Exam 21: Cost Allocation and Performance Measurement

Exam 1: Accounting in Business245 Questions

Exam 2: Analyzing and Recording Transactions201 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements227 Questions

Exam 4: Completing the Accounting Cycle177 Questions

Exam 5: Accounting for Merchandising Operations189 Questions

Exam 6: Inventories and Cost of Sales194 Questions

Exam 7: Accounting Information Systems166 Questions

Exam 8: Cash and Internal Controls195 Questions

Exam 9: Accounting for Receivables162 Questions

Exam 10: Long-Term Assets208 Questions

Exam 11: Current Liabilities and Payroll Accounting178 Questions

Exam 12: Accounting for Partnerships141 Questions

Exam 13: Accounting for Corporations210 Questions

Exam 14: Long-Term Liabilities158 Questions

Exam 15: Investments and International Operations156 Questions

Exam 16: Statement of Cash Flows173 Questions

Exam 17: Analysis of Financial Statements182 Questions

Exam 18: Managerial Accounting Concepts and Principles199 Questions

Exam 19: Job Order Cost Accounting165 Questions

Exam 20: Process Cost Accounting172 Questions

Exam 21: Cost Allocation and Performance Measurement173 Questions

Exam 22: Cost-Volume-Profit Analysis190 Questions

Exam 23: Master Budgets and Planning166 Questions

Exam 24: Flexible Budgets and Standard Costs178 Questions

Exam 25: Capital Budgeting and Managerial Decisions153 Questions

Select questions type

A system of performance measures, including nonfinancial measures, used to assess company and division manager performance is:

(Multiple Choice)

4.8/5  (33)

(33)

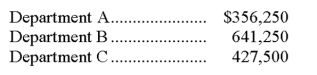

A retail store has three departments, A, B, and C, each of which has four full-time employees. The store does general advertising that benefits all departments. Advertising expense totaled $90,000 for the current year, and departmental sales were:

How much advertising expense should be allocated to each department?

(Essay)

4.7/5  (34)

(34)

The allocation bases for assigning indirect costs include:

(Multiple Choice)

4.7/5  (33)

(33)

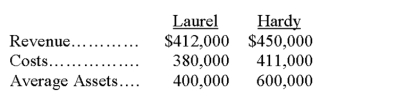

Laurel and Hardy are managers of two product lines for Keaton Company. One of them is a candidate for promotion based on performance. Using the data below, determine who had the better performance using performance measures such as net income, profit margin, and return on assets. Show your calculations and support your answer.

(Essay)

4.9/5  (36)

(36)

Jamesway Corporation has two separate divisions that operate as profit centers. The following information is available for the most recent year: The White Division occupies 20,000 square feet in the plant. The Grey Division occupies 30,000 square feet. Rent is an indirect expense and is allocated based on square footage. Rent expense for the year was $50,000. Compute gross profit for the White and Grey Divisions, respectively.

(Multiple Choice)

4.9/5  (36)

(36)

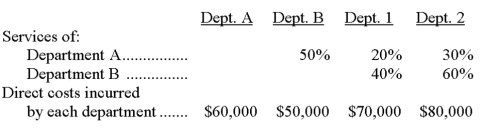

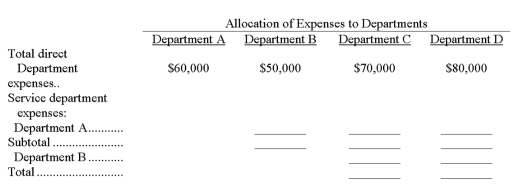

Blower Company is divided into four departments. Departments A and B are service departments and Departments 1 and 2 are operating (production) departments. The services of the two service departments are used by the other departments as follows:

Complete the following table:

(Essay)

4.7/5  (39)

(39)

A ______________________ incurs costs without directly generating revenues.

(Essay)

4.8/5  (30)

(30)

A company produces two joint products (called 101 and 202) in a single operation that uses one raw material called Casko. Four hundred gallons of Casko were purchased at a cost of $800 and were used to produce 150 gallons of Product 101, selling for $5 per gallon, and 75 gallons of Product 202, selling for $15 per gallon. How much of the $800 cost should be allocated to each product, assuming that the company allocates cost based on sales revenue?

(Essay)

4.9/5  (39)

(39)

An accounting system that provides information that management can use to evaluate the profitability and/or cost effectiveness of a department's activities is a:

(Multiple Choice)

4.9/5  (36)

(36)

The Footwear Department of Lee's Department Store had sales of $188,000, cost of goods sold of $132,500, indirect expenses of $13,250, and direct expenses of $27,500 for the current period. The Footwear Department's contribution to overhead as a percent of sales is:

(Multiple Choice)

5.0/5  (30)

(30)

An accounting system that provides information that management can use to evaluate the performance of a department's manager is called a:

(Multiple Choice)

4.8/5  (46)

(46)

Abbe Company reported the following financial numbers for one of its divisions for the year; average total assets of $4,100,000; sales of $4,525,000; cost of goods sold of $2,550,000; and operating expenses of $1,372,000. Compute the division's return on assets:

(Multiple Choice)

4.8/5  (44)

(44)

Joint costs are a group of several costs incurred in producing or purchasing a single product.

(True/False)

4.9/5  (24)

(24)

Showing 161 - 173 of 173

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)