Exam 7: Inventories

Exam 1: Introduction to Accounting and Business190 Questions

Exam 2: Analyzing Transactions224 Questions

Exam 3: The Adjusting Process179 Questions

Exam 4: Completing the Accounting Cycle194 Questions

Exam 5: Accounting Systems160 Questions

Exam 6: Accounting for Merchandising Businesses215 Questions

Exam 7: Inventories165 Questions

Exam 8: Sarbanes-Oxley, Internal Control, and Cash176 Questions

Exam 9: Receivables140 Questions

Exam 10: Fixed Assets and Intangible Assets170 Questions

Exam 11: Current Liabilities and Payroll169 Questions

Exam 12: Accounting for Partnerships and Limited Liability Companies190 Questions

Exam 13: Corporations: Organization, Stock Transactions, and Dividends165 Questions

Exam 14: Long-Term Liabilities: Bonds and Notes185 Questions

Exam 15: Investments and Fair Value Accounting133 Questions

Exam 16: Statement of Cash Flows160 Questions

Exam 17: Financial Statement Analysis185 Questions

Exam 18: Managerial Accounting Concepts and Principles173 Questions

Exam 19: Job Order Costing173 Questions

Exam 20: Process Cost Systems177 Questions

Exam 21: Cost Behavior and Cost-Volume-Profit Analysis215 Questions

Exam 22: Budgeting188 Questions

Exam 23: Performance Evaluation Using Variances From Standard Costs161 Questions

Exam 24: Performance Evaluation for Decentralized Operations200 Questions

Exam 25: Differential Analysis and Product Pricing162 Questions

Exam 26: Capital Investment Analysis179 Questions

Select questions type

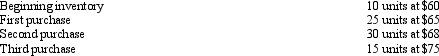

The following lots of a particular commodity were available for sale during the year:  The firm uses the periodic system and there are 25 units of the commodity on hand at the end of the year.

What is the amount of the inventory at the end of the year using the LIFO method?

The firm uses the periodic system and there are 25 units of the commodity on hand at the end of the year.

What is the amount of the inventory at the end of the year using the LIFO method?

(Multiple Choice)

4.8/5  (39)

(39)

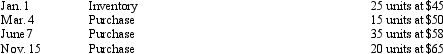

The units of an item available for sale during the year were as follows:

There are 30 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the ending inventory cost using FIFO.

There are 30 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the ending inventory cost using FIFO.

(Essay)

4.9/5  (49)

(49)

Garrison Company uses the retail method of inventory costing. They started the year with an inventory that had a retail cost of $45,000. During the year they purchased an inventory with a retail cost of $300,000. After performing a physical inventory, they calculated their inventory cost at retail to be $80,000. The mark up is 100% of cost. Determine the ending inventory at its estimated cost.

(Multiple Choice)

4.8/5  (35)

(35)

A purchase order establishes an initial record of the receipt of the inventory.

(True/False)

4.8/5  (38)

(38)

All of the following are reasons to use an estimated method of costing inventory except:

(Multiple Choice)

4.8/5  (38)

(38)

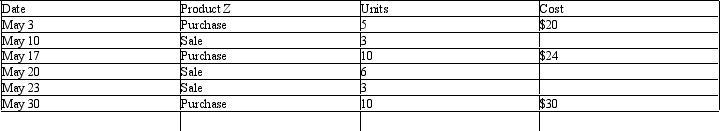

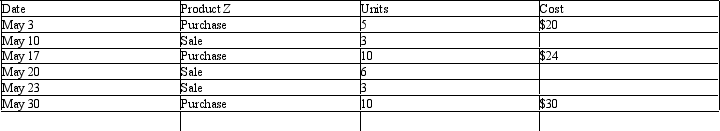

Use the following information to answer the following questions. The Boxwood Company sells blankets for $60 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1.

Assuming that the company uses the perpetual inventory system, determine the ending inventory value for the month of May using the FIFO inventory cost method.

Assuming that the company uses the perpetual inventory system, determine the ending inventory value for the month of May using the FIFO inventory cost method.

(Multiple Choice)

4.8/5  (30)

(30)

When merchandise inventory is shown on the balance sheet, both the method of determining the cost of the inventory and the method of valuing the inventory should be shown.

(True/False)

4.8/5  (29)

(29)

Kristin's Boutiques has identified the following items for possible inclusion in its December 31, 2010 inventory. Which of the following would not be included in the year end inventory?

(Multiple Choice)

4.9/5  (34)

(34)

1. Explain the effect of the following on the financial statements:

Goods held on consignment were included in the ending inventory count.

Goods purchased FOB shipping point were in transit on the last day of the year. The goods were not counted as part of ending inventory.

Goods sold FOB shipping point were in transit on the last day of the year. These goods were not counted as part of ending inventory.

2. What happens if inventory errors are not found and corrected?

(Essay)

4.8/5  (41)

(41)

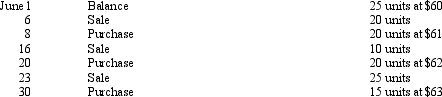

The following data regarding purchases and sales of a commodity were taken from the related perpetual inventory account:

(Essay)

4.9/5  (32)

(32)

If a manufacturer ships merchandise to a retailer on consignment, the unsold merchandise should be included in the inventory of the

(Multiple Choice)

4.8/5  (40)

(40)

Which of the following is used to analyze the efficiency and effectiveness of inventory management?

(Multiple Choice)

4.9/5  (32)

(32)

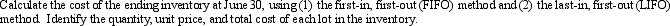

Match the following cost flow assumption to their inventory costing method:

(Essay)

4.8/5  (33)

(33)

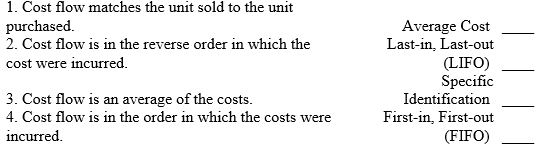

Determine the total value of the merchandise using Net Realizable Value:

(Multiple Choice)

4.9/5  (42)

(42)

If merchandise inventory is being valued at cost and the price level is steadily rising, the method of costing that will yield the highest net income is

(Multiple Choice)

4.9/5  (39)

(39)

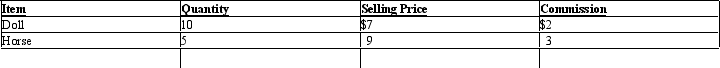

Using the lower of cost or market, what should the total inventory value be for the following items:

Apply the lower-of-cost-or-market method to inventory as a whole.

Apply the lower-of-cost-or-market method to inventory as a whole.

(Essay)

4.8/5  (31)

(31)

A consignor who has goods out on consignment with an agent should include the goods in ending inventory even though they are in the possession of the consignor.

(True/False)

4.8/5  (37)

(37)

During the taking of its physical inventory on December 31, 2014, Barry's Bike Shop incorrectly counted its inventory as $350,000 instead of the correct amount of $280,000. The effect on the balance sheet and income statement would be as follows:

(Multiple Choice)

4.8/5  (34)

(34)

Use the following information to answer the following questions. The Boxwood Company sells blankets for $60 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1.

Assuming that the company uses the perpetual inventory system, determine the gross profit for the sale of May 23 using the FIFO inventory cost method.

Assuming that the company uses the perpetual inventory system, determine the gross profit for the sale of May 23 using the FIFO inventory cost method.

(Multiple Choice)

5.0/5  (41)

(41)

Showing 61 - 80 of 165

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)