Exam 16: Time-Series Forecasting

Exam 1: Introduction145 Questions

Exam 2: Organizing and Visualizing Data210 Questions

Exam 3: Numerical Descriptive Measures153 Questions

Exam 4: Basic Probability171 Questions

Exam 5: Discrete Probability Distributions218 Questions

Exam 6: The Normal Distribution and Other Continuous Distributions191 Questions

Exam 7: Sampling and Sampling Distributions197 Questions

Exam 8: Confidence Interval Estimation196 Questions

Exam 9: Fundamentals of Hypothesis Testing: One-Sample Tests165 Questions

Exam 10: Two-Sample Tests210 Questions

Exam 11: Analysis of Variance213 Questions

Exam 12: Chi-Square Tests and Nonparametric Tests201 Questions

Exam 13: Simple Linear Regression213 Questions

Exam 14: Introduction to Multiple Regression355 Questions

Exam 15: Multiple Regression Model Building96 Questions

Exam 16: Time-Series Forecasting168 Questions

Exam 17: Statistical Applications in Quality Management133 Questions

Exam 18: A Roadmap for Analyzing Data54 Questions

Select questions type

TABLE 16-13

Given below is the monthly time-series data for U.S. retail sales of building materials over a specific year.

Month Retail Sales 1 6,594 2 6,610 3 8,174 4 9,513 5 10,595 6 10,415 7 9,949 8 9,810 9 9,637 10 9,732 11 9,214 12 9,201

The results of the linear trend, quadratic trend, exponential trend, first-order autoregressive, second-order autoregressive and third-order autoregressive model are presented below in which the coded month for the first month is 0:

Coefficients Standard Error t Stat P-value Intercept 7950.7564 617.6342 12.8729 0.0000 Coded Month 212.6503 95.1145 2.2357 0.0494

Quadratic trend model:

Coefficients Standard Error t Stat P-value Intercept 6358.2473 417.2692 15.2378 0.0000 Coded Month 1168.1558 176.3526 6.6240 0.0001 Coded Month 2 -86.8641 15.4474 -5.6232 0.0003

Exponential trend model:

Coefficients Standard Error t Stat P-value Intercept 3.8912 0.0315 123.3674 0.0000 Coded Month 0.0116 0.0049 2.3957 0.0376

Coefficients Standard Error t Stat P-value Intercept 3132.0951 1287.2899 2.4331 0.0378 YLag1 0.6823 0.1398 4.8812 0.0009

Second-order autoregressive::

Coefficients Standard Error t Stat P -value Intercept 4968.5789 766.9416 6.4784 0.0003 YLag1 0.9333 0.1547 6.0316 0.0005 YLag2 -0.4487 0.1238 -3.6235 0.0085

Third-order autoregressive::

Coefficients Standard Error t Stat P-value Intercept 6782.7567 2105.7115 3.2211 0.0234 YLag1 0.5481 0.3918 1.3990 0.2207 YLag2 0.0198 0.4034 0.0490 0.9628 YLag3 -0.2749 0.2234 -1.2308 0.2731

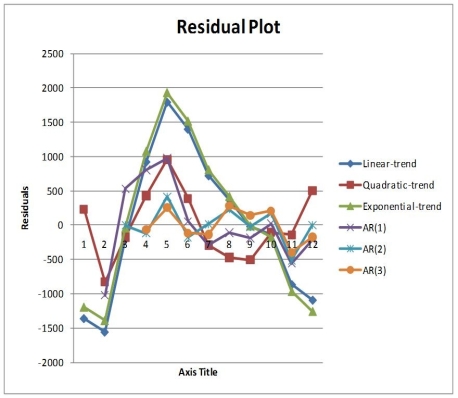

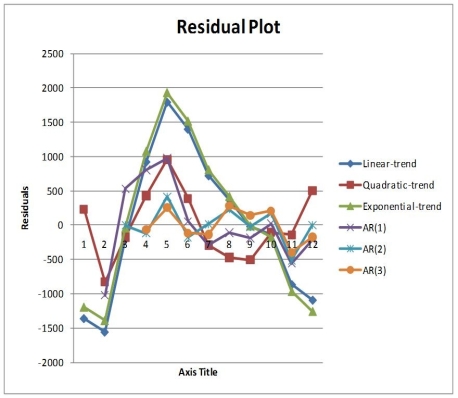

Below is the residual plot of the various models:

-Referring to Table 16-13, what is your forecast for the 13ᵗʰ month using the first-order autoregressive model?

