Exam 17: Decision-Making Tools

Exam 1: Operations and Productivity138 Questions

Exam 2: Operations Strategy in a Global Environment134 Questions

Exam 3: Project Management131 Questions

Exam 4: Forecasting148 Questions

Exam 5: Design of Goods and Services126 Questions

Exam 6: Managing Quality226 Questions

Exam 7: Process Strategies259 Questions

Exam 8: Location Strategies233 Questions

Exam 9: Human Resources, Job Design, and Work Measurement321 Questions

Exam 10: Supply Chain Management158 Questions

Exam 11: Inventory Management230 Questions

Exam 12: Aggregate Planning and Sop122 Questions

Exam 13: Material Requirements Planning Mrp and Erp133 Questions

Exam 14: Short-Term Scheduling124 Questions

Exam 15: Lean Operations122 Questions

Exam 16: Maintenance and Reliability119 Questions

Exam 17: Decision-Making Tools101 Questions

Exam 18: Linear Programming102 Questions

Exam 19: Transportation Models92 Questions

Exam 20: Waiting-Line Models126 Questions

Exam 21: Learning Curves114 Questions

Exam 22: Simulation78 Questions

Exam 23: Applying Analytics to Big Data in Operations Management61 Questions

Select questions type

A retailer is deciding how many units of a certain product to stock. The historical probability distribution of sales for this product is 0 units, 0.2; 1 unit, 0.3; 2 units, 0.4, and 3 units, 0.1. The product costs $8 per unit and sells for $33 per unit. What is the largest conditional value (profit) in the entire payoff table for this scenario?

(Multiple Choice)

4.8/5  (37)

(37)

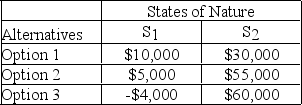

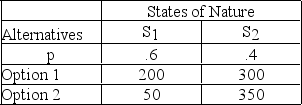

For the following decision table, the highest value for the equally likely criterion is ________; this occurs with alternative ________.

(Multiple Choice)

4.8/5  (41)

(41)

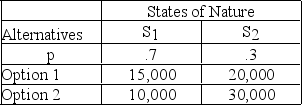

What is the EMV for Option 1 in the following decision table?

(Multiple Choice)

4.9/5  (35)

(35)

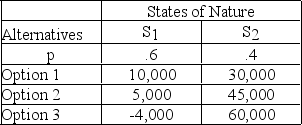

What is the EMV for Option 1 in the following decision table?

(Multiple Choice)

4.9/5  (38)

(38)

Decision trees and decision tables can both solve problems requiring a single decision, but decision trees are the preferred method when a sequence of decisions is involved.

(True/False)

4.7/5  (22)

(22)

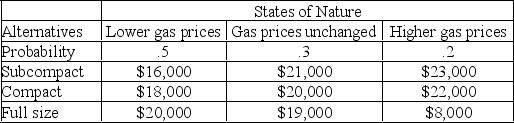

Miles is considering buying a new pickup truck for his lawn service firm. The economy in town seems to be growing, and he is wondering whether he should opt for a subcompact, compact, or full-size pickup truck. The smaller truck would have better fuel economy, but would sacrifice capacity and some durability. A friend at the Bureau of Economic Research told him that there is a 50% chance of lower gas prices in his area this year, a 20% chance of higher gas prices, and a 30% chance that gas prices will stay roughly unchanged. Based on this information, Miles has developed a decision table that indicates the profit amount he would end up with after a year for each combination of truck and gas prices.

Calculate the expected monetary value for each decision alternative. Which decision yields the highest EMV?

Calculate the expected monetary value for each decision alternative. Which decision yields the highest EMV?

(Essay)

4.7/5  (30)

(30)

Expected monetary value is most appropriate for problem solving that takes place:

(Multiple Choice)

4.9/5  (29)

(29)

Suppose a manufacturing plant is considering three options for expansion. The first one is to expand into a new plant (large), the second to add on third-shift to the daily schedule (medium), and the third to do nothing (small). There are three possibilities for demand. These are high, medium, and low with each having an equal likelihood of occurring. Suppose that the profits for the expansion plans are as follows (respective to high, medium, low demand). The large expansion profits are $100000, $10000, -$10000, the medium expansion choice $40000, $40000, $5000 and the small expansion choice $15000, $15000, $15000. Calculate the EMV of each choice. Which of the expansion plans should the manager choose?

(Essay)

4.8/5  (36)

(36)

The expected value of perfect information is the same as the expected value with perfect information.

(True/False)

4.9/5  (46)

(46)

A plant manager wants to know how much she should be willing to pay for perfect market research. Currently there are two states of nature facing her decision to expand or do nothing. Under favorable market conditions the manager would make $100,000 for the large plant and $5,000 for the small plant. Under unfavorable market conditions the large plant would lose $80,000 and the small plant would make $0. If the two states of nature are equally likely, how much should she pay for perfect information?

(Multiple Choice)

4.9/5  (41)

(41)

What is the expected value of perfect information of the following decision table?

(Multiple Choice)

5.0/5  (37)

(37)

The last step in the analytic decision process is to select the best alternative.

(True/False)

4.8/5  (35)

(35)

The expected monetary value of a decision alternative is the sum of all possible payoffs from the alternative, each weighted by the probability of that payoff occurring.

(True/False)

4.8/5  (32)

(32)

Showing 41 - 60 of 101

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)