Exam 3: Adjusting Accounts and Preparing Financial Statements

Exam 1: Accounting in Business245 Questions

Exam 2: Analyzing and Recording Transactions201 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements227 Questions

Exam 4: Completing the Accounting Cycle177 Questions

Exam 5: Accounting for Merchandising Operations189 Questions

Exam 6: Inventories and Cost of Sales194 Questions

Exam 7: Accounting Information Systems166 Questions

Exam 8: Cash and Internal Controls195 Questions

Exam 9: Accounting for Receivables162 Questions

Exam 10: Long-Term Assets208 Questions

Exam 11: Current Liabilities and Payroll Accounting178 Questions

Exam 12: Accounting for Partnerships141 Questions

Exam 13: Accounting for Corporations210 Questions

Exam 14: Long-Term Liabilities158 Questions

Exam 15: Investments and International Operations156 Questions

Exam 16: Statement of Cash Flows173 Questions

Exam 17: Analysis of Financial Statements182 Questions

Exam 18: Managerial Accounting Concepts and Principles199 Questions

Exam 19: Job Order Cost Accounting165 Questions

Exam 20: Process Cost Accounting172 Questions

Exam 21: Cost Allocation and Performance Measurement173 Questions

Exam 22: Cost-Volume-Profit Analysis190 Questions

Exam 23: Master Budgets and Planning166 Questions

Exam 24: Flexible Budgets and Standard Costs178 Questions

Exam 25: Capital Budgeting and Managerial Decisions153 Questions

Select questions type

A company made no adjusting entry for accrued and unpaid employee wages of $28,000 on December 31. This oversight would:

(Multiple Choice)

4.9/5  (38)

(38)

A company earned $2,000 in net income for October. Its net sales for October were $10,000. Its profit margin is:

(Multiple Choice)

4.8/5  (36)

(36)

______________________ revenues are liabilities requiring delivery of products and for services.

(Essay)

4.8/5  (36)

(36)

Harrow Co. is a multi-million business. The business results for the year have been seriously impacted by a slowing economy. The company wants to improve its net income. It has incurred $2,500,000 in unpaid salaries at the end of the year and wants to leave those amounts unrecorded at the end of the year. (a) How would this omission affect the financial statements of Harrow? (b) Which accrual basis of accounting principles does this omission violate? (c) Would this be considered an ethical problem?

(Essay)

4.7/5  (37)

(37)

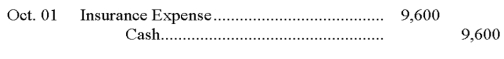

On October 1 of the current year, Morton Company paid $9,600 cash for a one-year insurance policy that took effect on that day. On the date of the payment, Morton recorded the following entry:

Prepare the required adjusting entry at December 31 of the current year.

(Essay)

4.8/5  (39)

(39)

Two accounting principles that are relied on in the adjusting process are:

(Multiple Choice)

4.8/5  (37)

(37)

What are the types of adjusting entries used for prepaid expenses, depreciation and unearned revenues?

(Essay)

4.8/5  (38)

(38)

Unearned revenue is reported in the financial statements as:

(Multiple Choice)

4.7/5  (35)

(35)

On January 1 a company purchased a five-year insurance policy for $1,800 with coverage starting immediately. If the purchase was recorded in the Prepaid Insurance account, and the company records adjustments only at year-end, the adjusting entry at the end of the first year is:

(Multiple Choice)

4.8/5  (42)

(42)

Under the alternative method for recording prepaid expenses, which is the correct set of journal entries?

(Multiple Choice)

4.7/5  (34)

(34)

The cash basis of accounting commonly results in financial statements that are less comparable from period to period than the accrual basis of accounting.

(True/False)

5.0/5  (34)

(34)

Before an adjusting entry is made to accrue employee salaries, Salaries Expense and Salaries Payable are both understated.

(True/False)

4.8/5  (31)

(31)

It is acceptable to record prepayment of expenses as debits to expense accounts.

(True/False)

4.8/5  (36)

(36)

An adjusting entry could be made for each of the following except:

(Multiple Choice)

4.9/5  (34)

(34)

Pfister Co. leases an office to a tenant at the rate of $5,000 per month. The tenant contacted Pfister and arranged to pay the rent for December on January 8 of the following year. Pfister agrees to this arrangement.

a.) Prepare the journal entry that Pfister must make at year ended December 31 to record the accrued rent revenue.

b.) Prepare the journal entry to record the receipt of the rent on January 8 of the following year.

(Essay)

4.8/5  (31)

(31)

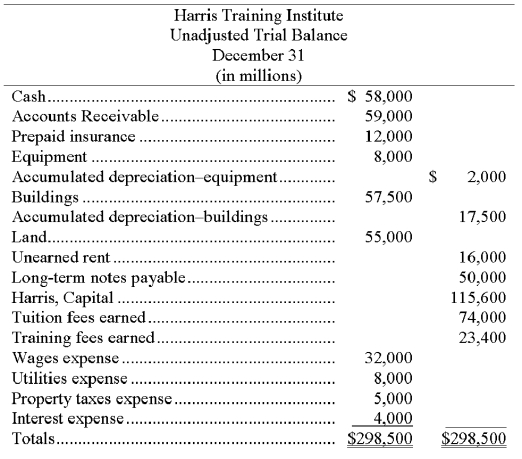

The unadjusted trial balance and the adjustment data for Harris Training Institute are given below along with adjusting entry information. If these adjustments are not recorded, what is the impact on net income? Show calculation for net income without the adjustments and net income with the adjustments. Which one gives the most accurate net income? What accounting principles are being violated if the adjustments are not made?

Additional information items:

a. The Prepaid Insurance account consists of a payment for a 1 year policy. An analysis of the insurance invoice indicates that one half of the policy has expired by the end of the December 31 year-end.

b. A cash payment for space sublet for 8 months was received on July 1 and was credited to Unearned Rent.

c. Accrued interest expense on the note payable of $1,000 has been incurred but not paid.

(Essay)

4.8/5  (32)

(32)

A fiscal year refers to an organization's accounting period that spans twelve consecutive months or 52 weeks.

(True/False)

4.8/5  (33)

(33)

Showing 181 - 200 of 227

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)