questions

Exam 3: Numerical Descriptive Measures123 Questions

Exam 4: Basic Probability Concepts107 Questions

Exam 5: Discrete Probability Distributions118 Questions

Exam 6: Continuous Probability Distributions114 Questions

Exam 7: Sampling and Sampling Distributions110 Questions

Exam 8: Interval Estimation111 Questions

Exam 9: Hypothesis Testing111 Questions

Exam 10: Statistical Inference Concerning Two Populations104 Questions

Exam 11: Statistical Inference Concerning Variance96 Questions

Exam 12: Chi-Square Tests100 Questions

Exam 13: Analysis of Variance89 Questions

Exam 14: Regression Analysis116 Questions

Exam 15: Inference With Regression Models117 Questions

Exam 16: Regression Models for Nonlinear Relationships95 Questions

Exam 17: Regression Models With Dummy Variables117 Questions

Exam 18: Time Series and Forecasting103 Questions

Exam 19: Returns, Index Numbers and Inflation98 Questions

Exam 20: Nonparametric Tests99 Questions

Select questions type

There is no need to have a constant base value for a price index.

(True/False)

4.8/5  (31)

(31)

Which of the following types of returns captures the changes in purchasing power?

(Multiple Choice)

4.8/5  (38)

(38)

Price indices are used to remove the effect of inflation so that business and economic time series can be evaluated in a more meaningful way.

(True/False)

4.8/5  (29)

(29)

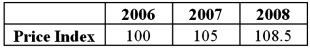

The following table provides the values of the simple price index for watches in a country.  If the base year is revised from 2006 to 2007,calculate the updated index for 2008.

If the base year is revised from 2006 to 2007,calculate the updated index for 2008.

(Multiple Choice)

4.8/5  (26)

(26)

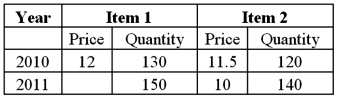

Consider the following price (in dollars)and quantity data for two items during 2010 and 2011.  If the value of the Laspeyres price index for 2011,using 2010 as the base year,is 89.46,find the price of item 1 in 2011.

If the value of the Laspeyres price index for 2011,using 2010 as the base year,is 89.46,find the price of item 1 in 2011.

(Short Answer)

4.8/5  (30)

(30)

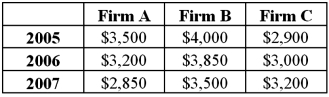

Exhibit 19-5.Firms A,B,and C operate in the market for computers.Each firm's product is popular in the market and distinct from what the other firms offer.The following table shows the prices of laptops from 2005 through 2007.  Refer to Exhibit 19-5.Compute the unweighted price index for the three types of laptops in 2006,using 2005 as the base year.

Refer to Exhibit 19-5.Compute the unweighted price index for the three types of laptops in 2006,using 2005 as the base year.

(Multiple Choice)

4.8/5  (43)

(43)

Tammy Welsh has two investment options to choose from.The stocks of both ABC Inc. ,and XYZ Corp. ,are currently trading at $200.ABC Inc. ,is paying a dividend of $10,and is expected to trade at $215 in a year's time.XYZ Corp. ,is paying a higher dividend of $25.However,the price of XYZ's stock is only expected to go up to $203 a year from now.Experts are estimating inflation to be about 2% in a year's time.

A)Which stock should Tammy invest in and why?

B)If the expected inflation rate was revised to 2.5%,would it alter Tammy's choice? Explain your answer.

(Essay)

4.8/5  (31)

(31)

The income yield from a one-year infrastructure bond purchased today is 0.5%.Compute the real return from this bond if the inflation rate a year later is expected to be 4% and the capital gains yield is zero.

(Short Answer)

4.7/5  (31)

(31)

Nicole Watson purchased a share of McAllister Inc. ,a year back when it was trading at $75.She also earned a dividend of $4 on this.The price of the same share has now increased to $87.

A)Compute the annual capital gain from this share.

B)Compute the annual income yield from this share.

