Exam 20: Decision Making Online

Exam 1: Defining and Collecting Data207 Questions

Exam 2: Organizing and Visualizing Variables213 Questions

Exam 3: Numerical Descriptive Measures167 Questions

Exam 4: Basic Probability171 Questions

Exam 5: Discrete Probability Distributions217 Questions

Exam 6: The Normal Distributions and Other Continuous Distributions189 Questions

Exam 7: Sampling Distributions135 Questions

Exam 8: Confidence Interval Estimation189 Questions

Exam 9: Fundamentals of Hypothesis Testing: One-Sample Tests187 Questions

Exam 10: Two-Sample Tests208 Questions

Exam 11: Analysis of Variance216 Questions

Exam 12: Chi-Square and Nonparametric Tests178 Questions

Exam 13: Simple Linear Regression214 Questions

Exam 14: Introduction to Multiple Regression336 Questions

Exam 15: Multiple Regression Model Building99 Questions

Exam 16: Time-Series Forecasting173 Questions

Exam 17: Business Analytics115 Questions

Exam 18: A Roadmap for Analyzing Data329 Questions

Exam 19: Statistical Applications in Quality Management Online162 Questions

Exam 20: Decision Making Online129 Questions

Exam 21: Understanding Statistics: Descriptive and Inferential Techniques39 Questions

Select questions type

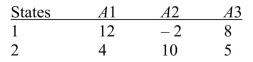

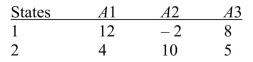

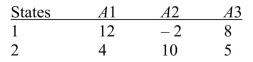

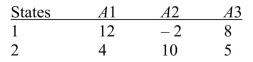

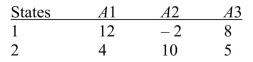

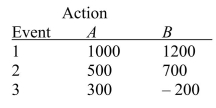

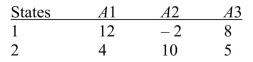

SCENARIO 20-1 The following payoff table shows profits associated with a set of 3 alternatives under 2 possible states of nature.  where:

where:  -Referring to Scenario 20-1, if the probability of S1 is 0.5, then the expected monetary value (EMV )for A2 is

-Referring to Scenario 20-1, if the probability of S1 is 0.5, then the expected monetary value (EMV )for A2 is

Free

(Multiple Choice)

4.9/5  (36)

(36)

Correct Answer:

B

SCENARIO 20-1 The following payoff table shows profits associated with a set of 3 alternatives under 2 possible states of nature.  where:

where:  -Referring to Scenario 20-1, what is the best action using the maximax criterion?

-Referring to Scenario 20-1, what is the best action using the maximax criterion?

Free

(Multiple Choice)

4.7/5  (34)

(34)

Correct Answer:

A

SCENARIO 20-1 The following payoff table shows profits associated with a set of 3 alternatives under 2 possible states of nature.  where:

where:  -Referring to Scenario 20-1, if the probability of S1 is 0.5, then the EVPI for the payoff table is

-Referring to Scenario 20-1, if the probability of S1 is 0.5, then the EVPI for the payoff table is

Free

(Multiple Choice)

4.7/5  (41)

(41)

Correct Answer:

B

Blossom's Flowers purchases roses for sale for Valentine's Day.The roses are purchased for $10 a dozen and are sold for $20 a dozen.Any roses not sold on Valentine's Day can be sold for $5 per dozen.The owner will purchase 1 of 3 amounts of roses for Valentine's Day: 100, 200, or 400 dozen roses.Given 0.2, 0.4, and 0.4 are the probabilities for the sale of 100, 200, or 400 dozen roses, respectively, then the optimal EOL for buying roses is

(Multiple Choice)

4.8/5  (38)

(38)

In a local cellular phone area, company A accounts for 60% of the cellular phone market, while company B accounts for the remaining 40% of the market.Of the cellular calls made with company A, 1% of the calls will have some sort of interference, while 2% of the cellular calls with company B will have interference.If a cellular call is selected at random, the probability that it will not have interference is

(Multiple Choice)

4.7/5  (43)

(43)

SCENARIO 20-1 The following payoff table shows profits associated with a set of 3 alternatives under 2 possible states of nature.  where:

where:  -Referring to Scenario 20-1, if the probability of S1 is 0.2 and S2 is 0.8, then the expected opportunity loss (EOL)for A1 is

-Referring to Scenario 20-1, if the probability of S1 is 0.2 and S2 is 0.8, then the expected opportunity loss (EOL)for A1 is

(Multiple Choice)

4.9/5  (33)

(33)

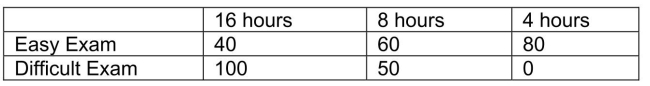

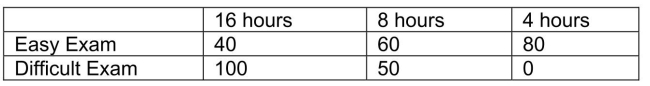

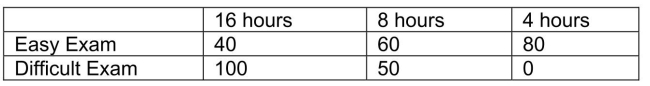

SCENARIO 20-6 A student wanted to find out the optimal strategy to study for a Business Statistics exam with scores out of 100 possible points.He constructed the following payoff table based on the mean amount of time he needed to study every week for the course and the degree of difficulty of the exam.From the information that he gathered from students who had taken the course, he concluded that there was a 40% probability that the exam would be easy.  -Referring to Scenario 20-6, what is the expected profit under certainty?

