Exam 6: Consolidated Financial Statements: on Date of Business Combination

Exam 1: Ethical Issues in Advanced Accounting33 Questions

Exam 2: Partnerships: Organization and Operation39 Questions

Exam 3: Partnership Liquidation and Incorporation; Joint Ventures40 Questions

Exam 4: Accounting for Branches; Combined Financial Statements39 Questions

Exam 5: Business Combinations25 Questions

Exam 6: Consolidated Financial Statements: on Date of Business Combination39 Questions

Exam 7: Consolidated Financial Statements: Subsequent to Date of Business Combination39 Questions

Exam 8: Consolidated Financial Statements: Intercompany Transactions49 Questions

Exam 9: Consolidated Financial Statements: Income Taxes, Cash Flows, and Installment Acquisitions31 Questions

Exam 10: Consolidated Financial Statements: Special Problems29 Questions

Exam 11: International Accounting Standards; Accounting for Foreign Currency Transactions24 Questions

Exam 12: Translation of Foreign Currency Financial Statements20 Questions

Exam 13: Components; Interim Reports; Reporting for the Sec40 Questions

Exam 14: Bankruptcy: Liquidation and Reorganization30 Questions

Exam 15: Estates and Trusts39 Questions

Exam 16: Nonprofit Organizations35 Questions

Exam 17: Governmental Entities: General Fund34 Questions

Exam 18: Governmental Entities: Other Governmental Funds and Account Groups31 Questions

Exam 19: Governmental Entities: Proprietary Funds, Fiduciary Funds, and Comprehensive Annual Financial Report29 Questions

Select questions type

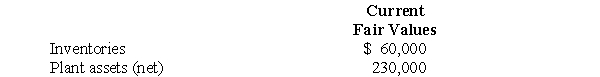

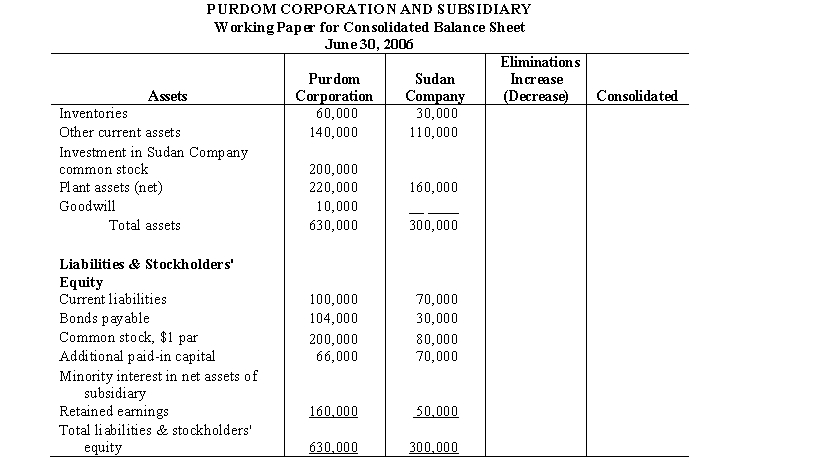

On June 30, 2006, Purdom Corporation acquired 80% of the outstanding common stock of Sudan Company. On the date of the business combination, identifiable net assets of Sudan with current fair values differing from carrying amounts were as follows:

Complete the following working paper for consolidated balance sheet of Purdom Corporation and subsidiary. Do not prepare a working paper elimination in journal entry format; however, explain the elimination on the working paper. Disregard income taxes.

Complete the following working paper for consolidated balance sheet of Purdom Corporation and subsidiary. Do not prepare a working paper elimination in journal entry format; however, explain the elimination on the working paper. Disregard income taxes.

Free

(Essay)

4.9/5  (31)

(31)

Correct Answer:

(a)

Answer ![(a) Answer Explanation of elimination: (a) To eliminate intercompany investment and equity accounts of subsidiary. *{($230,000 - $160,000) - [($300,000 x 0.80) - $200,000] = $30,000}](https://storage.examlex.com/TB10516/11eeb448_493c_a48d_85b5_958ab31329de_TB10516_00.jpg) Explanation of elimination:

Explanation of elimination:

(a) To eliminate intercompany investment and equity accounts of subsidiary.