-Referring to Table 16-13, what is your forecast for the 13ᵗʰ month using the first-order autoregressive model?

(Short Answer)

4.9/5  (39)

(39)

Which of the following statements about the method of exponential smoothing is not true?

(Multiple Choice)

4.8/5  (41)

(41)

TABLE 16-13

Given below is the monthly time-series data for U.S. retail sales of building materials over a specific year.

Month Retail Sales 1 6,594 2 6,610 3 8,174 4 9,513 5 10,595 6 10,415 7 9,949 8 9,810 9 9,637 10 9,732 11 9,214 12 9,201

The results of the linear trend, quadratic trend, exponential trend, first-order autoregressive, second-order autoregressive and third-order autoregressive model are presented below in which the coded month for the first month is 0:

Coefficients Standard Error t Stat P-value Intercept 7950.7564 617.6342 12.8729 0.0000 Coded Month 212.6503 95.1145 2.2357 0.0494

Quadratic trend model:

Coefficients Standard Error t Stat P-value Intercept 6358.2473 417.2692 15.2378 0.0000 Coded Month 1168.1558 176.3526 6.6240 0.0001 Coded Month 2 -86.8641 15.4474 -5.6232 0.0003

Exponential trend model:

Coefficients Standard Error t Stat P-value Intercept 3.8912 0.0315 123.3674 0.0000 Coded Month 0.0116 0.0049 2.3957 0.0376

Coefficients Standard Error t Stat P-value Intercept 3132.0951 1287.2899 2.4331 0.0378 YLag1 0.6823 0.1398 4.8812 0.0009

Second-order autoregressive::

Coefficients Standard Error t Stat P -value Intercept 4968.5789 766.9416 6.4784 0.0003 YLag1 0.9333 0.1547 6.0316 0.0005 YLag2 -0.4487 0.1238 -3.6235 0.0085

Third-order autoregressive::

Coefficients Standard Error t Stat P-value Intercept 6782.7567 2105.7115 3.2211 0.0234 YLag1 0.5481 0.3918 1.3990 0.2207 YLag2 0.0198 0.4034 0.0490 0.9628 YLag3 -0.2749 0.2234 -1.2308 0.2731

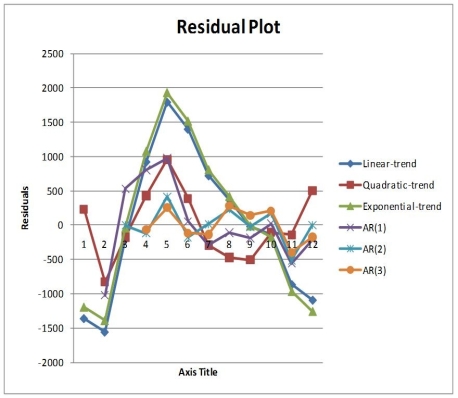

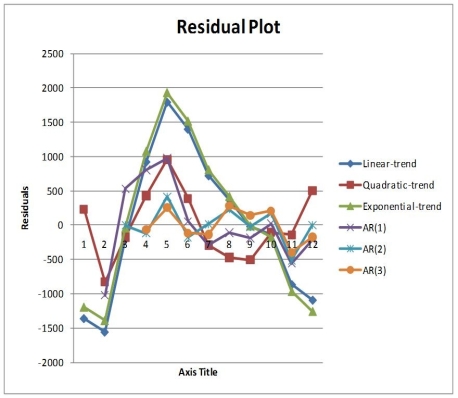

Below is the residual plot of the various models:

-Referring to Table 16-13, what is your forecast for the 13ᵗʰ month using the linear-trend model?

-Referring to Table 16-13, what is your forecast for the 13ᵗʰ month using the linear-trend model?

(Short Answer)

4.7/5  (36)

(36)

TABLE 16-13

Given below is the monthly time-series data for U.S. retail sales of building materials over a specific year.

