Exam 3: Adjusting Accounts and Preparing Financial Statements

Exam 1: Accounting in Business245 Questions

Exam 2: Analyzing and Recording Transactions201 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements227 Questions

Exam 4: Completing the Accounting Cycle177 Questions

Exam 5: Accounting for Merchandising Operations189 Questions

Exam 6: Inventories and Cost of Sales194 Questions

Exam 7: Accounting Information Systems166 Questions

Exam 8: Cash and Internal Controls195 Questions

Exam 9: Accounting for Receivables162 Questions

Exam 10: Long-Term Assets208 Questions

Exam 11: Current Liabilities and Payroll Accounting178 Questions

Exam 12: Accounting for Partnerships141 Questions

Exam 13: Accounting for Corporations210 Questions

Exam 14: Long-Term Liabilities158 Questions

Exam 15: Investments and International Operations156 Questions

Exam 16: Statement of Cash Flows173 Questions

Exam 17: Analysis of Financial Statements182 Questions

Exam 18: Managerial Accounting Concepts and Principles199 Questions

Exam 19: Job Order Cost Accounting165 Questions

Exam 20: Process Cost Accounting172 Questions

Exam 21: Cost Allocation and Performance Measurement173 Questions

Exam 22: Cost-Volume-Profit Analysis190 Questions

Exam 23: Master Budgets and Planning166 Questions

Exam 24: Flexible Budgets and Standard Costs178 Questions

Exam 25: Capital Budgeting and Managerial Decisions153 Questions

Select questions type

A company purchased a new truck at a cost of $42,000 on July 1. The truck is estimated to have a useful life of 6 years and a residual value of $3,000. The company uses the straight-line method of depreciation. How much depreciation expense will be recorded for the truck during the first year ended December 31?

(Multiple Choice)

4.8/5  (38)

(38)

It is acceptable to record cash received in advance of providing products or services to revenue accounts.

(True/False)

4.8/5  (38)

(38)

Two main accounting principles used in accrual accounting are matching and full closure.

(True/False)

4.9/5  (34)

(34)

The balance in Tee Tax Services' office supplies account on February 1 and February 28 was $1,200 and $375, respectively. If the office supplies expense for the month is $1,900, what amount of office supplies was purchased during February?

(Multiple Choice)

4.8/5  (32)

(32)

A company's month-end adjusting entry for Insurance Expense is $1,000. If this entry is not made then expenses are understated by $1,000 and net income is overstated by $1,000.

(True/False)

4.9/5  (36)

(36)

If a prepaid expense account were not adjusted for the amount used, on the balance sheet assets would be ___________________ and equity would be __________________.

(Essay)

4.9/5  (34)

(34)

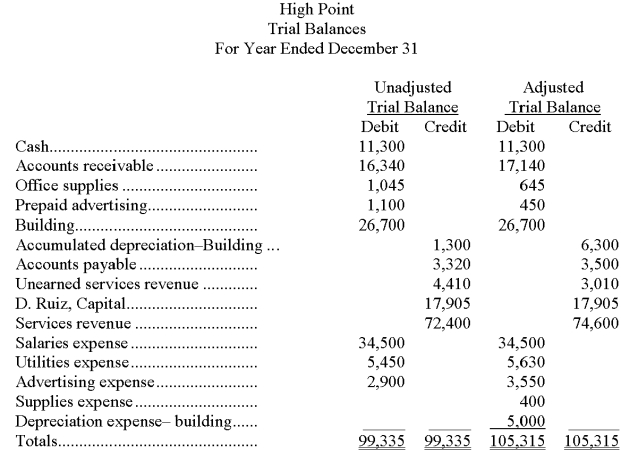

The following unadjusted and adjusted trial balances were taken from the current year's accounting system for High Point.

In general journal form, present the six adjusting entries that explain the changes in the account balances from the unadjusted to the adjusted trial balance.

(Essay)

4.9/5  (42)

(42)

A company had no office supplies available at the beginning of the year. During the year, the company purchased $250 worth of office supplies. On December 31, $75 worth of office supplies remained. How much should the company report as office supplies expense for the year?

(Multiple Choice)

4.8/5  (42)

(42)

The total amount of depreciation recorded against an asset or group of assets during the entire time the asset or assets have been owned:

(Multiple Choice)

4.7/5  (34)

(34)

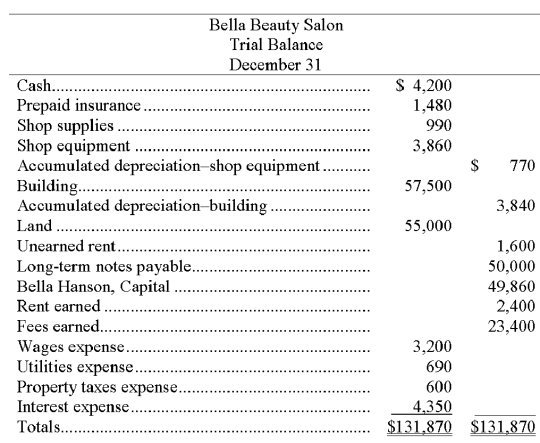

Based on the unadjusted trial balance for Bella's Beauty Salon and the adjusting information given below, prepare the adjusting journal entries for Bella's Beauty Salon.

Bella Beauty Salon's unadjusted trial balance for the current year follows:

Additional information:

a. An insurance policy examination showed $1,240 of expired insurance

b. An inventory count showed $210 of unused shop supplies still available.

c. Depreciation expense on shop equipment, $350.

d. Depreciation expense on the building, $2,220.

e. A beautician is behind on space rental payments, and this $200 of accrued revenues was unrecorded at the time the trial balance was prepared.

f. $800 of the Unearned Rent account balance was earned by year-end.

g. The one employee, a receptionist, works a five-day workweek at $50 per day. The employee was paid last week but has worked four days this week for which she has not been paid.

h. Three months' property taxes, totaling $450, have accrued. This additional amount of property taxes expense has not been recorded

i. One month's interest on the note payable, $600, has accrued but is unrecorded.

(Essay)

4.9/5  (43)

(43)

If throughout an accounting period the fees for legal services paid in advance by clients are recorded in an account called Unearned Legal Fees, the end-of-period adjusting entry to record the portion of those fees that has been earned is:

(Multiple Choice)

4.8/5  (43)

(43)

A company had $9,000,000 in net income for the year. Its net sales were $13,200,000 for the same period. Calculate its profit margin.

(Multiple Choice)

4.8/5  (31)

(31)

The accounting principle that requires revenue to be recorded when earned is the:

(Multiple Choice)

4.9/5  (36)

(36)

A company's Office Supplies account shows a beginning balance of $600 and an ending balance of $400. If office supplies expense for the year is $3,100, what amount of office supplies was purchased during the period?

(Multiple Choice)

4.7/5  (32)

(32)

A contra account is an account linked with another account; it is added to that account to show the proper amount for the item recorded in the associated account.

(True/False)

5.0/5  (39)

(39)

Earned but uncollected revenues are recorded during the adjusting process with a credit to a revenue and a debit to an expense.

(True/False)

4.8/5  (32)

(32)

Incurred but unpaid expenses that are recorded during the adjusting process with a debit to an expense and a credit to a liability are:

(Multiple Choice)

4.7/5  (27)

(27)

Barnes Company has 20 employees who are each paid $80 per day for a 5-day workweek. The employees are paid each Friday. This year the accounting period ends on Tuesday. Prepare the December 31 year-end adjusting journal entry Barnes Company should make to accrue wages.

(Essay)

4.8/5  (34)

(34)

Showing 41 - 60 of 227

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)