*{($230,000 - $160,000) - [($300,000 x 0.80) - $200,000] = $30,000}

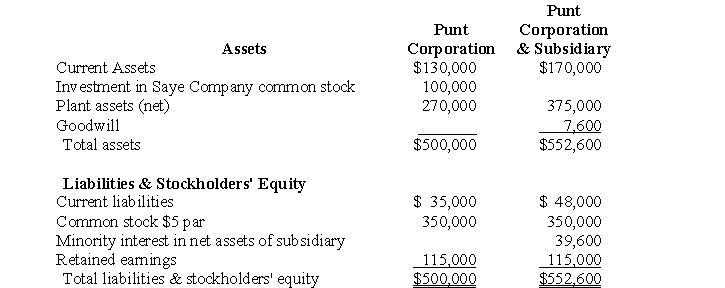

Punt Corporation acquired a controlling interest in Saye Company for cash. The separate balance sheet of Punt and the consolidated balance sheet immediately after the business combination were as follows:

Plant assets of Saye Company were undervalued by $15,000 on the date of the business combination; the remainder of Punt's cost was assigned to goodwill. The retained earnings of Saye on the date of the business combination amounted to $37,000.

a. Prepare the separate balance sheet of Saye Company on the date of the business combination.

b. What percentage of the common stock of Saye was acquired by Punt?

c. Prepare the working paper elimination (in journal entry format) for Punt Corporation and subsidiary on the date of the business combination.

Plant assets of Saye Company were undervalued by $15,000 on the date of the business combination; the remainder of Punt's cost was assigned to goodwill. The retained earnings of Saye on the date of the business combination amounted to $37,000.

a. Prepare the separate balance sheet of Saye Company on the date of the business combination.

b. What percentage of the common stock of Saye was acquired by Punt?

c. Prepare the working paper elimination (in journal entry format) for Punt Corporation and subsidiary on the date of the business combination.

Free

(Essay)

4.8/5  (34)

(34)

Correct Answer:

a.

b.

b.  c.

c.

Goodwill recognized in a business combination of a parent company and a partially owned subsidiary is attributable to the subsidiary.

Free

(True/False)

4.8/5  (38)

(38)

Correct Answer:

False

Only the balance sheet is consolidated on the date of a business combination of a parent company and subsidiary.

(True/False)

5.0/5  (44)

(44)

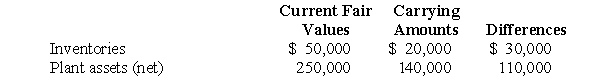

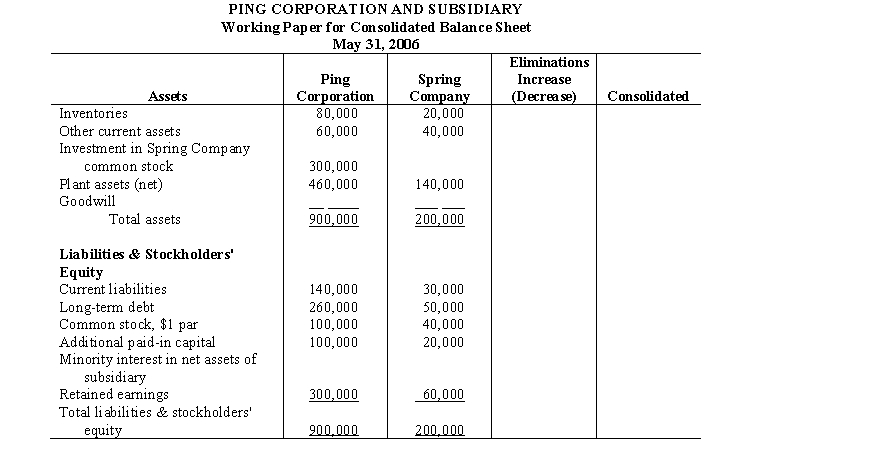

On May 31, 2006, Ping Corporation paid $300,000, including direct out-of-pocket costs of the business combination, for 82% of the outstanding common stock of Spring Company, which became a subsidiary. Differences between current fair values and carrying amounts of identifiable net assets of Spring Company on May 31, 2006, were limited to the following:

Complete the following working paper for consolidated balance sheet of Ping Corporation and subsidiary. Do not prepare a working paper elimination in journal entry format; however, explain the elimination on the working paper. Disregard income taxes.

Complete the following working paper for consolidated balance sheet of Ping Corporation and subsidiary. Do not prepare a working paper elimination in journal entry format; however, explain the elimination on the working paper. Disregard income taxes.