Month Retail Sales 1 6,594 2 6,610 3 8,174 4 9,513 5 10,595 6 10,415 7 9,949 8 9,810 9 9,637 10 9,732 11 9,214 12 9,201

The results of the linear trend, quadratic trend, exponential trend, first-order autoregressive, second-order autoregressive and third-order autoregressive model are presented below in which the coded month for the first month is 0:

Coefficients Standard Error t Stat P-value Intercept 7950.7564 617.6342 12.8729 0.0000 Coded Month 212.6503 95.1145 2.2357 0.0494

Quadratic trend model:

Coefficients Standard Error t Stat P-value Intercept 6358.2473 417.2692 15.2378 0.0000 Coded Month 1168.1558 176.3526 6.6240 0.0001 Coded Month 2 -86.8641 15.4474 -5.6232 0.0003

Exponential trend model:

Coefficients Standard Error t Stat P-value Intercept 3.8912 0.0315 123.3674 0.0000 Coded Month 0.0116 0.0049 2.3957 0.0376

Coefficients Standard Error t Stat P-value Intercept 3132.0951 1287.2899 2.4331 0.0378 YLag1 0.6823 0.1398 4.8812 0.0009

Second-order autoregressive::

Coefficients Standard Error t Stat P -value Intercept 4968.5789 766.9416 6.4784 0.0003 YLag1 0.9333 0.1547 6.0316 0.0005 YLag2 -0.4487 0.1238 -3.6235 0.0085

Third-order autoregressive::

Coefficients Standard Error t Stat P-value Intercept 6782.7567 2105.7115 3.2211 0.0234 YLag1 0.5481 0.3918 1.3990 0.2207 YLag2 0.0198 0.4034 0.0490 0.9628 YLag3 -0.2749 0.2234 -1.2308 0.2731

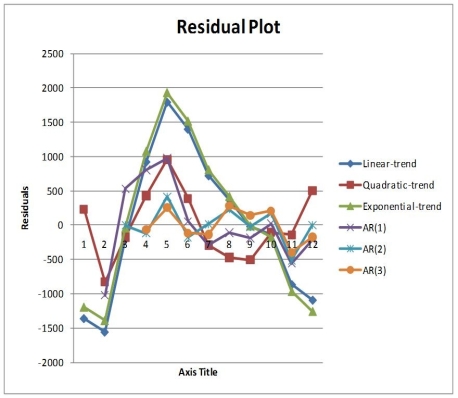

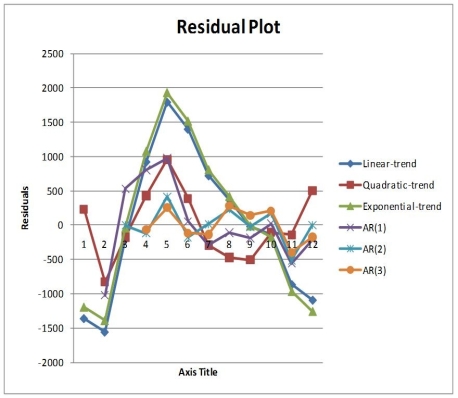

Below is the residual plot of the various models:

-Referring to Table 16-13, what is the exponentially smoothed value for the first month using a smoothing coefficient of W = 0.5?

-Referring to Table 16-13, what is the exponentially smoothed value for the first month using a smoothing coefficient of W = 0.5?

(Short Answer)

4.9/5  (39)

(39)

TABLE 16-1

The number of cases of chardonnay wine sold by a Paso Robles winery in an 8-year period follows. Year Cases of Wine 2003 270 2004 356 2005 398 2006 456 2007 438 2008 478 2009 460 2010 480

-Referring to Table 16-1, set up a scatter diagram (i.e., a time-series plot)with year on the horizontal X-axis.

(Essay)

4.9/5  (31)

(31)

TABLE 16-4

The number of cases of merlot wine sold by a Paso Robles winery in an 8-year period follows.

Year Cases of Wine 2003 270 2004 356 2005 398 2006 456 2007 358 2008 500 2009 410 2010 376

-Referring to Table 16-4, exponential smoothing with a weight or smoothing constant of 0.4 will be used to forecast wine sales. The forecast for 2011 is ________.

(Short Answer)

4.8/5  (37)

(37)

TABLE 16-5

The number of passengers arriving at San Francisco on the Amtrak cross-country express on 6 successive Mondays were: 60, 72, 96, 84, 36, and 48.

-Referring to Table 16-5, the number of arrivals will be smoothed with a 5-term moving average. The first smoothed value will be ________.

(Short Answer)

4.8/5  (30)

(30)

TABLE 16-2

The monthly advertising expenditures of a department store chain (in $1,000,000s) were collected over the last decade. The last 14 months of this time series follows:

-Referring to Table 16-2, set up a scatter plot (i.e., time-series plot)with months on the horizontal X-axis.

(Essay)

4.8/5  (34)

(34)

TABLE 16-4

The number of cases of merlot wine sold by a Paso Robles winery in an 8-year period follows.

