Exam 7: Inventories

Exam 1: Introduction to Accounting and Business190 Questions

Exam 2: Analyzing Transactions224 Questions

Exam 3: The Adjusting Process179 Questions

Exam 4: Completing the Accounting Cycle194 Questions

Exam 5: Accounting Systems160 Questions

Exam 6: Accounting for Merchandising Businesses215 Questions

Exam 7: Inventories165 Questions

Exam 8: Sarbanes-Oxley, Internal Control, and Cash176 Questions

Exam 9: Receivables140 Questions

Exam 10: Fixed Assets and Intangible Assets170 Questions

Exam 11: Current Liabilities and Payroll169 Questions

Exam 12: Accounting for Partnerships and Limited Liability Companies190 Questions

Exam 13: Corporations: Organization, Stock Transactions, and Dividends165 Questions

Exam 14: Long-Term Liabilities: Bonds and Notes185 Questions

Exam 15: Investments and Fair Value Accounting133 Questions

Exam 16: Statement of Cash Flows160 Questions

Exam 17: Financial Statement Analysis185 Questions

Exam 18: Managerial Accounting Concepts and Principles173 Questions

Exam 19: Job Order Costing173 Questions

Exam 20: Process Cost Systems177 Questions

Exam 21: Cost Behavior and Cost-Volume-Profit Analysis215 Questions

Exam 22: Budgeting188 Questions

Exam 23: Performance Evaluation Using Variances From Standard Costs161 Questions

Exam 24: Performance Evaluation for Decentralized Operations200 Questions

Exam 25: Differential Analysis and Product Pricing162 Questions

Exam 26: Capital Investment Analysis179 Questions

Select questions type

Of the three widely used inventory costing methods (FIFO, LIFO, and average cost), the LIFO method of costing inventory assumes costs are charged based on the most recent purchases first.

(True/False)

4.9/5  (34)

(34)

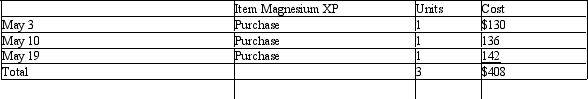

Three identical units of Item Magnesium XP are purchased during May, as shown below.

Assume that two units are sold on May 23 for $313. Determine the gross profit for May and ending inventory on May 31 using (a) FIFO, (b) LIFO, and (c) average cost methods.

Assume that two units are sold on May 23 for $313. Determine the gross profit for May and ending inventory on May 31 using (a) FIFO, (b) LIFO, and (c) average cost methods.

(Essay)

4.7/5  (42)

(42)

During periods of increasing costs, the use of the FIFO method of costing inventory will result in a greater amount of net income than would result from the use of the LIFO cost method.

(True/False)

4.9/5  (34)

(34)

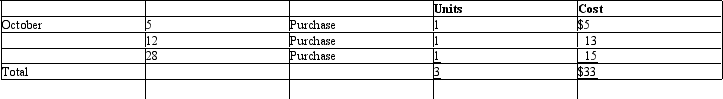

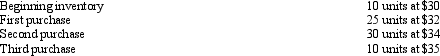

Assume that three identical units of merchandise are purchased during October, as follows:

Assume one unit is sold on October 31 for $28. Determine Cost of Merchandise Sold, Gross Profit, and Ending Inventory under the Average Cost method.

Assume one unit is sold on October 31 for $28. Determine Cost of Merchandise Sold, Gross Profit, and Ending Inventory under the Average Cost method.

(Essay)

4.8/5  (36)

(36)

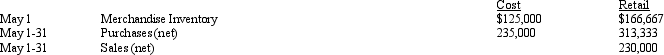

On the basis of the following data, what is the estimated cost of the merchandise inventory on May 31 using the retail method?

(Multiple Choice)

4.8/5  (35)

(35)

The lower-of-cost-or-market method of determining the value of ending inventory can be applied on an item by item, by major classification of inventory, or by the total inventory.

(True/False)

4.8/5  (46)

(46)

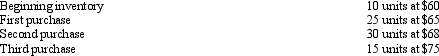

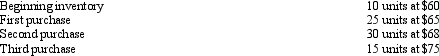

The following lots of a particular commodity were available for sale during the year:  The firm uses the periodic system and there are 25 units of the commodity on hand at the end of the year.

