Exam 4: Completing the Accounting Cycle

Exam 1: Accounting in Business245 Questions

Exam 2: Analyzing and Recording Transactions201 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements227 Questions

Exam 4: Completing the Accounting Cycle177 Questions

Exam 5: Accounting for Merchandising Operations189 Questions

Exam 6: Inventories and Cost of Sales194 Questions

Exam 7: Accounting Information Systems166 Questions

Exam 8: Cash and Internal Controls195 Questions

Exam 9: Accounting for Receivables162 Questions

Exam 10: Long-Term Assets208 Questions

Exam 11: Current Liabilities and Payroll Accounting178 Questions

Exam 12: Accounting for Partnerships141 Questions

Exam 13: Accounting for Corporations210 Questions

Exam 14: Long-Term Liabilities158 Questions

Exam 15: Investments and International Operations156 Questions

Exam 16: Statement of Cash Flows173 Questions

Exam 17: Analysis of Financial Statements182 Questions

Exam 18: Managerial Accounting Concepts and Principles199 Questions

Exam 19: Job Order Cost Accounting165 Questions

Exam 20: Process Cost Accounting172 Questions

Exam 21: Cost Allocation and Performance Measurement173 Questions

Exam 22: Cost-Volume-Profit Analysis190 Questions

Exam 23: Master Budgets and Planning166 Questions

Exam 24: Flexible Budgets and Standard Costs178 Questions

Exam 25: Capital Budgeting and Managerial Decisions153 Questions

Select questions type

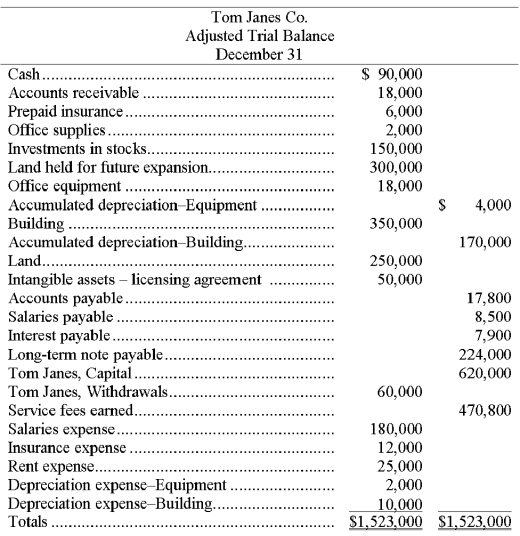

The following year-end adjusted trial balance is for Tom Janes Co. at the end of December 31. The credit balance in Tom Janes, Capital at the beginning of the year, January 1, was $320,000. The owner, Tom Janes, invested an additional $300,000 during the current year. The land held for future expansion was also purchased during the current year.

Required: 1. Prepare a classified year-end balance sheet. (Note: A $22,000 installment on the long-term note payable is due within one year.)

2. Using the information presented:

(a) Calculate the current ratio. Comment on the ability of Tom Janes Co. to meets its short-term debts.

(b) Calculate the debt ratio and comment on the financial position and risk analysis of Tom Janes Co.

(c) Using the account balances to analyze the financial position of Tom Janes Co., why would the owner need to invest an additional $300,000 in the business when the business is already profitable and the owner had an existing capital balance of $320,000?

(Essay)

4.8/5  (39)

(39)

The following are the steps in the accounting cycle. List them in the order in which they are completed:

Prepare adjusted trial balance

Post transactions

Prepare an unadjusted trial balance

Journalize transactions

Prepare the financial statements

Close the temporary accounts

Adjust the ledger accounts

Prepare a post-closing trial balance

Analyze transactions

(Essay)

4.7/5  (37)

(37)

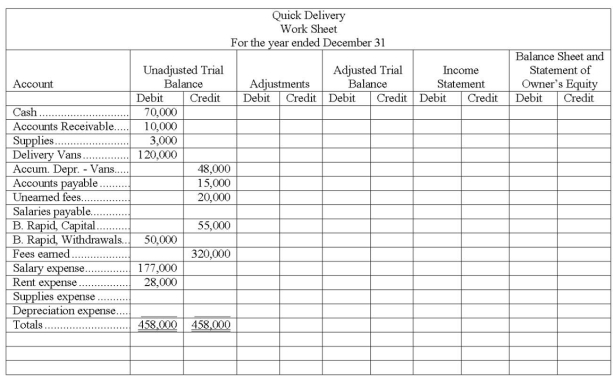

The unadjusted trial balance of Quick Delivery is entered on the partial work sheet below. Complete the work sheet using the following information:

(a) Salaries earned by employees that are unpaid and unrecorded, $5,000.

(b) An inventory of supplies showed $1,000 of unused supplies still on hand.

(c) Depreciation on delivery vans, $24,000.

(d) Services paid in advance by customers of $10,000 have now been provided to customers.

(Essay)

4.8/5  (34)

(34)

The closing process is a step in the accounting cycle that prepares accounts for the next accounting period.

(True/False)

4.7/5  (33)

(33)

A post-closing trial balance is a list of permanent accounts and their balances from the ledger after all closing entries are journalized and posted.

(True/False)

4.8/5  (47)

(47)

Which of the following errors would cause the Balance Sheet and Statement of Changes in Equity columns of a work sheet to be out of balance?

(Multiple Choice)

4.7/5  (41)

(41)

Which of the following statements regarding presentation of financial statements under IFRS is not ?