Year Cases of Wine 2003 270 2004 356 2005 398 2006 456 2007 358 2008 500 2009 410 2010 376

-Referring to Table 16-4, exponentially smooth the wine sales with a weight or smoothing constant of 0.4.

(Essay)

4.8/5  (35)

(35)

Which of the following statements about moving averages is not true?

(Multiple Choice)

4.8/5  (34)

(34)

TABLE 16-12

A local store developed a multiplicative time-series model to forecast its revenues in future quarters, using quarterly data on its revenues during the 4-year period from 2005 to 2009. The following is the resulting regression equation:

log₁₀ = 6.102 + 0.012 X - 0.129 Q₁ - 0.054 Q₂ + 0.098 Q₃

where is the estimated number of contracts in a quarter.

X is the coded quarterly value with X = 0 in the first quarter of 2005.

Q₁ is a dummy variable equal to 1 in the first quarter of a year and 0 otherwise.

Q₂ is a dummy variable equal to 1 in the second quarter of a year and 0 otherwise.

Q₃ is a dummy variable equal to 1 in the third quarter of a year and 0 otherwise.

-Referring to Table 16-12, to obtain a forecast for the first quarter of 2009 using the model, which of the following sets of values should be used in the regression equation?

(Multiple Choice)

4.9/5  (33)

(33)

TABLE 16-3

The following table contains the number of complaints received in a department store for the first 6 months of last year.

Month Complaints January 36 February 45 March 81 April 90 May 108 June 144

-Referring to Table 16-3, if a three-month moving average is used to smooth this series, what would be the second calculated value?

(Multiple Choice)

4.7/5  (40)

(40)

TABLE 16-13

Given below is the monthly time-series data for U.S. retail sales of building materials over a specific year.

Month Retail Sales 1 6,594 2 6,610 3 8,174 4 9,513 5 10,595 6 10,415 7 9,949 8 9,810 9 9,637 10 9,732 11 9,214 12 9,201

The results of the linear trend, quadratic trend, exponential trend, first-order autoregressive, second-order autoregressive and third-order autoregressive model are presented below in which the coded month for the first month is 0:

Coefficients Standard Error t Stat P-value Intercept 7950.7564 617.6342 12.8729 0.0000 Coded Month 212.6503 95.1145 2.2357 0.0494

Quadratic trend model:

Coefficients Standard Error t Stat P-value Intercept 6358.2473 417.2692 15.2378 0.0000 Coded Month 1168.1558 176.3526 6.6240 0.0001 Coded Month 2 -86.8641 15.4474 -5.6232 0.0003

Exponential trend model:

Coefficients Standard Error t Stat P-value Intercept 3.8912 0.0315 123.3674 0.0000 Coded Month 0.0116 0.0049 2.3957 0.0376

Coefficients Standard Error t Stat P-value Intercept 3132.0951 1287.2899 2.4331 0.0378 YLag1 0.6823 0.1398 4.8812 0.0009

Second-order autoregressive::

Coefficients Standard Error t Stat P -value Intercept 4968.5789 766.9416 6.4784 0.0003 YLag1 0.9333 0.1547 6.0316 0.0005 YLag2 -0.4487 0.1238 -3.6235 0.0085

Third-order autoregressive::

Coefficients Standard Error t Stat P-value Intercept 6782.7567 2105.7115 3.2211 0.0234 YLag1 0.5481 0.3918 1.3990 0.2207 YLag2 0.0198 0.4034 0.0490 0.9628 YLag3 -0.2749 0.2234 -1.2308 0.2731

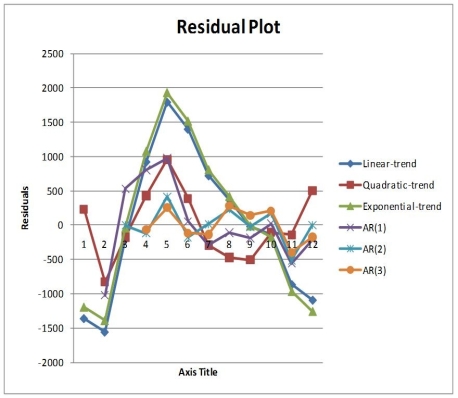

Below is the residual plot of the various models:

-Referring to Table 16-13, what is the exponentially smoothed value for the 12ᵗʰ month using a smoothing coefficient of W = 0.5 if the exponentially smooth value for the 10ᵗʰ and 11ᵗʰ month are 9,746.3672 and 9,480.1836, respectively?

