Exam 5: Uncertainty and Consumer Behavior

Exam 1: Preliminaries78 Questions

Exam 2: The Basics of Supply and Demand139 Questions

Exam 3: Consumer Behavior134 Questions

Exam 4: Individual and Market Demand131 Questions

Exam 5: Uncertainty and Consumer Behavior150 Questions

Exam 6: Production125 Questions

Exam 7: The Cost of Production178 Questions

Exam 8: Profit Maximization and Competitive Supply164 Questions

Exam 9: The Analysis of Competitive Markets183 Questions

Exam 10: Market Power: Monopoly and Monopsony158 Questions

Exam 11: Pricing With Market Power130 Questions

Exam 12: Monopolistic Competition and Oligopoly120 Questions

Exam 13: Game Theory and Competitive Strategy150 Questions

Exam 14: Markets for Factor Inputs134 Questions

Exam 15: Investment, Time, and Capital Markets153 Questions

Exam 16: General Equilibrium and Economic Efficiency126 Questions

Exam 17: Markets With Asymmetric Information133 Questions

Exam 18: Externalities and Public Goods131 Questions

Exam 19: Behavioral Economics101 Questions

Select questions type

Amos Long's marginal utility of income function is given as: MU(I) =  , where I represents income. From this you would say that he is:

, where I represents income. From this you would say that he is:

(Multiple Choice)

4.9/5  (38)

(38)

Consider two upward sloping income-utility curves with income on the horizontal axis. The steeper curve represents risk preferences that are more:

(Multiple Choice)

4.9/5  (37)

(37)

Scenario 5.3:

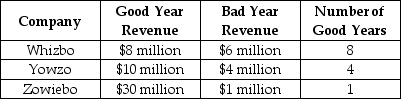

Wanting to invest in the computer games industry, you select Whizbo, Yowzo and Zowiebo as the three best firms. Over the past 10 years, the three firms have had good years and bad years. The following table shows their performance:

-Refer to Scenario 5.3. The expected revenue from all three companies combined is:

-Refer to Scenario 5.3. The expected revenue from all three companies combined is:

(Multiple Choice)

4.8/5  (35)

(35)

Scenario 5.3:

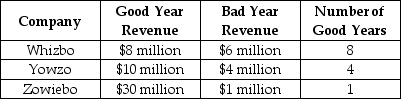

Wanting to invest in the computer games industry, you select Whizbo, Yowzo and Zowiebo as the three best firms. Over the past 10 years, the three firms have had good years and bad years. The following table shows their performance:

-Refer to Scenario 5.3. Based on the 10 years' past performance, rank the companies' expected revenue, highest to lowest.

-Refer to Scenario 5.3. Based on the 10 years' past performance, rank the companies' expected revenue, highest to lowest.

(Multiple Choice)

4.8/5  (37)

(37)

How might department stores best protect themselves against the risk of recession?

(Multiple Choice)

4.7/5  (37)

(37)

A farmer lives on a flat plain next to a river. In addition to the farm, which is worth $F, the farmer owns financial assets worth $A. The river bursts its banks and floods the plain with probability P, destroying the farm. If the farmer is risk averse, then the willingness to pay for flood insurance unambiguously falls when:

(Multiple Choice)

4.8/5  (32)

(32)

Actual insurance premiums charged by insurance companies may exceed the actuarially fair rates because:

(Multiple Choice)

4.8/5  (32)

(32)

Scenario 5.1:

Aline and Sarah decide to go into business together as economic consultants. Aline believes they have a 50-50 chance of earning $200,000 a year, and that if they don't, they'll earn $0. Sarah believes they have a 75% chance of earning $100,000 and a 25% chance of earning $10,000.

-Refer to Scenario 5.1. The probabilities discussed in the information above are:

(Multiple Choice)

4.9/5  (36)

(36)

United Plastics Company produces large plastic cups in a variety of colors. United can produce plain plastic cups that are sold in department stores in inexpensive ten cup bundles. Alternatively, United can sell Novelty Cups which are imprinted with slogans and designs. The printed cups cost more to produce, but they sell for a higher price. The appropriate strategy for United depends upon the state of the economy. Plain cups do better during a recession, while Novelty Cups earn higher profits during normal economic conditions. During a recession, United will earn a $100,000 profit selling plain cups and $40,000 with the Novelty line. Under normal economic conditions, United will earn $120,000 with the plain cups and a $200,000 profit with Novelty Cups. United currently does not use economic forecasts and simply assigns equal probabilities to a recession and normal conditions.

a. Using the probabilities assumed by United, what is the expected value of each alternative? Which alternative should the firm pursue? (Your recommendation should include separate recommendations for alternative attitudes toward risk.)

b. Calculate and interpret the value to the firm of complete information.

(Essay)

4.8/5  (33)

(33)

Showing 141 - 150 of 150

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)