Exam 4: Further Development and Analysis of the Classical Linear Regression Model

Exam 1: Introduction12 Questions

Exam 2: Mathematical and Statistical Foundations9 Questions

Exam 3: A Brief Overview of the Classical Linear Regression Model28 Questions

Exam 4: Further Development and Analysis of the Classical Linear Regression Model25 Questions

Exam 5: Classical Linear Regression Model Assumptions and Diagnostic Tests20 Questions

Exam 6: Univariate Time Series Modelling and Forecasting29 Questions

Exam 7: Multivariate Models30 Questions

Exam 8: Modelling Long-Run Relationships in Finance18 Questions

Exam 9: Modelling Volatility and Correlation22 Questions

Exam 10: Switching Models19 Questions

Exam 11: Panel Data and Limited Dependent Variable Models12 Questions

Select questions type

Which of the following is a correct interpretation of a "95% confidence interval" for a regression parameter?

Free

(Multiple Choice)

4.8/5  (33)

(33)

Correct Answer:

A

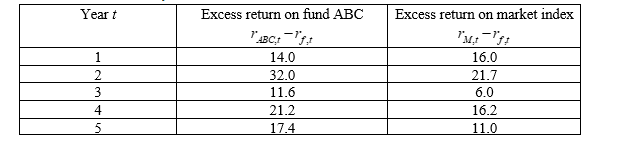

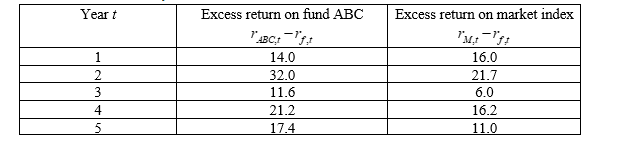

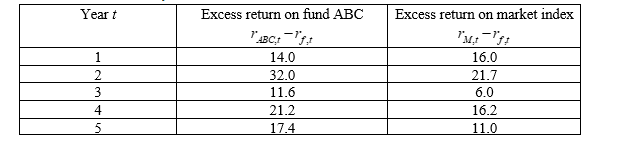

Suppose you have 5-year annual data on the excess returns on a fund manager’s portfolio (“fund ABC”) and the excess returns on a market index (where  is the return on fund ABC,

is the return on fund ABC,  is the risk-free rate and

is the risk-free rate and  is the return on the market index):

is the return on the market index):

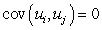

-What is the most appropriate interpretation of the assumption concerning the regression disturbance terms?

-What is the most appropriate interpretation of the assumption concerning the regression disturbance terms?

Free

(Multiple Choice)

4.7/5  (35)

(35)

Correct Answer:

D

Which of the following is the most accurate definition of the term "the OLS estimator"?

Free

(Multiple Choice)

4.8/5  (25)

(25)

Correct Answer:

B

Consider an increase in the size of the test used to examine a hypothesis from 5% to 10%. Which one of the following would be an implication?

(Multiple Choice)

4.8/5  (37)

(37)

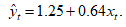

Suppose you have calculated the following regression results:

The standard errors of

The standard errors of  1.22 and 0.58, respectively

-Using the test of significance approach, what is the test statistic value of

1.22 and 0.58, respectively

-Using the test of significance approach, what is the test statistic value of  a hypothesis to test whether the true value ofstatistically different from zero?

a hypothesis to test whether the true value ofstatistically different from zero?

(Multiple Choice)

4.8/5  (42)

(42)

What does a positive linear relationship between x and y in a simple regression imply?

(Multiple Choice)

4.9/5  (35)

(35)

Which of the following statements is correct concerning the conditions required for OLS to be a usable estimation technique?

