Exam 18: Public Choice, Taxes, and the Distribution of Income

Exam 1: Economics: Foundations and Models444 Questions

Exam 2: Trade-Offs, Comparative Advantage, and the Market System498 Questions

Exam 3: Where Prices Come From: the Interaction of Demand and Supply475 Questions

Exam 4: Economic Efficiency, Government Price Setting, and Taxes419 Questions

Exam 5: Externalities, Environmental Policy, and Public Goods266 Questions

Exam 6: Elasticity: the Responsiveness of Demand and Supply295 Questions

Exam 7: The Economics of Health Care334 Questions

Exam 8: Firms, the Stock Market, and Corporate Governance278 Questions

Exam 9: Comparative Advantage and the Gains From International Trade379 Questions

Exam 10: Consumer Choice and Behavioral Economics302 Questions

Exam 11: Technology, Production, and Costs330 Questions

Exam 12: Firms in Perfectly Competitive Markets298 Questions

Exam 13: Monopolistic Competition: the Competitive Model in a More Realistic Setting276 Questions

Exam 14: Oligopoly: Firms in Less Competitive Markets262 Questions

Exam 15: Monopoly and Antitrust Policy271 Questions

Exam 16: Pricing Strategy263 Questions

Exam 17: The Markets for Labor and Other Factors of Production286 Questions

Exam 18: Public Choice, Taxes, and the Distribution of Income258 Questions

Exam 19: GDP: Measuring Total Production and Income266 Questions

Exam 20: Unemployment and Inflation292 Questions

Exam 21: Economic Growth, the Financial System, and Business Cycles257 Questions

Exam 22: Long-Run Economic Growth: Sources and Policies268 Questions

Exam 23: Aggregate Expenditure and Output in the Short Run306 Questions

Exam 24: Aggregate Demand and Aggregate Supply Analysis284 Questions

Exam 25: Money, Banks, and the Federal Reserve System280 Questions

Exam 26: Monetary Policy277 Questions

Exam 27: Fiscal Policy303 Questions

Exam 28: Inflation, Unemployment, and Federal Reserve Policy257 Questions

Exam 29: Macroeconomics in an Open Economy278 Questions

Exam 30: The International Financial System262 Questions

Select questions type

In the United States, the largest source of funds for public schools is

(Multiple Choice)

4.8/5  (35)

(35)

Which of the following is used to argue that the self-interest of public policymakers will often lead to actions that are inconsistent with the preferences of the voters they represent?

(Multiple Choice)

4.7/5  (45)

(45)

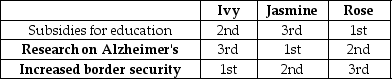

Table 18-1

Suppose $1 billion is available in the budget and Congress is considering allocating the funds to one of the following three alternatives: 1) Subsidies for education, 2) Research on Alzheimer's or 3) Increased border security. Table 18-1 shows three voters' rankings of the alternatives.

-Refer to Table 18-1. Suppose a series of votes are taken in which each pair of alternatives is considered in turn. If the vote is between allocating funds to subsidies for education and research on Alzheimer's,

Suppose $1 billion is available in the budget and Congress is considering allocating the funds to one of the following three alternatives: 1) Subsidies for education, 2) Research on Alzheimer's or 3) Increased border security. Table 18-1 shows three voters' rankings of the alternatives.

-Refer to Table 18-1. Suppose a series of votes are taken in which each pair of alternatives is considered in turn. If the vote is between allocating funds to subsidies for education and research on Alzheimer's,

(Multiple Choice)

4.9/5  (39)

(39)

Which of the following summarizes the information provided by a Lorenz curve?

(Multiple Choice)

4.9/5  (36)

(36)

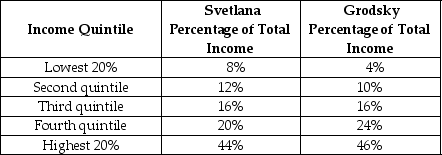

Table 18-11

Table 18-11 shows income distribution data for two countries. Use this data to answer the following questions.

-Refer to Table 18-11.

a. Draw a Lorenz curve for each country.

b. Which country has the more equal distribution of income?

c. Based on the Lorenz curve for the two countries, can you determine which country has the more progressive tax system? Explain your answer.

Table 18-11 shows income distribution data for two countries. Use this data to answer the following questions.

-Refer to Table 18-11.

a. Draw a Lorenz curve for each country.

b. Which country has the more equal distribution of income?

c. Based on the Lorenz curve for the two countries, can you determine which country has the more progressive tax system? Explain your answer.

(Essay)

4.9/5  (42)

(42)

Financial contributions to the campaigns of members of Congress, state legislators and other elected officials by firms that seek special interest legislation that make the firms better off are

(Multiple Choice)

4.8/5  (34)

(34)

What is the difference between a marginal tax rate and an average tax rate? Which is more important in determining the impact of the tax system on economic behavior?

(Essay)

4.8/5  (36)

(36)

The public choice model assumes that government policy makers

(Multiple Choice)

4.9/5  (44)

(44)

Article Summary

In 2012, Colorado and Washington legalized marijuana for recreational use, and one of the major selling points in each state's pro-marijuana campaign was the possibility of generating millions of dollars in tax revenue from sales which could be used for funding general education. The Colorado legislature was weighing a proposal to tax marijuana at 30 percent, of which 15 percent would be a sales tax on consumers and 15 percent an excise tax on growers. Washington has set a tax rate of 44 percent on consumers and 25 percent each for growers and retailers. Since the legalization of marijuana is relatively new, projecting the economic impact of its sale is difficult, leading to many questions as to the quantities that will be produced and sold and what actual tax revenues will be generated.

Source: Elizabeth Dwoskin, "Colorado and Washington Try to Figure Out How to Tax Marijuana," Bloomberg Businessweek, April 26, 2013.

-Between 1980 and 2011, income inequality in the United States has increased in part due to rapid technological change. How does technological change contribute to income inequality?

(Multiple Choice)

4.8/5  (37)

(37)

One argument advanced in favor of not increasing the income tax on individuals with high income is that

(Multiple Choice)

4.8/5  (29)

(29)

U.S. taxpayers spend many hours during the year maintaining records for tax purposes and preparing their income tax returns. This administrative cost

(Multiple Choice)

4.8/5  (34)

(34)

A tax imposed by a state or local government on retail sales of most products is

(Multiple Choice)

4.8/5  (34)

(34)

The corporate income tax is ultimately paid by all of the following except

(Multiple Choice)

4.9/5  (42)

(42)

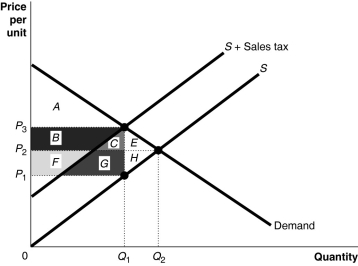

Figure 18-1  -Refer to Figure 18-1. The sales tax revenue collected by the government is represented by the area

-Refer to Figure 18-1. The sales tax revenue collected by the government is represented by the area

(Multiple Choice)

4.8/5  (38)

(38)

Consider a public good such as fire protection services. Rich people may benefit more than the poor from such a service because rich people stand to lose more from a fire that destroys property. In this case,

(Multiple Choice)

4.7/5  (38)

(38)

Policymakers focus on marginal tax rate changes when making changes in the tax code because the marginal tax rate

(Multiple Choice)

4.8/5  (28)

(28)

Showing 241 - 258 of 258

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)