Exam 13: Multiple Regression

Exam 1: Defining and Collecting Data205 Questions

Exam 2: Organizing and Visualizing Variables212 Questions

Exam 3: Numerical Descriptive Measures163 Questions

Exam 4: Basic Probability171 Questions

Exam 5: Discrete Probability Distributions117 Questions

Exam 6: The Normal Distribution144 Questions

Exam 7: Sampling Distributions127 Questions

Exam 8: Confidence Interval Estimation187 Questions

Exam 9: Fundamentals of Hypothesis Testing: One-Sample Tests177 Questions

Exam 10: Two-Sample Tests300 Questions

Exam 11: Chi-Square Tests128 Questions

Exam 12: Simple Linear Regression209 Questions

Exam 13: Multiple Regression307 Questions

Exam 14: Business Analytics254 Questions

Select questions type

The interpretation of the slope is different in a multiple linear regression model as compared to a simple linear regression model.

(True/False)

4.9/5  (33)

(33)

SCENARIO 13-4

A real estate builder wishes to determine how house size (House) is influenced by family income (Income) and family size (Size).House size is measured in hundreds of square feet and income is measured in thousands of dollars.The builder randomly selected 50 families and ran the multiple regression.Partial Microsoft Excel output is provided below: Regression Statistics Multiple R 0.8479 R Square 0.7189 Adjusted R Square 0.7069 Standard Error 17.5571 Observations 50

df SS MS F Significance F Regression 37043.3236 18521.6618 0.0000 Residual 14487.7627 308.2503 Total 49 51531.0863

Coefficients Standard Error t Stat P-value Intercept -5.5146 7.2273 -0.7630 0.4493 Income 0.4262 0.0392 10.8668 0.0000 Size 5.5437 1.6949 3.2708 0.0020

-Referring to SCENARIO 13-4, which of the following values for the level of significance is the smallest for which the regression model as a whole is significant?

(Multiple Choice)

4.8/5  (32)

(32)

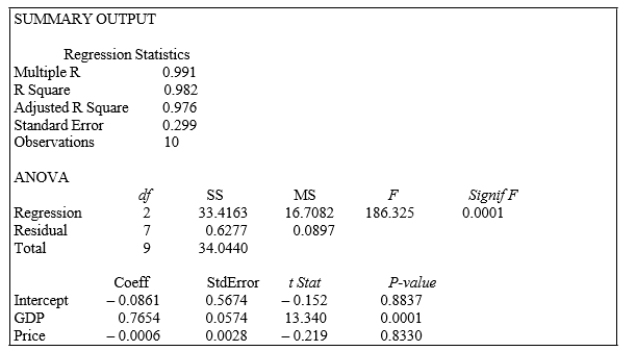

SCENARIO 13-3

An economist is interested to see how consumption for an economy (in $ billions) is influenced by gross domestic product ($ billions) and aggregate price (consumer price index).The Microsoft Excel output of this regression is partially reproduced below.  -Referring to SCENARIO 13-3, what is the estimated mean consumption level for an economy with GDP equal to $4 billion and an aggregate price index of 150?

-Referring to SCENARIO 13-3, what is the estimated mean consumption level for an economy with GDP equal to $4 billion and an aggregate price index of 150?

(Multiple Choice)

4.9/5  (29)

(29)

SCENARIO 13-18

A logistic regression model was estimated in order to predict the probability that a randomly chosen university or college would be a private university using information on mean total Scholastic Aptitude Test score (SAT) at the university or college and whether the TOEFL criterion is at least 90 (Toefl90 = 1 if yes, 0 otherwise.) The dependent variable, Y, is school type (Type = 1 if private and 0 otherwise).There are 80 universities in the sample.

The PHStat output is given below:

Binary Logistic Regression Predictor Coefficients SE Coef Z p -Value Intercept -3.9594 1.6741 -2.3650 0.0180 SAT 0.0028 0.0011 2.5459 0.0109 Toefl90:1 0.1928 0.5827 0.3309 0.7407 Deviance 101.9826

-Referring to SCENARIO 13-18, what should be the decision ('reject' or 'do not reject') on the null hypothesis when testing whether Toefl90 makes a significant contribution to the model in the presence of SAT at a 0.05 level of significance?

