Exam 5: Regression With a Single Regressor: Hypothesis Tests and Confidence Intervals

Exam 1: Economic Questions and Data11 Questions

Exam 2: Review of Probability61 Questions

Exam 3: Review of Statistics56 Questions

Exam 4: Linear Regression With One Regressor54 Questions

Exam 5: Regression With a Single Regressor: Hypothesis Tests and Confidence Intervals53 Questions

Exam 6: Linear Regression With Multiple Regressors54 Questions

Exam 7: Hypothesis Tests and Confidence Intervals in Multiple Regression50 Questions

Exam 8: Nonlinear Regression Functions53 Questions

Exam 9: Assessing Studies Based on Multiple Regression55 Questions

Exam 10: Regression With Panel Data40 Questions

Exam 11: Regression With a Binary Dependent Variable40 Questions

Exam 12: Instrumental Variables Regression40 Questions

Exam 13: Experiments and Quasi-Experiments40 Questions

Exam 14: Introduction to Time Series Regression and Forecasting36 Questions

Exam 15: Estimation of Dynamic Causal Effects40 Questions

Exam 16: Additional Topics in Time Series Regression40 Questions

Exam 17: The Theory of Linear Regression With One Regressor39 Questions

Exam 18: The Theory of Multiple Regression38 Questions

Select questions type

Under the least squares assumptions (zero conditional mean for the error term, Xi and Yi being i.i.d., and Xi and ui having finite fourth moments), the OLS estimator

For the slope and intercept a. has an exact normal distribution for .

b. is BLUE.

c. has a normal distribution even in small samples.

d. is unbiased.

(Short Answer)

4.7/5  (40)

(40)

In many of the cases discussed in your textbook, you test for the significance of

the slope at the 5% level.What is the size of the test? What is the power of the

test? Why is the probability of committing a Type II error so large here?

(Essay)

4.9/5  (34)

(34)

Consider the following two models involving binary variables as explanatory

variables: where Wage is the hourly wage rate, DFemme is a binary variable that is equal to 1 if the person is a female, and 0 if the person is a male. Male DFemme. Even though you have not learned about regression functions with two explanatory variables (or regressions without an intercept), assume that you had estimated both models, i.e., you obtained the estimates for the regression coefficients.

What is the predicted wage for a male in the two models? What is the predicted wage for a female in the two models? What is the relationship between the and the ? Why would you prefer one model over the other?

(Essay)

4.9/5  (35)

(35)

For the following estimated slope coefficients and their heteroskedasticity robust standard errors, find the t -statistics for the null hypothesis Assuming that your sample has more than 100 observations, indicate whether or not you are able to reject the null hypothesis at the 10 %, 5 % , and 1 % level of a one-sided and two-sided hypothesis.

(a)

(b)

(c)

(d)

(Essay)

4.9/5  (43)

(43)

If the absolute value of your calculated t-statistic exceeds the critical value from the standard normal distribution, you can

(Multiple Choice)

4.8/5  (33)

(33)

(continuation with the Purchasing Power Parity question from Chapter 4)

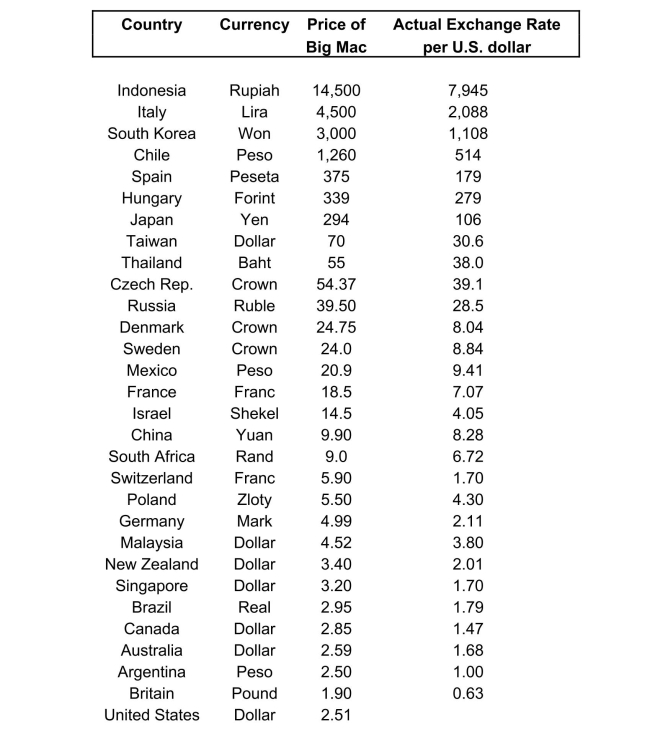

The news-magazine The Economist regularly publishes data on the so called Big

Mac index and exchange rates between countries.The data for 30 countries from

the April 29, 2000 issue is listed below:  The concept of purchasing power parity or PPP ("the idea that similar foreign and domestic goods ... should have the same price in terms of the same currency," Abel, A. and B. Bernanke, Macroeconomics, edition, Boston: Addison Wesley, 476) suggests that the ratio of the Big Mac priced in the local currency to the U.S. dollar price should equal the exchange rate between the two countries. 16

After entering the data into your spread sheet program, you calculate the predicted

exchange rate per U.S.dollar by dividing the price of a Big Mac in local currency

by the U.S.price of a Big Mac ($2.51).To test for PPP, you regress the actual

exchange rate on the predicted exchange rate.