-Referring to Scenario 20-6, what is the expected profit under certainty?

(Short Answer)

4.9/5  (39)

(39)

SCENARIO 20-6 A student wanted to find out the optimal strategy to study for a Business Statistics exam with scores out of 100 possible points.He constructed the following payoff table based on the mean amount of time he needed to study every week for the course and the degree of difficulty of the exam.From the information that he gathered from students who had taken the course, he concluded that there was a 40% probability that the exam would be easy.  -Referring to Scenario 20-6, what would be the expected profit if the student had perfect information on whether the exam will be easy or difficult?

-Referring to Scenario 20-6, what would be the expected profit if the student had perfect information on whether the exam will be easy or difficult?

(Short Answer)

4.8/5  (31)

(31)

Blossom's Flowers purchases roses for sale for Valentine's Day.The roses are purchased for $10 a dozen and are sold for $20 a dozen.Any roses not sold on Valentine's Day can be sold for $5 per dozen.The owner will purchase 1 of 3 amounts of roses for Valentine's Day: 100, 200, or 400 dozen roses.The number of states of nature for the payoff table is

(Multiple Choice)

4.9/5  (34)

(34)

For a potential investment of $5,000, a portfolio has an EMV of $1,000 and a standard deviation of $100.The return to risk ratio is

(Multiple Choice)

4.9/5  (36)

(36)

SCENARIO 20-6 A student wanted to find out the optimal strategy to study for a Business Statistics exam with scores out of 100 possible points.He constructed the following payoff table based on the mean amount of time he needed to study every week for the course and the degree of difficulty of the exam.From the information that he gathered from students who had taken the course, he concluded that there was a 40% probability that the exam would be easy.  -Referring to Scenario 20-6, the optimal strategy using the maximax criterion is to study 8 hours per week on average for the exam.

-Referring to Scenario 20-6, the optimal strategy using the maximax criterion is to study 8 hours per week on average for the exam.

(True/False)

4.8/5  (39)

(39)

SCENARIO 20-1 The following payoff table shows profits associated with a set of 3 alternatives under 2 possible states of nature.  where:

where:  -Referring to Scenario 20-1, if the probability of S1 is 0.5, then the expected monetary value (EMV )for A1 is

-Referring to Scenario 20-1, if the probability of S1 is 0.5, then the expected monetary value (EMV )for A1 is

(Multiple Choice)

4.9/5  (35)

(35)

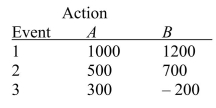

SCENARIO 20-5 The following payoff table shows profits associated with a set of 2 alternatives under 3 possible events.  Suppose that the probability of Event 1 is 0.2, Event 2 is 0.5, and Event 3 is 0.3.

-Referring to Scenario 20-5, what is the optimal action using maximin criterion?

Suppose that the probability of Event 1 is 0.2, Event 2 is 0.5, and Event 3 is 0.3.

-Referring to Scenario 20-5, what is the optimal action using maximin criterion?

(Short Answer)

4.8/5  (35)

(35)

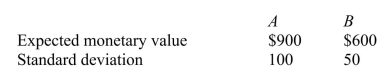

SCENARIO 20-3 The following information is from 2 investment opportunities.  -Referring to Scenario 20-3, which investment has the optimal coefficient of variation?

-Referring to Scenario 20-3, which investment has the optimal coefficient of variation?

(Multiple Choice)

4.8/5  (37)

(37)

A company that manufactures designer jeans is contemplating whether to increase its advertising budget by $1 million for next year.If the expanded advertising campaign is successful, the company expects sales to increase by $1.6 million next year.If the advertising campaign fails, the company expects sales to increase by only $400,000 next year.If the advertising budget is not increased, the company expects sales to increase by $200,000.Identify the events in this decision-making problem.

(Multiple Choice)

4.9/5  (46)

(46)

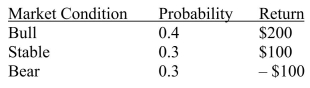

SCENARIO 20-4 A stock portfolio has the following returns under the market conditions listed below.  -Referring to Scenario 20-4, what is the return to risk ratio?

-Referring to Scenario 20-4, what is the return to risk ratio?

(Multiple Choice)

4.8/5  (34)

(34)

SCENARIO 20-5 The following payoff table shows profits associated with a set of 2 alternatives under 3 possible events.  Suppose that the probability of Event 1 is 0.2, Event 2 is 0.5, and Event 3 is 0.3.

-Referring to Scenario 20-5, what is the EOL for Action A?

Suppose that the probability of Event 1 is 0.2, Event 2 is 0.5, and Event 3 is 0.3.

-Referring to Scenario 20-5, what is the EOL for Action A?

(Short Answer)

4.8/5  (49)

(49)

SCENARIO 20-1 The following payoff table shows profits associated with a set of 3 alternatives under 2 possible states of nature.  where:

where:  -Referring to Scenario 20-1, if the probability of S1 is 0.4, then the probability of S2 is

-Referring to Scenario 20-1, if the probability of S1 is 0.4, then the probability of S2 is

(Multiple Choice)

4.8/5  (26)

(26)

In a local cellular phone area, company A accounts for 60% of the cellular phone market, while company B accounts for the remaining 40% of the market.Of the cellular calls made with company A, 1% of the calls will have some sort of interference, while 2% of the cellular calls with company B will have interference.If a cellular call is selected at random, the probability that it will have interference is

(Multiple Choice)

4.8/5  (30)

(30)

Showing 1 - 20 of 129

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)