Exam 18: Managerial Accounting Concepts and Principles

Exam 1: Accounting in Business245 Questions

Exam 2: Analyzing and Recording Transactions201 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements227 Questions

Exam 4: Completing the Accounting Cycle177 Questions

Exam 5: Accounting for Merchandising Operations189 Questions

Exam 6: Inventories and Cost of Sales194 Questions

Exam 7: Accounting Information Systems166 Questions

Exam 8: Cash and Internal Controls195 Questions

Exam 9: Accounting for Receivables162 Questions

Exam 10: Long-Term Assets208 Questions

Exam 11: Current Liabilities and Payroll Accounting178 Questions

Exam 12: Accounting for Partnerships141 Questions

Exam 13: Accounting for Corporations210 Questions

Exam 14: Long-Term Liabilities158 Questions

Exam 15: Investments and International Operations156 Questions

Exam 16: Statement of Cash Flows173 Questions

Exam 17: Analysis of Financial Statements182 Questions

Exam 18: Managerial Accounting Concepts and Principles199 Questions

Exam 19: Job Order Cost Accounting165 Questions

Exam 20: Process Cost Accounting172 Questions

Exam 21: Cost Allocation and Performance Measurement173 Questions

Exam 22: Cost-Volume-Profit Analysis190 Questions

Exam 23: Master Budgets and Planning166 Questions

Exam 24: Flexible Budgets and Standard Costs178 Questions

Exam 25: Capital Budgeting and Managerial Decisions153 Questions

Select questions type

A company's prime costs total $4,500,000 and its conversion costs total $5,500,000. If direct materials are $2,000,000, calculate the overhead costs:

(Multiple Choice)

4.9/5  (33)

(33)

The following information relates to the manufacturing operations of the IMH Publishing Corporation for the year: The raw materials used in manufacturing during the year totaled $118,000. Raw materials purchased during the year amount to:

(Multiple Choice)

4.9/5  (37)

(37)

Managerial accounting is different from financial accounting in that

(Multiple Choice)

4.7/5  (29)

(29)

Four factors come together in the manufacturing process: beginning goods in process inventory, direct materials, direct labor, and factory overhead.

(True/False)

4.7/5  (33)

(33)

Product costs are expenditures necessary and integral to finished products.

(True/False)

4.9/5  (31)

(31)

Bourne Crafts manufactures specialty key chains for tourist attractions. On January 1, the firm had 200 souvenir attraction disks used in the production of the chains that cost $3 each; and 600 completed key chains that cost $6 each. During the year Bourne Crafts purchased 1,500 souvenir disks costing $3 each and produced 1,100 key chains. Compute the total cost of raw materials inventory at December 31.

(Essay)

4.9/5  (42)

(42)

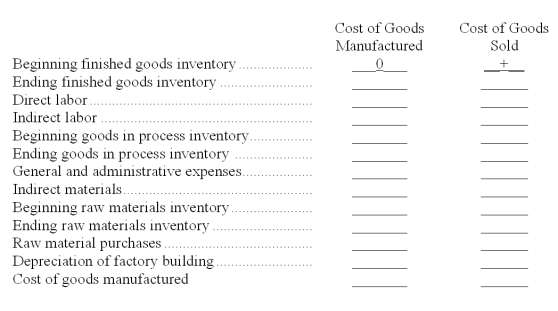

The following items for Titus Company are used to compute the cost of goods manufactured and the cost of goods sold. Indicate how each item should be used in the calculations by filling in the blanks with "+" if the item is to be added, "-" if the item is to be subtracted, or "0" if the item is not used in the calculation. The first item is completed as an example.

(Essay)

4.7/5  (30)

(30)

The following information pertains to the Hewett Corporation. Calculate the cost of goods sold for the period:

(Multiple Choice)

4.7/5  (37)

(37)

An _____________________ cost requires the future outlay of cash and is relevant for decision making.

(Essay)

4.9/5  (43)

(43)

What is the main difference between the income statement of a manufacturer and that of a merchandiser?

(Essay)

4.9/5  (30)

(30)

The Ticky Company manufactures tacks. Costs for September were direct labor, $84,000; indirect labor, $36,700; direct materials, $55,900; factory maintenance, $4,800; factory utilities, $3,200; and insurance on plant and equipment, $700. What is Ticky Company's factory overhead for September?

(Essay)

4.9/5  (35)

(35)

When the attitude of continuous improvement exists throughout an organization, every manager and employee seeks to continuously experiment with new and improved business practices.

(True/False)

4.9/5  (40)

(40)

Which of the following represents the correct formula for calculating cost of goods manufactured?

(Multiple Choice)

4.9/5  (29)

(29)

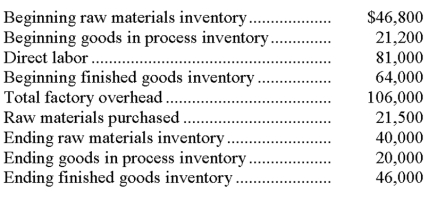

Information for Reedy Manufacturing is presented below. Compute both the cost of goods manufactured and the cost of goods sold for Reedy Manufacturing.

(Essay)

4.7/5  (43)

(43)

_____________________ rejects the notions of "good enough" or "acceptable" and challenges employees and managers to continuously experiment with new and improved business practices.

(Essay)

4.8/5  (43)

(43)

Which of the following costs would not be classified as factory overhead?

(Multiple Choice)

4.9/5  (27)

(27)

Expenditures necessary and integral to the manufacture of finished products are ________________ costs.

(Essay)

4.9/5  (38)

(38)

The manufacturing statement must be prepared monthly as it is a required general-purpose financial statement.

(True/False)

5.0/5  (32)

(32)

Showing 181 - 199 of 199

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)