The estimated regression is as follows: -27.05+1.35\times Pr edExRate =0.994,n=29,SER=122.15 (23.74) (0.02) (a)Your spreadsheet program does not allow you to calculate heteroskedasticity

robust standard errors.Instead, the numbers in parenthesis are homoskedasticity

only standard errors.State the two null hypothesis under which PPP holds.Should

you use a one-tailed or two-tailed alternative hypothesis?

The concept of purchasing power parity or PPP ("the idea that similar foreign and domestic goods ... should have the same price in terms of the same currency," Abel, A. and B. Bernanke, Macroeconomics, edition, Boston: Addison Wesley, 476) suggests that the ratio of the Big Mac priced in the local currency to the U.S. dollar price should equal the exchange rate between the two countries. 16

After entering the data into your spread sheet program, you calculate the predicted

exchange rate per U.S.dollar by dividing the price of a Big Mac in local currency

by the U.S.price of a Big Mac ($2.51).To test for PPP, you regress the actual

exchange rate on the predicted exchange rate.

The estimated regression is as follows: -27.05+1.35\times Pr edExRate =0.994,n=29,SER=122.15 (23.74) (0.02) (a)Your spreadsheet program does not allow you to calculate heteroskedasticity

robust standard errors.Instead, the numbers in parenthesis are homoskedasticity

only standard errors.State the two null hypothesis under which PPP holds.Should

you use a one-tailed or two-tailed alternative hypothesis?

(Essay)

4.7/5  (41)

(41)

You recall from one of your earlier lectures in macroeconomics that the per capita

income depends on the savings rate of the country: those who save more end up

with a higher standard of living.To test this theory, you collect data from the

Penn World Tables on GDP per worker relative to the United States (RelProd)in

1990 and the average investment share of GDP from 1980-1990 (sK ),

remembering that investment equals saving.The regression results in the

following output: =0.08+2.44\times,=0.46,SER=0.21 (0.04)(0.38) (a)Interpret the regression results carefully.

(Essay)

4.7/5  (32)

(32)

The effect of decreasing the student-teacher ratio by one is estimated to result in

an improvement of the districtwide score by 2.28 with a standard error of 0.52.

Construct a 90% and 99% confidence interval for the size of the slope coefficient

and the corresponding predicted effect of changing the student-teacher ratio by

one.What is the intuition on why the 99% confidence interval is wider than the

90% confidence interval?

(Essay)

4.9/5  (33)

(33)

Assume that the homoskedastic normal regression assumption hold.Using the

Student t-distribution, find the critical value for the following situation: (a) significance level, one-sided test.

(b) significance level, two-sided test.

(c) significance level, one-sided test.

(d) significance level, two-sided test.

(Essay)

4.8/5  (27)

(27)

In order to formulate whether or not the alternative hypothesis is one-sided or

two-sided, you need some guidance from economic theory.Choose at least three

examples from economics or other fields where you have a clear idea what the

null hypothesis and the alternative hypothesis for the slope coefficient should be.

Write a brief justification for your answer.

(Essay)

4.8/5  (37)

(37)

Changing the units of measurement obviously will have an effect on the slope of your regression function. For example, let

Then it is easy

but tedious to show that Given this result, how do you think

the standard errors and the regression will change?

(Essay)

4.8/5  (47)

(47)

Your textbook discussed the regression model when X is a binary variable

Let represent wages, and let be one for females, and 0 for males. Using the OLS formula for the intercept coefficient, prove that is the average wage for males.

(Essay)

4.9/5  (35)

(35)

(Continuation from Chapter 4, number 6)The neoclassical growth model predicts

that for identical savings rates and population growth rates, countries should

converge to the per capita income level.This is referred to as the convergence

hypothesis.One way to test for the presence of convergence is to compare the

growth rates over time to the initial starting level.

(a)The results of the regression for 104 countries were as follows: = 0.019-0.0006\times,=0.00007,SER=0.016 (0.004)(0.0073) where is the average annual growth rate of GDP per worker for the 1990 sample period, and is GDP per worker relative to the United States in 1960. Numbers in parenthesis are heteroskedasticity robust standard errors. Using the OLS estimator with homoskedasticity-only standard errors, the results

changed as follows: = 0.019-0.0006\times,=0.00007,SER=0.016 (0.002)(0.0068) Why didn't the estimated coefficients change? Given that the standard error of the

slope is now smaller, can you reject the null hypothesis of no beta convergence?

Are the results in the second equation more reliable than the results in the first

equation? Explain.

(Essay)

4.7/5  (37)

(37)

Showing 41 - 53 of 53

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)