(Multiple Choice)

4.8/5  (46)

(46)

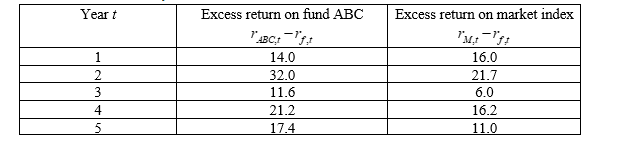

Suppose you have 5-year annual data on the excess returns on a fund manager’s portfolio (“fund ABC”) and the excess returns on a market index (where  is the return on fund ABC,

is the return on fund ABC,  is the risk-free rate and

is the risk-free rate and  is the return on the market index):

is the return on the market index):

-The estimated alpha (

-The estimated alpha (  ) and beta (

) and beta (  ) of a rival fund, Fund DEF, are 2.3 and 3.1, respectively. If the expected market risk premium is 12%, what would we expect the excess return of Fund DEF to be?

) of a rival fund, Fund DEF, are 2.3 and 3.1, respectively. If the expected market risk premium is 12%, what would we expect the excess return of Fund DEF to be?

(Multiple Choice)

4.9/5  (40)

(40)

Regression is concerned with describing and evaluating the relationship between

(Multiple Choice)

4.9/5  (33)

(33)

The type I error associated with testing a hypothesis is equal to

(Multiple Choice)

4.9/5  (29)

(29)

What is the relationship, if any, between the normal and t-distributions?

(Multiple Choice)

4.7/5  (42)

(42)

Which of the following is NOT correct with regard to the p-value attached to a test statistic?

(Multiple Choice)

4.9/5  (39)

(39)

Assuming there are 1000 observations in your sample, what are the test statistic and critical value of a two-sided hypothesis test of whether the true value of  statistically different from zero be given a 5% significance level?

statistically different from zero be given a 5% significance level?

(Multiple Choice)

4.8/5  (30)

(30)

The method of estimating econometric models which involves fitting a line to the data by minimising the sum of squared residuals is the

(Multiple Choice)

4.9/5  (44)

(44)

Which of these is not a standard method for estimating econometric models?

(Multiple Choice)

4.8/5  (33)

(33)

Which of these is not a reason for adding a disturbance term to a regression model ?

(Multiple Choice)

4.9/5  (40)

(40)

Suppose you have 5-year annual data on the excess returns on a fund manager’s portfolio (“fund ABC”) and the excess returns on a market index (where  is the return on fund ABC,

is the return on fund ABC,  is the risk-free rate and

is the risk-free rate and  is the return on the market index):

is the return on the market index):

-Suppose that the unbiased estimator of the standard deviation of the disturbance (s) is 5.1. What is the nearest value to the standard errors of the estimated CAPM alpha (

-Suppose that the unbiased estimator of the standard deviation of the disturbance (s) is 5.1. What is the nearest value to the standard errors of the estimated CAPM alpha (  ) of Fund ABC from question 6?

) of Fund ABC from question 6?

(Multiple Choice)

4.9/5  (34)

(34)

Which of the following is NOT a good reason for including a disturbance term in a regression equation?

(Multiple Choice)

4.7/5  (40)

(40)

Suppose you have 5-year annual data on the excess returns on a fund manager’s portfolio (“fund ABC”) and the excess returns on a market index (where  is the return on fund ABC,

is the return on fund ABC,  is the risk-free rate and

is the risk-free rate and  is the return on the market index):

is the return on the market index):

-The estimators

-The estimators  and

and  determined by OLS will be the Best Linear Unbiased Estimators (BLUE) if which of the following assumptions hold?

(I) The errors have zero mean

(II) The variance of the errors is constant and finite over all values of the independent variable(s)

(III) The errors are linearly independent of one another

(IV)There is no relationship between the error and corresponding independent variables

determined by OLS will be the Best Linear Unbiased Estimators (BLUE) if which of the following assumptions hold?

(I) The errors have zero mean

(II) The variance of the errors is constant and finite over all values of the independent variable(s)

(III) The errors are linearly independent of one another

(IV)There is no relationship between the error and corresponding independent variables

(Multiple Choice)

4.9/5  (32)

(32)

In a time series regression of the excess return of a mutual fund on a constant and the excess return on a market index, which of the following statements should be true for the fund manager to be considered to have "beaten the market" in a statistical sense?

(Multiple Choice)

4.8/5  (32)

(32)

Showing 1 - 20 of 25

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)