Exam 35: Accounting for Foreign Currency Transactions

Exam 1: An Overview of the Australian External Reporting Environment50 Questions

Exam 2: The Conceptual Framework of Accounting and Its Relevance to Financ62 Questions

Exam 3: Theories of Financial Accounting61 Questions

Exam 4: An Overview of Accounting for Assets62 Questions

Exam 5: Depreciation of Property, plant and Equipment62 Questions

Exam 6: Revaluation and Impairment Testing of Non-Current Assets59 Questions

Exam 7: Inventory61 Questions

Exam 8: Accounting for Intangibles61 Questions

Exam 9: Accounting for Heritage Assets and Biological Assets61 Questions

Exam 10: An Overview of Accounting for Liabilities58 Questions

Exam 11: Accounting for Lease78 Questions

Exam 12: Set-Off and Extinguishment of Debt47 Questions

Exam 13: Accounting for Employee Benefits67 Questions

Exam 15: Accounting for Financial Instruments72 Questions

Exam 16: Revenue Recognition Issues64 Questions

Exam 17: The Statement of Comprehensive Income and Statement of Changes in E62 Questions

Exam 19: Accounting for Income Taxes56 Questions

Exam 20: Cash-Flow Statements60 Questions

Exam 21: Accounting for the Extractive Industries60 Questions

Exam 22: Accounting for General Insurance Contracts58 Questions

Exam 23: Accounting for Superannuation Plans62 Questions

Exam 24: Events Occurring After Balance Sheet Date62 Questions

Exam 25: Segment Reporting61 Questions

Exam 26: Related-Party Disclosures59 Questions

Exam 28: Accounting for Group Structures69 Questions

Exam 29: Further Consolidation Issues I: Accounting for Intragroup Transact46 Questions

Exam 30: Further Consolidation Issues II: Accounting for Minority Interests34 Questions

Exam 31: Further Consolidation Issues III: Accounting for Indirect Ownershi38 Questions

Exam 32: Further Consolidation Issues Iv: Accounting for Changes in the Deg39 Questions

Exam 33: Accounting for Equity Investments67 Questions

Exam 33: Accounting for Equity Investments59 Questions

Exam 35: Accounting for Foreign Currency Transactions58 Questions

Exam 36: Translation of the Accounts of Foreign Operations41 Questions

Exam 37: Accounting for Corporate Social Responsibility59 Questions

Select questions type

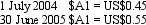

On 1 July 2004 Waugh Ltd enters into an arrangement with a US bank - Big Bank - to borrow US$900,000.The term of the loan is 3 years with interest payable annually in arrears on 30 June at the rate of 10 per cent.The exchange rate information is:  What journal entries are required in Waugh Ltd's books for 1 July 2004 and 30 June 2005 in accordance with AASB 121 (rounded to the nearest whole $A)?

What journal entries are required in Waugh Ltd's books for 1 July 2004 and 30 June 2005 in accordance with AASB 121 (rounded to the nearest whole $A)?

(Multiple Choice)

4.9/5  (38)

(38)

What is the required treatment for long-term monetary items denominated in a foreign currency according to AASB 121 and what is a concern that has been raised about the treatment?

(Multiple Choice)

4.8/5  (38)

(38)

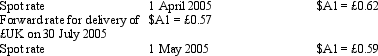

Sure Ltd purchased goods for £210,000 from a British supplier on 1 April 2005.The amount owing on the purchase is payable on 30 July 2005.On 1 May 2005 a forward-exchange contract for the delivery of £210,000 on 30 July 2005 is taken out with Aus Bank.Exchange rates are as follows:  What entries are required to record the initial transaction and the forward-exchange contract in accordance with AASB 121 and AASB 139 (rounded to the nearest whole $A)?

What entries are required to record the initial transaction and the forward-exchange contract in accordance with AASB 121 and AASB 139 (rounded to the nearest whole $A)?

(Multiple Choice)

4.9/5  (37)

(37)

AASB 123 Borrowing Costs defines a qualifying asset as an asset that:

(Multiple Choice)

4.8/5  (27)

(27)

Management may exercise its judgement to determine the functional currency that most faithfully represents the economic effects of the underlying transactions,events and conditions.

(True/False)

4.8/5  (39)

(39)

To classify an arrangement as a hedge,and therefore to apply 'hedge accounting',AASB 132 requires a set of strict conditions be met.

(True/False)

4.9/5  (42)

(42)

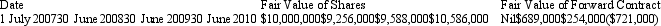

The following data is provided for the fair value of a share portfolio,and the fair value of a forward contract taken out on 1 July 2007 to 'hedge' movements in the fair value of the shares.Assume the hedge was highly effective at inception of the hedge.  Which of the following statements is true?

Which of the following statements is true?

(Multiple Choice)

4.8/5  (42)

(42)

Which of the following statements is correct with respect to AASB 121 "The effects of changes in foreign exchange rates"?

(Multiple Choice)

4.8/5  (33)

(33)

The functional currency of an entity is the currency of the prime economic environment in which the entity operates:

(True/False)

4.8/5  (30)

(30)

Exchange gains or losses on a qualifying asset that arise before it ceases to be a qualifying asset are to be deferred and amortised over the life of the asset according to AASB 123:

(True/False)

4.8/5  (34)

(34)

The effect of an increase in the exchange rate for Australian dollars relative to other major world currencies would include:

(Multiple Choice)

4.8/5  (36)

(36)

According to AASB 123 a qualifying asset is one that necessarily takes a substantial period of time to get ready for its intended use or sale:

(True/False)

4.9/5  (47)

(47)

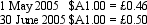

On 1 May 2005 Harriet's Importers Ltd acquires goods from a supplier in Britain.The goods are shipped f.o.b.from England on 1 May 2005.The cost of the goods is £200,000.The amount has not been paid at period end,30 June 2005.Exchange rates are as follows:  Harriet's Importers Ltd uses a perpetual inventory system.

What entries are required at transaction date and reporting date (rounded to the nearest whole $A)?

Harriet's Importers Ltd uses a perpetual inventory system.

What entries are required at transaction date and reporting date (rounded to the nearest whole $A)?

(Multiple Choice)

4.9/5  (26)

(26)

An entity's may change its functional currency when there is a change in the underlying transactions,events and conditions.

(True/False)

4.8/5  (39)

(39)

Monetary items are units of currency held and assets and liabilities to be received or paid in a fixed or determinable number of units of currency.

(True/False)

4.8/5  (34)

(34)

AASB 121 requires that foreign currency monetary items outstanding at reporting date must be:

(Multiple Choice)

4.8/5  (48)

(48)

Exchange differences recognised as borrowing costs and included in the cost of an asset,are recogniseD.

(Multiple Choice)

4.9/5  (44)

(44)

Hedges cannot be designated and/or documented on a retrospective basis:

(True/False)

4.9/5  (35)

(35)

Which of the following items is not within the scope of AASB 112 "The effects of changes in foreign exchange rates"?

(Multiple Choice)

4.8/5  (37)

(37)

Showing 21 - 40 of 58

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)