Exam 7: Inventories

Exam 1: Introduction to Accounting and Business190 Questions

Exam 2: Analyzing Transactions224 Questions

Exam 3: The Adjusting Process179 Questions

Exam 4: Completing the Accounting Cycle194 Questions

Exam 5: Accounting Systems160 Questions

Exam 6: Accounting for Merchandising Businesses215 Questions

Exam 7: Inventories165 Questions

Exam 8: Sarbanes-Oxley, Internal Control, and Cash176 Questions

Exam 9: Receivables140 Questions

Exam 10: Fixed Assets and Intangible Assets170 Questions

Exam 11: Current Liabilities and Payroll169 Questions

Exam 12: Accounting for Partnerships and Limited Liability Companies190 Questions

Exam 13: Corporations: Organization, Stock Transactions, and Dividends165 Questions

Exam 14: Long-Term Liabilities: Bonds and Notes185 Questions

Exam 15: Investments and Fair Value Accounting133 Questions

Exam 16: Statement of Cash Flows160 Questions

Exam 17: Financial Statement Analysis185 Questions

Exam 18: Managerial Accounting Concepts and Principles173 Questions

Exam 19: Job Order Costing173 Questions

Exam 20: Process Cost Systems177 Questions

Exam 21: Cost Behavior and Cost-Volume-Profit Analysis215 Questions

Exam 22: Budgeting188 Questions

Exam 23: Performance Evaluation Using Variances From Standard Costs161 Questions

Exam 24: Performance Evaluation for Decentralized Operations200 Questions

Exam 25: Differential Analysis and Product Pricing162 Questions

Exam 26: Capital Investment Analysis179 Questions

Select questions type

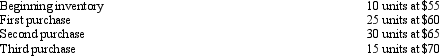

The following units of an inventory item were available for sale during the year:  The firm uses the periodic inventory system. During the year, 60 units of the item were sold.

The value of ending inventory using FIFO is:

The firm uses the periodic inventory system. During the year, 60 units of the item were sold.

The value of ending inventory using FIFO is:

(Multiple Choice)

4.8/5  (38)

(38)

Under the LIFO inventory costing method, the most recent costs are assigned to ending inventory.

(True/False)

4.8/5  (32)

(32)

The three inventory costing methods will normally each yield different amounts of net income.

(True/False)

4.7/5  (41)

(41)

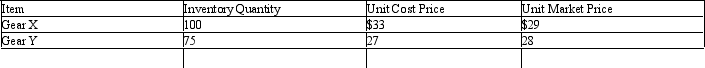

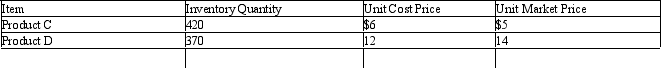

On the basis of the following data, determine the value of the inventory at the lower of cost or market. Apply lower of cost or market to each inventory item. Show your work.

(Essay)

4.8/5  (42)

(42)

Which of the following measures the length of time it takes to acquire, sell and replace inventory?

(Multiple Choice)

4.8/5  (44)

(44)

One effect of carrying too much inventory is risk that customers will change their buying habits.

(True/False)

4.9/5  (43)

(43)

During periods of decreasing costs the use of the LIFO method of costing inventory will result in a lower amount of net income than would result from the use of the FIFO method.

(True/False)

4.8/5  (38)

(38)

When using the FIFO inventory costing method, the most recent costs are assigned to the cost of goods sold.

(True/False)

5.0/5  (41)

(41)

Cost flow is in the order in which costs were incurred when using

(Multiple Choice)

4.8/5  (32)

(32)

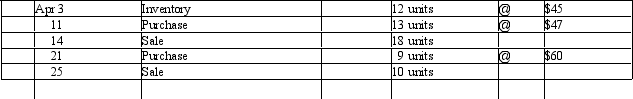

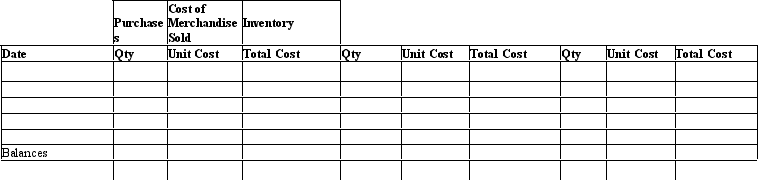

Beginning inventory, purchases and sales data for tennis rackets are as follows:

Complete the inventory cost card assuming the business maintains a perpetual inventory system and calculates the cost of merchandise sold and ending inventory using FIFO.

Complete the inventory cost card assuming the business maintains a perpetual inventory system and calculates the cost of merchandise sold and ending inventory using FIFO.

(Essay)

4.9/5  (31)

(31)

FIFO is the inventory costing method that follows the physical flow of the goods.

(True/False)

4.9/5  (42)

(42)

If ending inventory for the year is overstated, owner's equity reported on the balance sheet at the end of the year is understated.

(True/False)

4.8/5  (40)

(40)

If a company values inventory at the lower of cost or market, which of the following is the value of merchandise inventory on the balance sheet? Apply the lower-of-cost-or-market method to inventory as a whole.

(Multiple Choice)

4.8/5  (42)

(42)

The use of the lower-of-cost-or-market method of inventory valuation increases net income for the period in which the inventory replacement price declined.

(True/False)

4.7/5  (41)

(41)

If ending inventory for the year is understated, net income for the year is overstated.

(True/False)

4.8/5  (42)

(42)

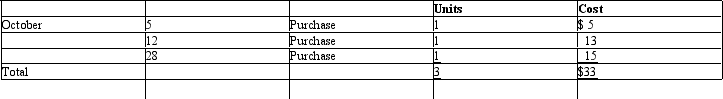

Assume that three identical units of merchandise are purchased during October, as follows:

Assume one unit is sold on October 31 for $28. Determine Cost of Merchandise Sold, Gross profit, and Ending Inventory under the FIFO method.

Assume one unit is sold on October 31 for $28. Determine Cost of Merchandise Sold, Gross profit, and Ending Inventory under the FIFO method.

(Essay)

4.8/5  (35)

(35)

If Beginning Inventory (BI) + Purchases (P) - Ending Inventory (EI) = Cost of Goods Sold (COGS), an equivalent equation can be written as?

(Multiple Choice)

4.8/5  (39)

(39)

Damaged merchandise that can be sold only at prices below cost should be valued at

(Multiple Choice)

4.8/5  (32)

(32)

While taking a physical inventory, a company counts their inventory as less than the actual amount on hand. How will this error affect the income statement?

(Short Answer)

4.8/5  (33)

(33)

Showing 81 - 100 of 165

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)