-Referring to Table 16-13, what is the exponentially smoothed value for the 12ᵗʰ month using a smoothing coefficient of W = 0.5 if the exponentially smooth value for the 10ᵗʰ and 11ᵗʰ month are 9,746.3672 and 9,480.1836, respectively?

(Short Answer)

4.9/5  (38)

(38)

TABLE 16-7

The executive vice-president of a drug manufacturing firm believes that the demand for the firm's most popular drug has been evidencing an exponential trend since 1995. She uses Microsoft Excel to obtain the partial output below. The dependent variable is the log base 10 of the demand for the drug, while the independent variable is years, where 1995 is coded as 0, 1996 is coded as 1, etc.

SUMMARY OUTPUT

Regression Statistics Multiple R 0.996 R Square 0.992 Adjusted R Square 0.991 Standard Error 0.02831 Observations 12 Coefficients Intercept 1.44 Coded Year 0.068

-Referring to Table 16-7, the fitted exponential trend equation to predict Y is ________.

(Short Answer)

4.8/5  (38)

(38)

TABLE 16-13

Given below is the monthly time-series data for U.S. retail sales of building materials over a specific year.

Month Retail Sales 1 6,594 2 6,610 3 8,174 4 9,513 5 10,595 6 10,415 7 9,949 8 9,810 9 9,637 10 9,732 11 9,214 12 9,201

The results of the linear trend, quadratic trend, exponential trend, first-order autoregressive, second-order autoregressive and third-order autoregressive model are presented below in which the coded month for the first month is 0:

Coefficients Standard Error t Stat P-value Intercept 7950.7564 617.6342 12.8729 0.0000 Coded Month 212.6503 95.1145 2.2357 0.0494

Quadratic trend model:

Coefficients Standard Error t Stat P-value Intercept 6358.2473 417.2692 15.2378 0.0000 Coded Month 1168.1558 176.3526 6.6240 0.0001 Coded Month 2 -86.8641 15.4474 -5.6232 0.0003

Exponential trend model:

Coefficients Standard Error t Stat P-value Intercept 3.8912 0.0315 123.3674 0.0000 Coded Month 0.0116 0.0049 2.3957 0.0376

Coefficients Standard Error t Stat P-value Intercept 3132.0951 1287.2899 2.4331 0.0378 YLag1 0.6823 0.1398 4.8812 0.0009

Second-order autoregressive::

Coefficients Standard Error t Stat P -value Intercept 4968.5789 766.9416 6.4784 0.0003 YLag1 0.9333 0.1547 6.0316 0.0005 YLag2 -0.4487 0.1238 -3.6235 0.0085

Third-order autoregressive::

Coefficients Standard Error t Stat P-value Intercept 6782.7567 2105.7115 3.2211 0.0234 YLag1 0.5481 0.3918 1.3990 0.2207 YLag2 0.0198 0.4034 0.0490 0.9628 YLag3 -0.2749 0.2234 -1.2308 0.2731

Below is the residual plot of the various models:

-Referring to Table 16-13, what is the exponentially smoothed value for the second month using a smoothing coefficient of W = 0.25?

-Referring to Table 16-13, what is the exponentially smoothed value for the second month using a smoothing coefficient of W = 0.25?

(Short Answer)

4.7/5  (34)

(34)

TABLE 16-8

The manager of a marketing consulting firm has been examining his company's yearly profits. He believes that these profits have been showing a quadratic trend since 1990. He uses Microsoft Excel to obtain the partial output below. The dependent variable is profit (in thousands of dollars), while the independent variables are coded years and squared of coded years, where 1990 is coded as 0, 1991 is coded as 1, etc. SUMMARY OUTPUT

Regression Statistics

Multiple R 0.998 R Square 0.996 Adjusted R Square 0.996 Standard Error 4.996 Observations 17

Coefficients Intercept 35.5 Coded Year 0.45 Year Squared 1.00

-Referring to Table 16-8, the fitted value for 1990 is ________.

(Short Answer)

4.9/5  (31)

(31)

The annual multiplicative time-series model does not possess ________ component.

(Multiple Choice)

4.9/5  (37)

(37)

TABLE 16-13

Given below is the monthly time-series data for U.S. retail sales of building materials over a specific year.