(Short Answer)

4.9/5  (45)

(45)

SCENARIO 13-6

One of the most common questions of prospective house buyers pertains to the cost of heating in dollars (Y).To provide its customers with information on that matter, a large real estate firm used the following 2 variables to predict heating costs: the daily minimum outside temperature in degrees of Fahrenheit ( X1 ) and the amount of insulation in inches ( X 2 ).Given below is EXCEL output of the regression model. Regression Statistics Multiple R 0.5270 R Square 0.2778 Adjusted R Square 0.1928 Standard Error 40.9107 Observations 20

ANOVA df SS MS F Significance F Regression 2 10943.0190 5471.5095 3.2691 0.0629 Residual 17 28452.6027 1673.6825 Total 19 39395.6218 13-22 Multiple Regression Coefficients Standard Error t Stat P-volue Lower 95\% Upper 95\% Intercept 448.2925 90.7853 4.9379 0.0001 256.7522 639.8328 Temperature -2.7621 1.2371 -2.2327 0.0393 -5.3721 -0.1520 Insulation -15.9408 10.0638 -1.5840 0.1316 -37.1736 5.2919 Also SSR \mid =8343.3572 and SSR \mid =4199.2672

-Referring to SCENARIO 13-6, the partial F test forH0: Variable X2 does not significantly improve the model after variable X1 has been includedH1: Variable X2 significantly improves the model after variable X1 has been included has and degrees of freedom.

(Short Answer)

5.0/5  (39)

(39)

SCENARIO 13-17

Given below are results from the regression analysis where the dependent variable is the number of weeks a worker is unemployed due to a layoff (Unemploy) and the independent variables are the age of the worker (Age) and a dummy variable for management position (Manager: 1 = yes, 0 = no).

The results of the regression analysis are given below: Regression Statistics Multiple R 0.6391 R Square 0.4085 Adjusted R Square 0.3765 Standard Error 18.8929 Observations 40 ANOVA df SS MS F Significance F Regression 2 9119.0897 4559.5448 12.7740 0.0000 Residual 37 13206.8103 356.9408 Total 39 22325.9 Coefficients Standard Error t Stat P -value Intercept -0.2143 11.5796 -0.0185 0.9853 Age 1.4448 0.3160 4.5717 0.0000 Manager -22.5761 11.3488 -1.9893 0.0541

-Referring to SCENARIO 13-17, which of the following is a correct statement?

(Multiple Choice)

4.8/5  (42)

(42)

SCENARIO 13-14

An automotive engineer would like to be able to predict automobile mileages.She believes that the two most important characteristics that affect mileage are horsepower and the number of cylinders (4 or 6) of a car.She believes that the appropriate model is

Y = 40 - 0.05X1 + 20X2 - 0.1X1X2

where X1 = horsepower

X2 = 1 if 4 cylinders, 0 if 6 cylinders

Y = mileage.

-Referring to SCENARIO 13-14, the predicted mileage for a 300 horsepower, 6-cylinder car is_.

(Short Answer)

4.7/5  (37)

(37)

SCENARIO 13-17

Given below are results from the regression analysis where the dependent variable is the number of weeks a worker is unemployed due to a layoff (Unemploy) and the independent variables are the age of the worker (Age) and a dummy variable for management position (Manager: 1 = yes, 0 = no).

The results of the regression analysis are given below: Regression Statistics Multiple R 0.6391 R Square 0.4085 Adjusted R Square 0.3765 Standard Error 18.8929 Observations 40 ANOVA df SS MS F Significance F Regression 2 9119.0897 4559.5448 12.7740 0.0000 Residual 37 13206.8103 356.9408 Total 39 22325.9 Coefficients Standard Error t Stat P -value Intercept -0.2143 11.5796 -0.0185 0.9853 Age 1.4448 0.3160 4.5717 0.0000 Manager -22.5761 11.3488 -1.9893 0.0541

-Referring to SCENARIO 13-17, we can conclude definitively that, holding constant the effect of the other independent variables, there is not a difference in the mean number of weeks a worker is unemployed due to a layoff between a worker who is in a management position and one who is not at a 10% level of significance if all we have is the information of the 95% confidence interval estimate for the difference in the mean number ofweeks a worker is unemployed due to a layoff between a worker who is in a management position and one who is not.

