Exam 20: Decision Making Online

Exam 1: Defining and Collecting Data207 Questions

Exam 2: Organizing and Visualizing Variables213 Questions

Exam 3: Numerical Descriptive Measures167 Questions

Exam 4: Basic Probability171 Questions

Exam 5: Discrete Probability Distributions217 Questions

Exam 6: The Normal Distributions and Other Continuous Distributions189 Questions

Exam 7: Sampling Distributions135 Questions

Exam 8: Confidence Interval Estimation189 Questions

Exam 9: Fundamentals of Hypothesis Testing: One-Sample Tests187 Questions

Exam 10: Two-Sample Tests208 Questions

Exam 11: Analysis of Variance216 Questions

Exam 12: Chi-Square and Nonparametric Tests178 Questions

Exam 13: Simple Linear Regression214 Questions

Exam 14: Introduction to Multiple Regression336 Questions

Exam 15: Multiple Regression Model Building99 Questions

Exam 16: Time-Series Forecasting173 Questions

Exam 17: Business Analytics115 Questions

Exam 18: A Roadmap for Analyzing Data329 Questions

Exam 19: Statistical Applications in Quality Management Online162 Questions

Exam 20: Decision Making Online129 Questions

Exam 21: Understanding Statistics: Descriptive and Inferential Techniques39 Questions

Select questions type

Look at the utility function graphed below and select the type of decision maker that corresponds to the graph.

(Multiple Choice)

4.9/5  (40)

(40)

A medical doctor is involved in a $1 million malpractice suit.He can either settle out of court for $250,000 or go to court.If he goes to court and loses, he must pay $825,000 plus $175,000 in court costs.If he wins in court the plaintiffs pay the court costs.Identify the outcomes of this decision-making problem.

(Multiple Choice)

4.7/5  (36)

(36)

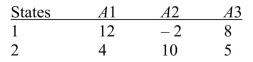

SCENARIO 20-1 The following payoff table shows profits associated with a set of 3 alternatives under 2 possible states of nature.  where:

where:  -Referring to Scenario 20-1, the opportunity loss for A2 when S1 occurs is

-Referring to Scenario 20-1, the opportunity loss for A2 when S1 occurs is

(Multiple Choice)

4.8/5  (41)

(41)

In portfolio analysis, the _______ is the reciprocal of the return to risk ratio.

(Short Answer)

4.8/5  (43)

(43)

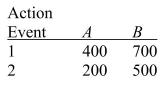

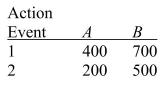

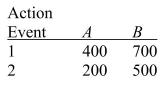

SCENARIO 20-2 The following payoff matrix is given in dollars.  Suppose the probability of Event 1 is 0.5 and Event 2 is 0.5.

-Referring to Scenario 20-2, the EVPI is

Suppose the probability of Event 1 is 0.5 and Event 2 is 0.5.

-Referring to Scenario 20-2, the EVPI is

(Multiple Choice)

4.8/5  (44)

(44)

The curve for the will show a rapid increase in utility for initial amounts of money followed by a gradual leveling off for increasing dollar amounts.

(Multiple Choice)

4.9/5  (32)

(32)

A medical doctor is involved in a $1 million malpractice suit.He can either settle out of court for $250,000 or go to court.If he goes to court and loses, he must pay $825,000 plus $175,000 in court costs.If he wins in court the plaintiffs pay the court costs.Identify the actions of this decision-making problem.

(Multiple Choice)

4.8/5  (38)

(38)

Blossom's Flowers purchases roses for sale for Valentine's Day.The roses are purchased for $10 a dozen and are sold for $20 a dozen.Any roses not sold on Valentine's Day can be sold for $5 per dozen.The owner will purchase 1 of 3 amounts of roses for Valentine's Day: 100, 200, or 400 dozen roses.Given 0.2, 0.4, and 0.4 are the probabilities for the sale of 100, 200, or 400 dozen roses, respectively, then the optimal EMV for buying roses is

(Multiple Choice)

4.8/5  (38)

(38)

SCENARIO 20-2 The following payoff matrix is given in dollars.  Suppose the probability of Event 1 is 0.5 and Event 2 is 0.5.

-Referring to Scenario 20-2, the expected profit under certainty (EPUC )is

Suppose the probability of Event 1 is 0.5 and Event 2 is 0.5.