Month Retail Sales 1 6,594 2 6,610 3 8,174 4 9,513 5 10,595 6 10,415 7 9,949 8 9,810 9 9,637 10 9,732 11 9,214 12 9,201

The results of the linear trend, quadratic trend, exponential trend, first-order autoregressive, second-order autoregressive and third-order autoregressive model are presented below in which the coded month for the first month is 0:

Coefficients Standard Error t Stat P-value Intercept 7950.7564 617.6342 12.8729 0.0000 Coded Month 212.6503 95.1145 2.2357 0.0494

Quadratic trend model:

Coefficients Standard Error t Stat P-value Intercept 6358.2473 417.2692 15.2378 0.0000 Coded Month 1168.1558 176.3526 6.6240 0.0001 Coded Month 2 -86.8641 15.4474 -5.6232 0.0003

Exponential trend model:

Coefficients Standard Error t Stat P-value Intercept 3.8912 0.0315 123.3674 0.0000 Coded Month 0.0116 0.0049 2.3957 0.0376

Coefficients Standard Error t Stat P-value Intercept 3132.0951 1287.2899 2.4331 0.0378 YLag1 0.6823 0.1398 4.8812 0.0009

Second-order autoregressive::

Coefficients Standard Error t Stat P -value Intercept 4968.5789 766.9416 6.4784 0.0003 YLag1 0.9333 0.1547 6.0316 0.0005 YLag2 -0.4487 0.1238 -3.6235 0.0085

Third-order autoregressive::

Coefficients Standard Error t Stat P-value Intercept 6782.7567 2105.7115 3.2211 0.0234 YLag1 0.5481 0.3918 1.3990 0.2207 YLag2 0.0198 0.4034 0.0490 0.9628 YLag3 -0.2749 0.2234 -1.2308 0.2731

Below is the residual plot of the various models:

-Referring to Table 16-13, what is your forecast for the 13ᵗʰ month using the second-order autoregressive model?

-Referring to Table 16-13, what is your forecast for the 13ᵗʰ month using the second-order autoregressive model?

(Short Answer)

4.9/5  (44)

(44)

A second-order autoregressive model for average mortgage rate is:

Rateᵢ = - 2.0 + 1.8(Rate)ᵢ₋₁ - 0.5 (Rate)ᵢ₋₂.

If the average mortgage rate in 2010 was 7.0, and in 2009 was 6.4, the forecast for 2011 is ________.

(Short Answer)

4.9/5  (33)

(33)

TABLE 16-13

Given below is the monthly time-series data for U.S. retail sales of building materials over a specific year.

Month Retail Sales 1 6,594 2 6,610 3 8,174 4 9,513 5 10,595 6 10,415 7 9,949 8 9,810 9 9,637 10 9,732 11 9,214 12 9,201

The results of the linear trend, quadratic trend, exponential trend, first-order autoregressive, second-order autoregressive and third-order autoregressive model are presented below in which the coded month for the first month is 0:

Coefficients Standard Error t Stat P-value Intercept 7950.7564 617.6342 12.8729 0.0000 Coded Month 212.6503 95.1145 2.2357 0.0494

Quadratic trend model:

Coefficients Standard Error t Stat P-value Intercept 6358.2473 417.2692 15.2378 0.0000 Coded Month 1168.1558 176.3526 6.6240 0.0001 Coded Month 2 -86.8641 15.4474 -5.6232 0.0003

Exponential trend model:

Coefficients Standard Error t Stat P-value Intercept 3.8912 0.0315 123.3674 0.0000 Coded Month 0.0116 0.0049 2.3957 0.0376

Coefficients Standard Error t Stat P-value Intercept 3132.0951 1287.2899 2.4331 0.0378 YLag1 0.6823 0.1398 4.8812 0.0009

Second-order autoregressive::

Coefficients Standard Error t Stat P -value Intercept 4968.5789 766.9416 6.4784 0.0003 YLag1 0.9333 0.1547 6.0316 0.0005 YLag2 -0.4487 0.1238 -3.6235 0.0085

Third-order autoregressive::

Coefficients Standard Error t Stat P-value Intercept 6782.7567 2105.7115 3.2211 0.0234 YLag1 0.5481 0.3918 1.3990 0.2207 YLag2 0.0198 0.4034 0.0490 0.9628 YLag3 -0.2749 0.2234 -1.2308 0.2731

Below is the residual plot of the various models:

-Referring to Table 16-13, you can reject the null hypothesis for testing the appropriateness of the third-order autoregressive model at the 5% level of significance.

-Referring to Table 16-13, you can reject the null hypothesis for testing the appropriateness of the third-order autoregressive model at the 5% level of significance.

(True/False)

4.8/5  (34)

(34)

Showing 121 - 140 of 168

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)