(True/False)

4.8/5  (40)

(40)

SCENARIO 13-17

Given below are results from the regression analysis where the dependent variable is the number of weeks a worker is unemployed due to a layoff (Unemploy) and the independent variables are the age of the worker (Age) and a dummy variable for management position (Manager: 1 = yes, 0 = no).

The results of the regression analysis are given below: Regression Statistics Multiple R 0.6391 R Square 0.4085 Adjusted R Square 0.3765 Standard Error 18.8929 Observations 40 ANOVA df SS MS F Significance F Regression 2 9119.0897 4559.5448 12.7740 0.0000 Residual 37 13206.8103 356.9408 Total 39 22325.9 Coefficients Standard Error t Stat P -value Intercept -0.2143 11.5796 -0.0185 0.9853 Age 1.4448 0.3160 4.5717 0.0000 Manager -22.5761 11.3488 -1.9893 0.0541

-Referring to SCENARIO 13-17, the null hypothesis H0 : 1 = 2 = 0 implies that the number of weeks a worker is unemployed due to a layoff is not related to one of the explanatory variables.

(True/False)

4.7/5  (37)

(37)

SCENARIO 13-5

A microeconomist wants to determine how corporate sales are influenced by capital and wage spending by companies.She proceeds to randomly select 26 large corporations and record information in millions of dollars.The Microsoft Excel output below shows results of this multiple regression. SUMMARY OUTPUT

Regression Statistics

Multiple R 0.830 R Square 0.689 Adjusted R Square 0.662 Standard Error 17501.643 Observations 26

ANOVA

df SS MS F Signif F Regression 2 15579777040 7789888520 25.432 0.0001 Residual 23 7045072780 306307512 Total 25 22624849820

Coeff StdError t Stat P-value Intercept 15800.0000 6038.2999 2.617 0.0154 Capital 0.1245 0.2045 0.609 0.5485 Wages 7.0762 1.4729 4.804 0.0001

-Referring to SCENARIO 13-5, one company in the sample had sales of $20 billion (Sales =20,000).This company spent $300 million on capital and $700 million on wages.What is the residual (in millions of dollars) for this data point?

(Multiple Choice)

4.8/5  (41)

(41)

SCENARIO 13-17

Given below are results from the regression analysis where the dependent variable is the number of weeks a worker is unemployed due to a layoff (Unemploy) and the independent variables are the age of the worker (Age) and a dummy variable for management position (Manager: 1 = yes, 0 = no).

The results of the regression analysis are given below: Regression Statistics Multiple R 0.6391 R Square 0.4085 Adjusted R Square 0.3765 Standard Error 18.8929 Observations 40 ANOVA df SS MS F Significance F Regression 2 9119.0897 4559.5448 12.7740 0.0000 Residual 37 13206.8103 356.9408 Total 39 22325.9 Coefficients Standard Error t Stat P -value Intercept -0.2143 11.5796 -0.0185 0.9853 Age 1.4448 0.3160 4.5717 0.0000 Manager -22.5761 11.3488 -1.9893 0.0541

-Referring to SCENARIO 13-17, there is sufficient evidence that age has an effect on the number of weeks a worker is unemployed due to a layoff while holding constant the effect of the other independent variable at a 10% level of significance.

(True/False)

4.7/5  (39)

(39)

SCENARIO 13-4

A real estate builder wishes to determine how house size (House) is influenced by family income (Income) and family size (Size).House size is measured in hundreds of square feet and income is measured in thousands of dollars.The builder randomly selected 50 families and ran the multiple regression.Partial Microsoft Excel output is provided below: Regression Statistics Multiple R 0.8479 R Square 0.7189 Adjusted R Square 0.7069 Standard Error 17.5571 Observations 50

df SS MS F Significance F Regression 37043.3236 18521.6618 0.0000 Residual 14487.7627 308.2503 Total 49 51531.0863

Coefficients Standard Error t Stat P-value Intercept -5.5146 7.2273 -0.7630 0.4493 Income 0.4262 0.0392 10.8668 0.0000 Size 5.5437 1.6949 3.2708 0.0020

-Referring to SCENARIO 13-4 and allowing for a 1% probability of committing a type I error,what is the decision and conclusion for the test H: 1 - 2=0 vs.H : At least one j 0, j - 1, 20 1 2 1 j?

