Exam 13: Foreign Exchange Risk

Exam 1: Why Are Financial Institutions Special90 Questions

Exam 2: Deposit-Taking Institutions43 Questions

Exam 3: Finance Companies71 Questions

Exam 4: Securities, Brokerage, and Investment Banking91 Questions

Exam 5: Mutual Funds, Hedge Funds, and Pension Funds61 Questions

Exam 6: Insurance Companies80 Questions

Exam 7: Risks of Financial Institutions110 Questions

Exam 8: Interest Rate Risk I110 Questions

Exam 9: Interest Rate Risk II116 Questions

Exam 10: Credit Risk: Individual Loans112 Questions

Exam 11: Credit Risk: Loan Portfolio and Concentration Risk51 Questions

Exam 12: Liquidity Risk85 Questions

Exam 13: Foreign Exchange Risk87 Questions

Exam 14: Sovereign Risk89 Questions

Exam 15: Market Risk95 Questions

Exam 16: Off-Balance-Sheet Risk101 Questions

Exam 17: Technology and Other Operational Risks107 Questions

Exam 18: Liability and Liquidity Management38 Questions

Exam 19: Deposit Insurance and Other Liability Guarantees54 Questions

Exam 20: Capital Adequacy102 Questions

Exam 21: Product and Geographic Expansion114 Questions

Exam 22: Futures and Forwards234 Questions

Exam 23: Options, Caps, Floors, and Collars113 Questions

Exam 24: Swaps95 Questions

Exam 25: Loan Sales83 Questions

Exam 26: Securitization Index98 Questions

Select questions type

FX trading risk exposure continues into the night until all FI operations are closed.

(True/False)

4.8/5  (31)

(31)

The FI is acting as a FX market agent for its customers when it

(Multiple Choice)

5.0/5  (32)

(32)

As the Canadian dollar appreciates against the Japanese yen, Canadian goods become less expensive to Japanese consumers.

(True/False)

4.9/5  (35)

(35)

Suppose that the current spot exchange rate of Canadian dollars for Russian rubles is $0.15/1ruble. The price of Russian-produced goods increases by 8 percent, and the Canadian price index increases by 3 percent. According to PPP, the new exchange rate of Russian rubles to dollars is

(Multiple Choice)

4.8/5  (30)

(30)

A positive net exposure position in FX implies that the FI is

(Multiple Choice)

4.9/5  (33)

(33)

Deviations from the international currency parity relationships may occur because of

(Multiple Choice)

4.8/5  (39)

(39)

An FI can eliminate its currency risk exposure by matching its foreign currency assets to its foreign currency liabilities.

(True/False)

4.8/5  (34)

(34)

Yen Bank wishes to invest in Yen loans at a rate of 10 percent. The bank will fund the loans in the domestic GIC market at a rate of 6.3 percent. This on-balance-sheet FX risk will be hedged in the spot market at a forward rate of $0.62/¥. The spot rate on yen is $0.60/¥. What must be the forward exchange rate to eliminate the preference for the yen loans?

(Multiple Choice)

4.8/5  (33)

(33)

The foreign exchange market in Tokyo is the largest FX trading market.

(True/False)

4.9/5  (41)

(41)

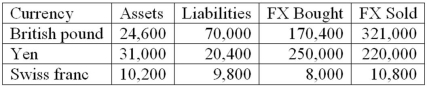

The following are the net currency positions of a Canadian FI (stated in Canadian dollars).  How would you characterize the FI's risk exposure to fluctuations in the Swiss franc/dollar exchange rate?

How would you characterize the FI's risk exposure to fluctuations in the Swiss franc/dollar exchange rate?

(Multiple Choice)

4.8/5  (41)

(41)

As of 2012, which of the following FX "markets" is the largest?

(Multiple Choice)

4.9/5  (29)

(29)

The greater the volatility of foreign exchange rates given any net exposure position, the greater the fluctuations in value of the foreign exchange portfolio.

(True/False)

4.8/5  (29)

(29)

Your U.S. bank issues a one-year U.S. CD at 5 percent annual interest to finance a C$1.274 million (Canadian dollar) investment in two-year, fixed rate Canadian bonds selling at par and paying 7 percent annually. You expect to liquidate your position in one year. Currently, spot exchange rates are US$0.78493 per Canadian dollar. If you wanted to hedge your bank's risk exposure, what hedge position would you take?

(Multiple Choice)

4.8/5  (28)

(28)

Long-term violations of the interest rate parity relationship may occur if imperfections in the international financial markets are allowed to exist.

(True/False)

4.9/5  (37)

(37)

The underlying cause of foreign exchange volatility reflects fluctuations in the demand and supply of a country's currency.

(True/False)

4.8/5  (31)

(31)

FX risk exposure of an FI essentially relates to which of the following activities?

(Multiple Choice)

4.9/5  (27)

(27)

The one-year CD rates for financial institutions with AA ratings are 5 percent in Canada and 8 percent in France. An AA-rated Canadian financial institution can borrow by issuing GICs or lend by purchasing GICs at these rates in either market. The current spot rate is $0.20/Euro. If the bank receives a quote of $0.1975/€ for one-year forward rates for the Euro (to buy and to sell), what is the arbitrage profit for the bank if it uses $1,000,000 as the notional amount?

(Multiple Choice)

4.8/5  (37)

(37)

Your U.S. bank issues a one-year U.S. CD at 5 percent annual interest to finance a C$1.274 million (Canadian dollar) investment in two-year, fixed rate Canadian bonds selling at par and paying 7 percent annually. You expect to liquidate your position in one year. Currently, spot exchange rates are US$0.78493 per Canadian dollar. If in one year there is no change to either interest rates or exchange rates, what is the end-of-year profit or loss for the bank? (Hint: Annual interest is paid on both the Canadian bonds and the CD on the date of liquidation in exactly one year.)

(Multiple Choice)

4.9/5  (36)

(36)

Which of the following is NOT a source of foreign exchange risk?

(Multiple Choice)

4.8/5  (33)

(33)

The one-year CD rates for financial institutions with AA ratings are 5 percent in Canada and 8 percent in France. An AA-rated Canadian financial institution can borrow by issuing GICs or lend by purchasing GICs at these rates in either market. The current spot rate is $0.20/Euro. What should be the one-year forward rate in order to prevent any arbitrage?

(Multiple Choice)

4.8/5  (38)

(38)

Showing 21 - 40 of 87

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)