Explanation of elimination: (a)

Explanation of elimination: (a)

(Essay)

4.8/5  (36)

(36)

On March 31, 2006, Preston Corporation acquired for cash at $25 a share all 300,000 shares of the outstanding common stock of Sexton Company. Out-of-pocket costs of the business combination may be disregarded. Sexton's balance sheet on March 31, 2006, had net assets of $6,000,000. Additionally, the current fair value of Preston's plant assets on March 31, 2006, was $800,000 in excess of carrying amount. The amount to be shown for the balance sheet caption "Goodwill" in the March 31, 2006, consolidated balance sheet of Preston Corporation and its wholly owned subsidiary, Sexton Company, is:

(Multiple Choice)

4.8/5  (34)

(34)

In a business combination resulting in a parent company-subsidiary relationship, differences between current fair values and carrying amounts of the subsidiary's identifiable net assets on the date of the combination are:

(Multiple Choice)

5.0/5  (38)

(38)

Under the parent company concept of consolidated financial statements, the minority interest in net assets of a subsidiary is displayed as a liability.

(True/False)

4.9/5  (40)

(40)

A parent company's journal entries to record a business combination with a subsidiary do not include debits and credits to recognize the assets and liabilities of the subsidiary.

(True/False)

4.9/5  (41)

(41)

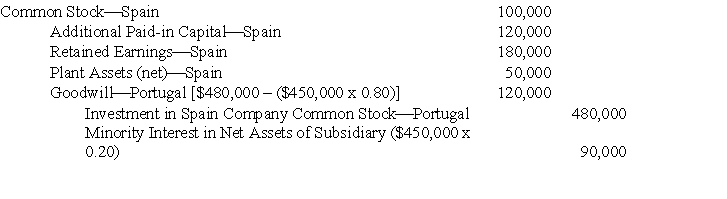

On October 31, 2006, Portugal Corporation acquired 80% of the outstanding common stock of Spain Company in a business combination. Total cost of the investment, including direct out-of-pocket costs, was $480,000. The working paper elimination (in journal entry format, explanation omitted) for Portugal Corporation and Subsidiary on October 31, 2006, was as follows:  If minority interest in net assets of subsidiary had been reflected at carrying amount, rather than at current fair value, of the subsidiary's identifiable net assets, the credit to Minority Interest in Net Assets of Subsidiary in the foregoing elimination would have been:

If minority interest in net assets of subsidiary had been reflected at carrying amount, rather than at current fair value, of the subsidiary's identifiable net assets, the credit to Minority Interest in Net Assets of Subsidiary in the foregoing elimination would have been:

(Multiple Choice)

4.8/5  (34)

(34)

In a business combination that establishes a parent company-subsidiary affiliation, the subsidiary prepares journal entries on the date of the combination to increase the carrying amounts of its net assets to current fair values.

(True/False)

4.8/5  (42)

(42)

A parent company's control of a subsidiary may be achieved both directly and indirectly, the latter through another subsidiary of the parent.

(True/False)

4.8/5  (40)

(40)

Consolidated financial statements are intended primarily for the use of:

(Multiple Choice)

4.8/5  (36)

(36)

In a business combination resulting in a parent company-subsidiary affiliation, the parent company's Investment in Subsidiary Common Stock ledger account is not closed, as it is in other types of business combinations.

(True/False)

4.8/5  (38)

(38)

Consolidated financial statements emphasize the legal form of the parent company-subsidiary relationship.

(True/False)

4.8/5  (39)

(39)

A subsidiary's paid-in capital ledger accounts always are eliminated in the preparation of a consolidated balance sheet for the parent company and the subsidiary.

(True/False)

4.8/5  (43)

(43)

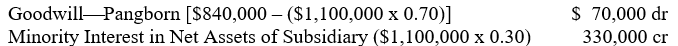

Pangborn Corporation paid $840,000 (including direct out-of-pocket costs) for 70% of the outstanding common stock of Siddon Company on September 30, 2006, the end of Pangborn's fiscal year. Included in the working paper elimination (in journal entry format) for Pangborn Corporation and subsidiary on that date were the following:

If Pangborn had inferred a current fair value for 100% of Siddon's total net assets from the $840,000 cost, Goodwill and Minority Interest in Net Assets of Subsidiary in the September 30, 2006, working paper elimination would have been, respectively:

If Pangborn had inferred a current fair value for 100% of Siddon's total net assets from the $840,000 cost, Goodwill and Minority Interest in Net Assets of Subsidiary in the September 30, 2006, working paper elimination would have been, respectively:

(Multiple Choice)

4.9/5  (39)

(39)

A widely used method of accounting for business combinations involving a partially owned subsidiary values goodwill at the amount acquired by the parent company.

(True/False)

4.7/5  (34)

(34)

The Financial Accounting Standards Board requires push-down accounting in the separate financial statements of subsidiaries.

(True/False)

4.7/5  (37)

(37)

Showing 1 - 20 of 39

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)