(Multiple Choice)

4.9/5  (36)

(36)

SCENARIO 13-7

The department head of the accounting department wanted to see if she could predict the GPA of students using the number of course units and total SAT scores of each.She takes a sample of 6 students and generates the following Microsoft Excel output: SUMMARY OUTPUT

Regression Statistics

Multiple R 0.916 R Square 0.839 Adjusted R Square 0.732 Standard Error 0.24685 Observations 6

ANOVA

df SS MS F Signif F Regression 2 0.95219 0.47610 7.813 0.0646 Residual 3 0.18281 0.06094 Total 5 1.13500

Coeff StdError t Stat P -value Intercept 4.593897 1.13374542 4.052 0.0271 Units -0.247270 0.06268485 -3.945 0.0290 Total SAT 0.001443 0.00101241 1.425 0.2494

-Referring to SCENARIO 13-7, the estimate of the unit change in the mean of Y per unit change in X1, holding X2 constant, is _.

(Short Answer)

4.8/5  (37)

(37)

SCENARIO 13-5

A microeconomist wants to determine how corporate sales are influenced by capital and wage spending by companies.She proceeds to randomly select 26 large corporations and record information in millions of dollars.The Microsoft Excel output below shows results of this multiple regression. SUMMARY OUTPUT

Regression Statistics

Multiple R 0.830 R Square 0.689 Adjusted R Square 0.662 Standard Error 17501.643 Observations 26

ANOVA

df SS MS F Signif F Regression 2 15579777040 7789888520 25.432 0.0001 Residual 23 7045072780 306307512 Total 25 22624849820

Coeff StdError t Stat P-value Intercept 15800.0000 6038.2999 2.617 0.0154 Capital 0.1245 0.2045 0.609 0.5485 Wages 7.0762 1.4729 4.804 0.0001

-Referring to SCENARIO 13-5, at the 0.01 level of significance, what conclusion should the microeconomist reach regarding the inclusion of Capital in the regression model?

(Multiple Choice)

4.9/5  (39)

(39)

SCENARIO 13-15

The superintendent of a school district wanted to predict the percentage of students passing a sixth- grade proficiency test.She obtained the data on percentage of students passing the proficiency test (% Passing), mean teacher salary in thousands of dollars (Salaries), and instructional spending per pupil in thousands of dollars (Spending) of 47 schools in the state.

Following is the multiple regression output with Y = % Passing as the dependent variable,

X1 =

Salaries and

X 2 = Spending: Regression Statistics Multiple R 0.4276 R Square 0.1828 Adjusted R Square 0.1457 Standard Error 5.7351 Observations 47 ANOVA df SS MS F Significance F Regression 2 323.8284 161.9142 4.9227 0.0118 Residual 44 1447.2094 32.8911 Total 46 1771.0378 Coefficients Standard Error t Stat P-value Lower 95\% Upper 95\% Intercept -72.9916 45.9106 -1.5899 0.1190 -165.5184 19.5352 Salary 2.7939 0.8974 3.1133 0.0032 0.9853 4.6025 Spending 0.3742 0.9782 0.3825 0.7039 -1.5972 2.3455

-Referring to SCENARIO 13-15, the alternative hypothesis H 1: At least one of j 0 for j =1, 2 implies that percentage of students passing the proficiency test is affected by at least one of the explanatory variables.