-Referring to Scenario 20-2, the expected profit under certainty (EPUC )is

(Multiple Choice)

4.7/5  (44)

(44)

Look at the utility function graphed below and select the type of decision maker that corresponds to the graph.

(Multiple Choice)

4.9/5  (34)

(34)

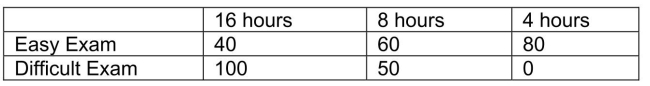

SCENARIO 20-6 A student wanted to find out the optimal strategy to study for a Business Statistics exam with scores out of 100 possible points.He constructed the following payoff table based on the mean amount of time he needed to study every week for the course and the degree of difficulty of the exam.From the information that he gathered from students who had taken the course, he concluded that there was a 40% probability that the exam would be easy.  -Referring to Scenario 20-6, the optimal strategy using the coefficient of variation criterion is to study 8 hours per week on average for the exam.

-Referring to Scenario 20-6, the optimal strategy using the coefficient of variation criterion is to study 8 hours per week on average for the exam.

(True/False)

4.8/5  (46)

(46)

SCENARIO 20-2 The following payoff matrix is given in dollars.  Suppose the probability of Event 1 is 0.5 and Event 2 is 0.5.

-Referring to Scenario 20-2, the return to risk ratio for Action B is

Suppose the probability of Event 1 is 0.5 and Event 2 is 0.5.

-Referring to Scenario 20-2, the return to risk ratio for Action B is

(Multiple Choice)

4.9/5  (34)

(34)

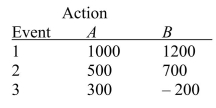

SCENARIO 20-5 The following payoff table shows profits associated with a set of 2 alternatives under 3 possible events.  Suppose that the probability of Event 1 is 0.2, Event 2 is 0.5, and Event 3 is 0.3.

-Referring to Scenario 20-5, what is the opportunity loss for Action A with Event 1?

Suppose that the probability of Event 1 is 0.2, Event 2 is 0.5, and Event 3 is 0.3.

-Referring to Scenario 20-5, what is the opportunity loss for Action A with Event 1?

(Short Answer)

4.9/5  (42)

(42)

For a potential investment of $5,000, a portfolio has an EMV of $1,000 and a standard deviation of $100.What is the coefficient of variation?

(Multiple Choice)

4.9/5  (37)

(37)

The risk seeker's curve represents the utility of one who enjoys taking risks.Therefore, the slope of the utility curve becomes for large dollar amounts.

(Multiple Choice)

4.9/5  (32)

(32)

A tabular presentation that shows the outcome for each decision alternative under the various states of nature is called:

(Multiple Choice)

4.9/5  (30)

(30)

Blossom's Flowers purchases roses for sale for Valentine's Day.The roses are purchased for $10 a dozen and are sold for $20 a dozen.Any roses not sold on Valentine's Day can be sold for $5 per dozen.The owner will purchase 1 of 3 amounts of roses for Valentine's Day: 100, 200, or 400 dozen roses.The payoff for buying 200 dozen roses and selling 100 dozen roses at the full price is

(Multiple Choice)

4.9/5  (35)

(35)

Blossom's Flowers purchases roses for sale for Valentine's Day.The roses are purchased for $10 a dozen and are sold for $20 a dozen.Any roses not sold on Valentine's Day can be sold for $5 per dozen.The owner will purchase 1 of 3 amounts of roses for Valentine's Day: 100, 200, or 400 dozen roses.The opportunity loss for buying 400 dozen roses and selling 200 dozen roses at the full price is

(Multiple Choice)

4.8/5  (46)

(46)

The risk- _______ curve represents the expected monetary value approach.

(Short Answer)

4.9/5  (37)

(37)

Blossom's Flowers purchases roses for sale for Valentine's Day.The roses are purchased for $10 a dozen and are sold for $20 a dozen.Any roses not sold on Valentine's Day can be sold for $5 per dozen.The owner will purchase 1 of 3 amounts of roses for Valentine's Day: 100, 200, or 400 dozen roses.Given 0.2, 0.4, and 0.4 are the probabilities for the sale of 100, 200, or 400 dozen roses, respectively, then the EVPI for buying roses is

(Multiple Choice)

4.9/5  (41)

(41)

Showing 41 - 60 of 129

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)