Exam 6: Deductions and Losses: in General

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law139 Questions

Exam 2: Working With the Tax Law78 Questions

Exam 3: Computing the Tax130 Questions

Exam 4: Gross Income: Concepts and Inclusions125 Questions

Exam 5: Gross Income: Exclusions116 Questions

Exam 6: Deductions and Losses: in General144 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses90 Questions

Exam 8: Depreciation,cost Recovery,amortization,and Depletion108 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses150 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions100 Questions

Exam 11: Investor Losses94 Questions

Exam 12: Tax Credits and Payments104 Questions

Exam 13: Part 1--Property Transactions: Determination of Gain or Loss,basis Considerations,and Nontaxable Exchanges199 Questions

Exam 13: Part 2--Property Transactions: Determination of Gain or Loss,basis Considerations,and Nontaxable Exchanges82 Questions

Exam 14: Property Transactions: Capital Gains and Losses,1231,and Recapure Provisions144 Questions

Exam 15: Alternative Minimum Tax119 Questions

Exam 16: Accounting Periods and Methods86 Questions

Exam 17: Corporations: Introduction and Operating Rules108 Questions

Exam 18: Corporations: Organization and Capital Structure93 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation136 Questions

Exam 20: Distributions in Complete Liquidation and an Overview of Reorganizations66 Questions

Exam 21: Partnerships157 Questions

Exam 22: S Corporations144 Questions

Exam 23: Exempt Entities132 Questions

Exam 24: Multistate Corporate Taxation119 Questions

Exam 25: Taxation of International Transactions146 Questions

Exam 26: Tax Practice and Ethics135 Questions

Exam 27: The Federal Gift and Estate Taxes144 Questions

Exam 28: Income Taxation of Trusts and Estates132 Questions

Select questions type

If a taxpayer makes a profit in three of the five consecutive years ending with the taxable year,the burden of proof is on the IRS to prove the activity is a hobby rather than a trade or business.

(True/False)

4.9/5  (31)

(31)

Generally,a closely-held family corporation is not permitted to take a deduction for a salary paid to a family member in calculating corporate taxable income.

(True/False)

4.9/5  (31)

(31)

Which of the following statements is correct in connection with the investigation of a business?

(Multiple Choice)

5.0/5  (35)

(35)

Susan is a sales representative for a U.S.weapons manufacturer.She makes a $100,000 "grease" payment to a U.S.government official associated with a weapons purchase by the U.S.Army.She makes a similar payment to a Saudi Arabian government official associated with a similar sale.Neither of these payments is deductible by Susan's employer.

(True/False)

4.7/5  (36)

(36)

Fines paid in the course of carrying on a trade or business generally are deductible if there is a related business purpose.

(True/False)

4.7/5  (36)

(36)

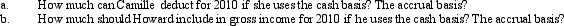

Camille,a calendar year taxpayer,rented a building from Howard for use in her business on November 1,2010.Camille paid $30,000 for 15 months' rent and a $2,500 damage deposit.

(Essay)

4.7/5  (45)

(45)

Ordinary and necessary business expenses,other than cost of goods sold,of an illegal drug trafficking business do not reduce taxable income.

(True/False)

5.0/5  (35)

(35)

For purposes of the § 267 loss disallowance provision,a taxpayer's nephew is a related party.

(True/False)

4.9/5  (43)

(43)

A baseball team that pays a star player an annual salary of $25 million can deduct the entire $25 million as salary expense.If the same amount is paid to the CEO of IBM,only $1 million is deductible.

(True/False)

4.9/5  (35)

(35)

Because Scott is three months delinquent on the mortgage payments for his personal residence,Jeanette (his sister)is going to cover the arrearage.Based on past experience,she does not expect to be repaid by Scott.Which of the following statements is correct?

(Multiple Choice)

4.8/5  (40)

(40)

A taxpayer pays his son's real estate taxes.The taxpayer may deduct the real estate taxes,but the son cannot.

(True/False)

4.8/5  (32)

(32)

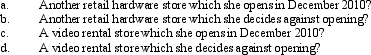

Gladys owns a retail hardware store in Tangipahoa.She is considering opening a business in Hammond,a community located 25 miles away.She incurs expenses of $60,000 in 2010 in investigating the feasibility and desirability of doing so.What amount can Gladys deduct in 2010 if the business is:

(Essay)

4.8/5  (33)

(33)

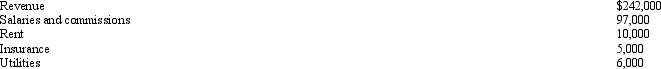

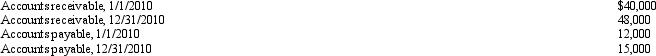

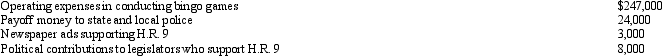

Woody owns a barber shop.The following selected data are taken from the barber shop balance sheet and income statement prepared for 2010 using the cash method.

The following supplemental data also is provided.

The following supplemental data also is provided.

Calculate Woody's net profit for 2010 using the accrual method.

Calculate Woody's net profit for 2010 using the accrual method.

(Essay)

4.9/5  (31)

(31)

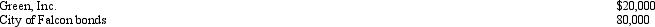

Brenda invested in the following stocks and bonds during 2010.

To finance the investments,she borrowed $100,000 from Swan Bank.Interest expense paid on the loan during 2010 was $6,000.During 2010,Brenda received $2,400 of dividend income from Green,Inc.and $3,200 of interest income on the municipal bonds.

To finance the investments,she borrowed $100,000 from Swan Bank.Interest expense paid on the loan during 2010 was $6,000.During 2010,Brenda received $2,400 of dividend income from Green,Inc.and $3,200 of interest income on the municipal bonds.

(Essay)

4.9/5  (34)

(34)

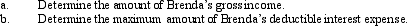

Rex,a cash basis calendar year taxpayer,runs a bingo operation which is illegal under state law.During 2010,a bill designated H.R.9 is introduced into the state legislature which,if enacted,would legitimize bingo games.In 2010,Rex had the following expenses:  Of these expenditures,Rex may deduct:

Of these expenditures,Rex may deduct:

(Multiple Choice)

4.8/5  (36)

(36)

A political contribution to the Democratic Party or the Republican Party is not deductible,but a contribution to the Presidential Election Campaign Fund is deductible.

(True/False)

4.9/5  (41)

(41)

Priscella pursued a hobby of making bedspreads in her spare time.Her AGI before considering the hobby is $40,000.During the year she sold the bedspreads for $10,000.She incurred expenses as follows:  Assuming that the activity is deemed a hobby,how should she report these items on her tax return?

Assuming that the activity is deemed a hobby,how should she report these items on her tax return?

(Multiple Choice)

4.8/5  (48)

(48)

Theo owns a vacation home that is classified in the personal use/rental use category.Rent income is $9,000,while property taxes and mortgage interest allocated to the rental use part are $12,000.Only $9,000 of the $12,000 expenses can be deducted.

(True/False)

4.9/5  (43)

(43)

Showing 121 - 140 of 144

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)