(True/False)

4.9/5  (28)

(28)

SCENARIO 13-5

A microeconomist wants to determine how corporate sales are influenced by capital and wage spending by companies.She proceeds to randomly select 26 large corporations and record information in millions of dollars.The Microsoft Excel output below shows results of this multiple regression. SUMMARY OUTPUT

Regression Statistics

Multiple R 0.830 R Square 0.689 Adjusted R Square 0.662 Standard Error 17501.643 Observations 26

ANOVA

df SS MS F Signif F Regression 2 15579777040 7789888520 25.432 0.0001 Residual 23 7045072780 306307512 Total 25 22624849820

Coeff StdError t Stat P-value Intercept 15800.0000 6038.2999 2.617 0.0154 Capital 0.1245 0.2045 0.609 0.5485 Wages 7.0762 1.4729 4.804 0.0001

-Referring to SCENARIO 13-5, what is the p-value for testing whether Capital has a positive influence on corporate sales?

(Multiple Choice)

4.9/5  (31)

(31)

SCENARIO 13-8

A financial analyst wanted to examine the relationship between salary (in $1,000) and 2 variables: age (X1 = Age) and experience in the field (X2 = Exper).He took a sample of 20 employees and obtained the following Microsoft Excel output: Regression Statistics Multiple R 0.8535 R Square 0.7284 Adjusted R Square 0.6964 Standard Error 10.5630 Observations 20 ANOYA df SS MS F Siqnificonce F Regression 2 5086.5764 2543.2882 22.7941 0.0000 Residual 17 1896.8050 111.5768 Total 19 6983.3814 Coefficients Standard Error t Stat P-value Lower 95\% Upper 95\% Intercept 1.5740 9.2723 0.1698 0.8672 -17.9888 21.1368 Age 1.3045 0.1956 6.6678 0.0000 0.8917 1.7173 Exper -0.1478 0.1944 -0.7604 0.4574 -0.5580 0.2624

-Referring to SCENARIO 13-8, the partial F test forH0: Variable X1 does not significantly improve the model after variable X2 has been includedH1: Variable X1 significantly improves the model after variable X2 has been included has and degrees of freedom.

(Short Answer)

4.7/5  (34)

(34)

SCENARIO 13-10

You worked as an intern at We Always Win Car Insurance Company last summer.You notice that individual car insurance premiums depend very much on the age of the individual and the number of traffic tickets received by the individual.You performed a regression analysis in EXCEL and obtained the following partial information: Regression Statistics Multiple R 0.8546 R Square 0.7303 Adjusted R Square 0.6853 Standard Error 226.7502 Observations 15 ANOVA df SS MS F Significance F Regression 2 835284.6500 16.2457 0.0004 Residual 12 616987.8200 Total 2287557.1200 Coefficients Standard Error t Stat P-value Lower 99\% Upper 99\% Intercept 821.2617 161.9391 5.0714 0.0003 326.6124 1315.9111 Age -1.4061 2.5988 -0.5411 0.5984 -9.3444 6.5321 Tickets 243.4401 43.2470 5.6291 0.0001 111.3406 375.5396

-Referring to SCENARIO 13-10, the estimated mean change in insurance premiums for every 2 additional tickets received is .

(Short Answer)

5.0/5  (41)

(41)

The total sum of squares (SST) in a regression model will never be greater than the regression sum of squares (SSR).

(True/False)

4.8/5  (38)

(38)

SCENARIO 13-8

A financial analyst wanted to examine the relationship between salary (in $1,000) and 2 variables: age (X1 = Age) and experience in the field (X2 = Exper).He took a sample of 20 employees and obtained the following Microsoft Excel output: Regression Statistics Multiple R 0.8535 R Square 0.7284 Adjusted R Square 0.6964 Standard Error 10.5630 Observations 20 ANOYA df SS MS F Siqnificonce F Regression 2 5086.5764 2543.2882 22.7941 0.0000 Residual 17 1896.8050 111.5768 Total 19 6983.3814 Coefficients Standard Error t Stat P-value Lower 95\% Upper 95\% Intercept 1.5740 9.2723 0.1698 0.8672 -17.9888 21.1368 Age 1.3045 0.1956 6.6678 0.0000 0.8917 1.7173 Exper -0.1478 0.1944 -0.7604 0.4574 -0.5580 0.2624

-Referring to SCENARIO 13-8, the analyst wants to use a t test to test for the significance of the coefficient of X2.The p-value of the test is _.

(Short Answer)

4.7/5  (43)

(43)

Showing 41 - 60 of 307

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)