(Multiple Choice)

4.8/5  (33)

(33)

Bentley records adjusting entries at its December 31 year end. At December 31, employees had earned $12,000 of unpaid and unrecorded salaries. The next payday is January 3, at which time $30,000 will be paid. Prepare the January 1 journal entry to reverse the effect of the December 31 salary expense accrual.

(Multiple Choice)

4.9/5  (39)

(39)

Excalibur frequently has accrued expenses at the end of its fiscal year that should be recorded for proper financial statement presentation. Excalibur pays on a weekly basis and has $50,000 of accrued salaries incurred but not paid for June 30, its fiscal year-end. This consists of one day's accrued salaries for the week. Excalibur will pay its employees $250,000 on July 4; the one day of accrued salaries and the remaining four days for July salaries. Record the following entries:

(a) Accrual of the salaries on June 30.

(b) Payment of the salaries on July 4, assuming that Excalibur does not prepare reversing entries.

(c) Assuming that Excalibur prepares reversing entries, reverse the adjusting entry made on June 30.

(d) Assuming that Excalibur prepares reversing entries, payment of the salaries on July 4.

(Essay)

4.8/5  (40)

(40)

If in preparing a work sheet an adjusted trial balance amount is mistakenly sorted to the wrong work sheet column. The Balance Sheet columns will balance on completing the work sheet but with the wrong net income, if the amount sorted in error is:

(Multiple Choice)

4.9/5  (37)

(37)

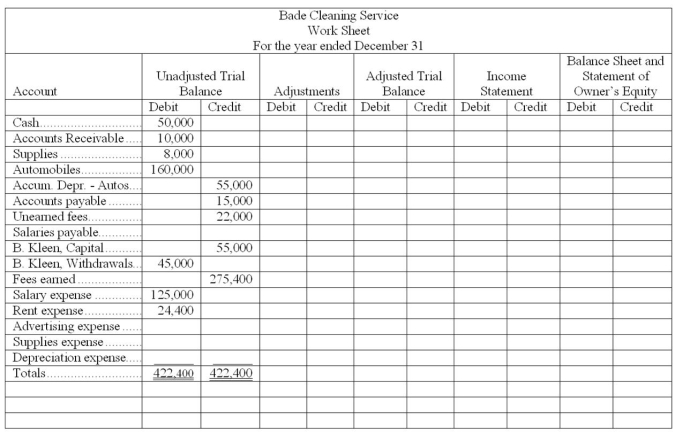

The unadjusted trial balance of Bade Cleaning Service is entered on the partial work sheet below. Complete the work sheet using the following information:

(a) Salaries earned by employees that are unpaid and unrecorded, $4,000.

(b) An inventory of supplies showed $3,000 of unused supplies still on hand.

(c) Depreciation on automobiles, $30,000.

(d) Services paid in advance by customers of $12,000 have now been provided to customers.

(e) Advertising for November and December in the amount of $8,000 remains unpaid and unrecorded.

(Essay)

4.8/5  (44)

(44)

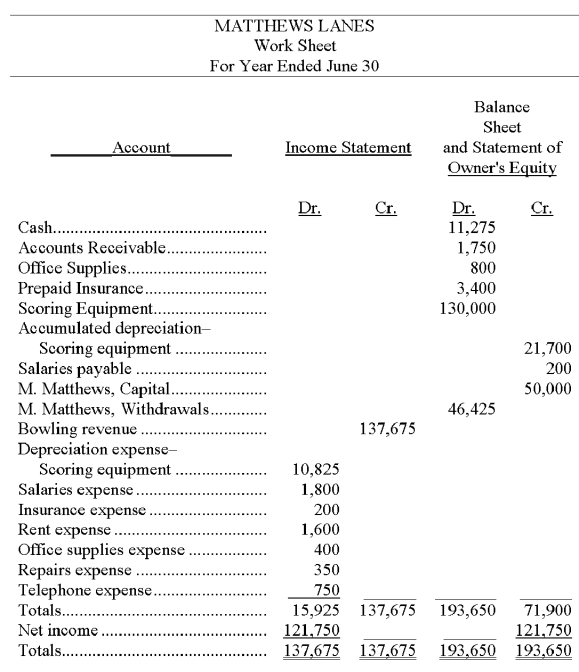

Use the following partial work sheet from Matthews Lanes to prepare its income statement, statement of changes in equity and a classified balance sheet (Assume the owner did not make any investments in the business this year.)

(Essay)

4.8/5  (45)

(45)

Cash and office supplies are both classified as current assets.

(True/False)

4.9/5  (34)

(34)

A company has current assets of $15,000 and current liabilities of $9,500. Its current ratio is 1.6.

(True/False)

4.9/5  (39)

(39)

All of the following statements regarding the Income Statement columns on the worksheet are except:

(Multiple Choice)

4.9/5  (39)

(39)

The last four steps in the accounting cycle include preparing the adjusted trial balance, preparing financial statements and recording closing and adjusting entries.

(True/False)

4.7/5  (41)

(41)

In the process of completing a work sheet, you determine that the Income Statement debit column totals $83,000, while the Income Statement credit column totals $65,000. To enter net income (or net loss) for the period into the work sheet would require an entry to

(Multiple Choice)

4.9/5  (32)

(32)

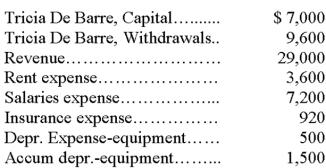

A company's ledger accounts and their end-of-period balances before closing entries are posted are shown below. What amount will be posted to Tricia DeBarre, Capital in the process of closing the Income Summary account? (Assume all accounts have normal balances.)

(Multiple Choice)

4.9/5  (46)

(46)

Showing 101 - 120 of 177

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)