Exam 5: Customer Relationships and Customer Service

Exam 1: Operations Management, Processes, and Supply Chain Management41 Questions

Exam 2: Corporate Strategy, Performance, and Sustainability55 Questions

Exam 3: Product Design and Development50 Questions

Exam 4: Process Design and Capacity Management48 Questions

Exam 5: Customer Relationships and Customer Service50 Questions

Exam 6: Demand Management, Forecasting, and Aggregate Planning45 Questions

Exam 7: Independent Demand Inventory Management45 Questions

Exam 8: Supplement: Job Scheduling and Vehicle Routing and Material Flow Analysis and Facility Layouts93 Questions

Exam 9: Lean Systems50 Questions

Exam 10: Managing Customer and Work Flows50 Questions

Exam 11: Managing Information Flowsmrp and ERP46 Questions

Exam 12: Managing Projects42 Questions

Exam 13: Supplement: Statistical Quality Control and Six Sigma Quality Management97 Questions

Exam 14: Supply Chain Processes50 Questions

Exam 15: Location, Logistics, and Product Returns49 Questions

Exam 16: Integrating Processes Along the Supply Chain42 Questions

Select questions type

Find out the customer lifetime value using the following information and a discount rate of 6%.

Average Annual Sales = $7,500 (treat the average sales as annuity)

Average Profit Margin = 8%

Expected Lifetime in Years = 7

(Multiple Choice)

4.8/5  (40)

(40)

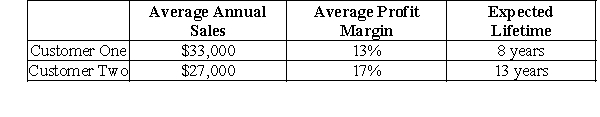

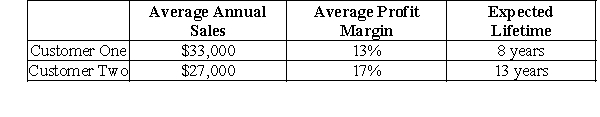

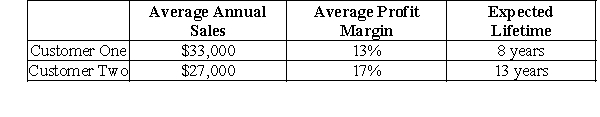

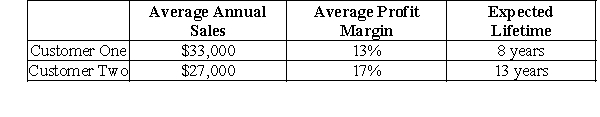

-Using a discount rate of 12% and treating the average annual sales as annuities, calculate the present value of Customer Two's lifetime value.

-Using a discount rate of 12% and treating the average annual sales as annuities, calculate the present value of Customer Two's lifetime value.

(Multiple Choice)

4.8/5  (30)

(30)

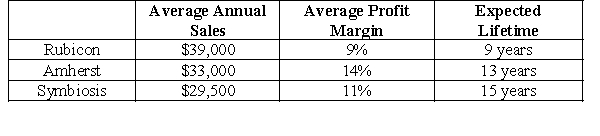

Lafayette Landscaping Company sells mulch to local businesses and residential customers. Lafayette has decided to begin calculating the expected lifetime profitability of each of their premier customers in order to design marketing promotions. Their top-three customers have the following characteristics:

-Using a discount rate of 16% and treating the average annual sales as annuities, calculate the present value of Amherst's lifetime value.

-Using a discount rate of 16% and treating the average annual sales as annuities, calculate the present value of Amherst's lifetime value.

(Multiple Choice)

4.8/5  (37)

(37)

Find out the customer lifetime value using the following information and a discount rate of 11%.

Average Annual Sales = $168,075 (treat the average sales as annuity)

Average Profit Margin = 14%

Expected Lifetime in Years = 14

(Multiple Choice)

4.9/5  (40)

(40)

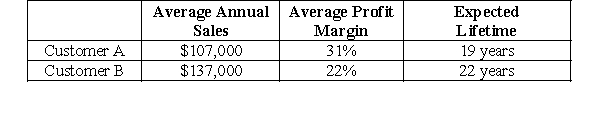

-Using a discount rate of 11% and treating the average annual sales as annuities, what would the average profit margin have to be for Customer A to have a customer lifetime value equal $300,000?

-Using a discount rate of 11% and treating the average annual sales as annuities, what would the average profit margin have to be for Customer A to have a customer lifetime value equal $300,000?

(Multiple Choice)

4.7/5  (30)

(30)

Find out the customer lifetime value using the following information and a discount rate of 15%.

Average Annual Sales = $287,000 (treat the average sales as annuity)

Average Profit Margin = 16%

Expected Lifetime in Years = 19

(Multiple Choice)

4.8/5  (42)

(42)

-Using a discount rate of 12% and treating the average annual sales as annuities, calculate the present value of Customer One's lifetime value.

-Using a discount rate of 12% and treating the average annual sales as annuities, calculate the present value of Customer One's lifetime value.

(Multiple Choice)

4.8/5  (34)

(34)

-Using a discount rate of 10% and treating the average annual sales as annuities, calculate the present value of Customer One's lifetime value.

-Using a discount rate of 10% and treating the average annual sales as annuities, calculate the present value of Customer One's lifetime value.

(Multiple Choice)

4.9/5  (42)

(42)

Find out the customer lifetime value using the following information and a discount rate of 4%.

Average Annual Sales = $6,700 (treat the average sales as annuity)

Average Profit Margin = 13%

Expected Lifetime in Years = 9

(Multiple Choice)

5.0/5  (45)

(45)

-Based on the calculation of lifetime value in Questions 14 and 15, which customer is more important?

-Based on the calculation of lifetime value in Questions 14 and 15, which customer is more important?

(Multiple Choice)

4.9/5  (28)

(28)

Showing 41 - 50 of 50

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)