What is the amount of the inventory at the end of the year using the average cost method?

The firm uses the periodic system and there are 25 units of the commodity on hand at the end of the year.

What is the amount of the inventory at the end of the year using the average cost method?

(Multiple Choice)

4.8/5  (32)

(32)

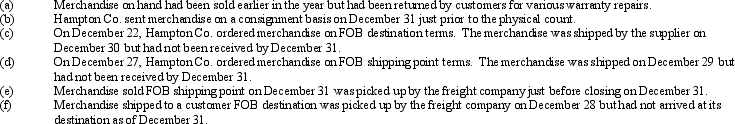

Hampton Co. took a physical count of its inventory on December 31. In addition, it had to decide whether or not the following items should be added to this count.

Indicate which items should be added to (answer: yes) and which items should not be added to (answer: no) the December 31 inventory count.

Indicate which items should be added to (answer: yes) and which items should not be added to (answer: no) the December 31 inventory count.

(Essay)

4.9/5  (39)

(39)

During periods of increasing costs, the use of the FIFO method of costing inventory will yield an inventory amount for the balance sheet that is higher than LIFO would produce.

(True/False)

4.8/5  (47)

(47)

The following lots of a particular commodity were available for sale during the year:  The firm uses the periodic system and there are 25 units of the commodity on hand at the end of the year.

What is the amount of the inventory at the end of the year using the FIFO method?

The firm uses the periodic system and there are 25 units of the commodity on hand at the end of the year.

What is the amount of the inventory at the end of the year using the FIFO method?

(Multiple Choice)

4.9/5  (40)

(40)

The following lots of a particular commodity were available for sale during the year:  The firm uses the periodic system and there are 20 units of the commodity on hand at the end of the year. What is the amount of inventory at the end of the year according to the LIFO method?

The firm uses the periodic system and there are 20 units of the commodity on hand at the end of the year. What is the amount of inventory at the end of the year according to the LIFO method?

(Multiple Choice)

4.9/5  (39)

(39)

If the perpetual inventory system is used, the account entitled Merchandise Inventory is debited for purchases of merchandise.

(True/False)

4.8/5  (34)

(34)

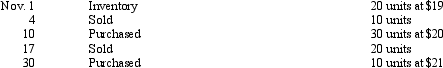

The inventory data for an item for November are:  Using a perpetual system, what is the cost of the merchandise sold for November if the company uses FIFO?

Using a perpetual system, what is the cost of the merchandise sold for November if the company uses FIFO?

(Multiple Choice)

4.7/5  (37)

(37)

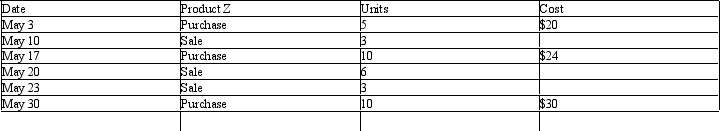

Use the following information to answer the following questions. The Boxwood Company sells blankets for $60 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1.

Assuming that the company uses the perpetual inventory system, determine the Gross Profit for the month of May using the LIFO cost method

Assuming that the company uses the perpetual inventory system, determine the Gross Profit for the month of May using the LIFO cost method

(Multiple Choice)

4.7/5  (35)

(35)

In valuing damaged merchandise for inventory purposes, net realizable value is the estimated selling price less any direct costs of disposal.

(True/False)

4.9/5  (32)

(32)

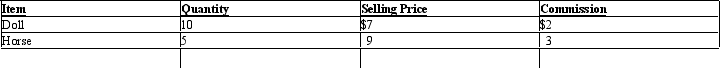

Determine the total value of the merchandise using Net Realizable Value:

(Essay)

4.8/5  (38)

(38)

Under the _________ inventory method, accounting records maintain a continuously updated inventory value.

(Multiple Choice)

4.9/5  (35)

(35)

Inventory controls start when the merchandise is shelved in the store area.

(True/False)

4.9/5  (40)

(40)

Showing 21 - 40 of 165

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)