(Short Answer)

4.9/5  (37)

(37)

Amy Peterson's annual salary when she started working in 2006 was $35,000.In 2011,her annual salary had increased to $44,000.Using 2006 as the base year,the consumer price index for 2011 was computed to be 112.Use this information to determine if Amy was better off in 2006 or in 2011.

(Essay)

5.0/5  (39)

(39)

Exhibit 19-1.Joanna Robertson bought a share of XYZ Corp.at $200 last year.She was paid a dividend of $30 during the same year.However,the same share is trading at $280 this year. Refer to Exhibit 19-1.Calculate Joanna's capital gains percent yield if she sells the shares at $280.

(Multiple Choice)

4.8/5  (38)

(38)

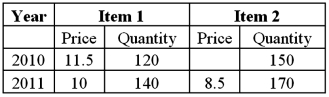

Consider the following price (in dollars)and quantity data for two items during 2010 and 2011.  If the value of the Paasche price index for 2011 is 90.61 (base year 2010),find the price of item 2 in 2010.

If the value of the Paasche price index for 2011 is 90.61 (base year 2010),find the price of item 2 in 2010.

(Short Answer)

4.9/5  (40)

(40)

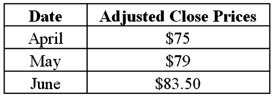

The following table provides the adjusted close prices of the shares of firm X for three consecutive months of the last year.  a.Compute the monthly return for May.

B)Compute the monthly return for June.

a.Compute the monthly return for May.

B)Compute the monthly return for June.

(Short Answer)

4.7/5  (36)

(36)

If the price index for a particular year is 75,it implies that:

(Multiple Choice)

5.0/5  (29)

(29)

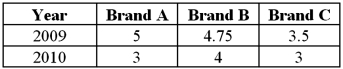

Consider the following table providing the prices for three different brands of chocolate-chip cookies during 2009-2010 in a particular country.(Prices are in the country's local currency. )  a.Compute the unweighted aggregate price index for 2010,using 2009 as the base year.

B)Interpret the result.

a.Compute the unweighted aggregate price index for 2010,using 2009 as the base year.

B)Interpret the result.

(Essay)

4.7/5  (39)

(39)

Sales revenue of firm X was $10 million in 2007.In 2010,the same firm reported higher sales revenue of $15 million.The producer price indices for 2007 and 2010 were 130 and 135.

A)Compute the nominal increase in sales revenue between 2007 and 2010.

B)Compute the real increase in sales revenue between 2007 and 2010.

(Short Answer)

4.8/5  (21)

(21)

Which of the following statements is true of the Consumer Price Index (CPI)?

(Multiple Choice)

4.7/5  (43)

(43)

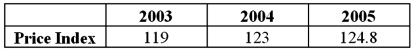

Exhibit 19-7.The following table shows the value of CPI for three years in a country.  Refer to Exhibit 19-7.Compute the annual inflation rate for 2004.

Refer to Exhibit 19-7.Compute the annual inflation rate for 2004.

(Multiple Choice)

4.9/5  (39)

(39)

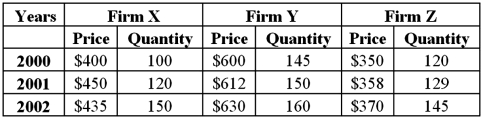

Exhibit 19-6.Three firms X,Y,and Z operate in the same industry,although their products have different features and are priced differently.The following table provides the prices and the quantities sold (in units)during the period 2000-2002.  Refer to Exhibit 19-6.Compute the Laspeyres price index for 2002,using 2000 as the base year.

Refer to Exhibit 19-6.Compute the Laspeyres price index for 2002,using 2000 as the base year.

(Multiple Choice)

4.8/5  (43)

(43)

Since both the Laspeyres and Paasche indices are weighted aggregate price indices,they will yield the same value for a given evaluation period.

(True/False)

4.8/5  (27)

(27)

Showing 41 - 60 of 98

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)