Exam 15: Interest Rates and the Capital Market

Exam 1: Economic Issues and Concepts130 Questions

Exam 2: Economic Theories,Data,and Graphs140 Questions

Exam 3: Demand, Supply, and Price161 Questions

Exam 4: Elasticity160 Questions

Exam 5: Price Controls and Market Efficiency125 Questions

Exam 6: Consumer Behaviour140 Questions

Exam 7: Producers in the Short Run144 Questions

Exam 8: Producers in the Long Run141 Questions

Exam 9: Competitive Markets154 Questions

Exam 10: Monopoly, cartels, and Price Discrimination126 Questions

Exam 11: Imperfect Competition and Strategic Behaviour126 Questions

Exam 12: Economic Efficiency and Public Policy123 Questions

Exam 13: How Factor Markets Work123 Questions

Exam 14: Labour Markets and Income Inequality119 Questions

Exam 15: Interest Rates and the Capital Market107 Questions

Exam 16: Market Failures and Government Intervention123 Questions

Exam 17: The Economics of Environmental Protection133 Questions

Exam 18: Taxation and Public Expenditure121 Questions

Exam 19: What Macroeconomics Is All About116 Questions

Exam 20: The Measurement of National Income117 Questions

Exam 21: The Simplest Short-Run Macro Model156 Questions

Exam 22: Adding Government and Trade to the Simple Macro Model132 Questions

Exam 23: Output and Prices in the Short Run142 Questions

Exam 24: From the Short Run to the Long Run: The Adjustment of Factor Prices149 Questions

Exam 25: Long-Run Economic Growth129 Questions

Exam 26: Money and Banking129 Questions

Exam 27: Money, Interest Rates, and Economic Activity135 Questions

Exam 28: Monetary Policy in Canada119 Questions

Exam 29: Inflation and Disinflation122 Questions

Exam 30: Unemployment Fluctuations and the Nairu120 Questions

Exam 31: Government Debt and Deficits129 Questions

Exam 32: The Gains From International Trade127 Questions

Exam 33: Trade Policy126 Questions

Exam 34: Exchange Rates and the Balance of Payments161 Questions

Select questions type

The Canadian government introduced the Tax-Free Savings Account (TFSA)in 2009,which allows Canadians to earn tax-free investment returns on a limited amount of savings each year.In theory,and all else remaining equal,what do we expect the effect of such a policy to be on the market for financial capital?

Free

(Multiple Choice)

4.8/5  (33)

(33)

Correct Answer:

C

Suppose that you lend me $100 for a year,and that I agree to pay you $110 at that time (principal plus interest).Over the intervening year,however,the average price of goods in the economy falls by 4%.The real rate of return that you will earn on your loan to me is therefore equal to

Free

(Multiple Choice)

4.8/5  (32)

(32)

Correct Answer:

D

If the annual interest rate is 10%,the present value of $100 to be received two years from now is

Free

(Multiple Choice)

4.8/5  (43)

(43)

Correct Answer:

B

Consider the market for commercial ovens as a factor of production in the commercial bread industry.Assume that all commercial ovens are identical,they have a lifespan of 10 years,and the purchase price is $12 000.The present value of the stream of MRPs from the last oven purchased by each commercial bakery is $16 000.We can expect that

(Multiple Choice)

4.9/5  (33)

(33)

In recent decades the economy has experienced dramatic technological improvement in many types of capital equipment.All else remaining equal,this change has the effect of shifting the investment demand curve to the ________ and causing an excess ________ capital,and thus a ________ in the equilibrium interest rate.

(Multiple Choice)

4.8/5  (33)

(33)

The economy's supply curve for saving (financial capital)shows

(Multiple Choice)

4.9/5  (37)

(37)

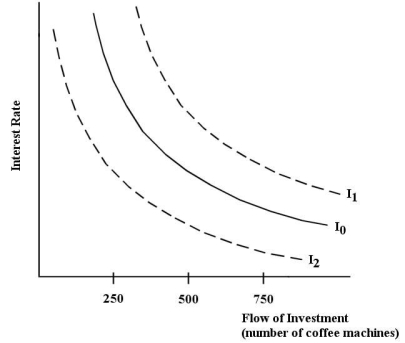

The diagram below shows a firm's demand for its units of capital-coin-operated coffee machines.The firm places its machines in universities and colleges across Canada.  FIGURE 15-1

-Refer to Figure 15-1.The downward slope of the firm's investment demand curve can be explained by

FIGURE 15-1

-Refer to Figure 15-1.The downward slope of the firm's investment demand curve can be explained by

(Multiple Choice)

4.8/5  (34)

(34)

To determine an individual profit-maximizing firm's maximum purchase price for a unit of capital it is necessary to

(Multiple Choice)

4.9/5  (34)

(34)

Carol can borrow $13 000 to buy a used car from the bank at 8% for five years,or from her friend Eric,who is willing to lend her the money at 7% for five years.If Carol accepts Eric's offer,he can expect a lump-sum repayment in five years of approximately

(Multiple Choice)

4.9/5  (34)

(34)

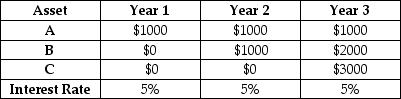

The table below shows the payments at the end of each year from three different physical assets.

TABLE 15-1

-Refer to Table 15-1.A,B,and C represent possible purchases of physical capital,each offering a stream of payments as indicated in the table.There are no payments beyond Year 3.The interest rates in each year are also specified in the table.What is the present value (at the beginning of Year 1)of asset B?

TABLE 15-1

-Refer to Table 15-1.A,B,and C represent possible purchases of physical capital,each offering a stream of payments as indicated in the table.There are no payments beyond Year 3.The interest rates in each year are also specified in the table.What is the present value (at the beginning of Year 1)of asset B?

(Multiple Choice)

4.9/5  (32)

(32)

Consider the economy's downward-sloping demand for investment curve.An increase in the interest rate causes

(Multiple Choice)

4.9/5  (36)

(36)

For the economy as a whole,the equilibrium interest rate is determined by

(Multiple Choice)

4.9/5  (37)

(37)

We can think about the interest rate as the "price" of capital because

(Multiple Choice)

4.8/5  (32)

(32)

The Canadian government introduced the Tax-Free Savings Account (TFSA)in 2009,which allows Canadians to earn tax-free investment returns on a limited amount of savings each year.What is the underlying goal of such a government policy?

(Multiple Choice)

4.9/5  (31)

(31)

Consider a manufacturing firm that contemplates buying a lathe with an annual MRP of $1000 (beginning one year from now).Suppose the interest rate is 5% per year.If the lathe is obsolete after the fourth MRP is generated,the maximum the firm is prepared to pay now for the lathe is

(Multiple Choice)

4.7/5  (32)

(32)

The amount of physical capital is a ________ variable;________.

(Multiple Choice)

4.9/5  (40)

(40)

If the annual interest rate is 5%,the present value of $100 to be received two years from now is

(Multiple Choice)

4.9/5  (37)

(37)

The textbook presentation of present value involves an important simplification of reality in order to analyze the concept.That simplification is in assuming that

(Multiple Choice)

4.8/5  (34)

(34)

Showing 1 - 20 of 107

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)