Exam 18: Public Choice, Taxes, and the Distribution of Income

Exam 1: Economics: Foundations and Models444 Questions

Exam 2: Trade-Offs, Comparative Advantage, and the Market System498 Questions

Exam 3: Where Prices Come From: the Interaction of Demand and Supply475 Questions

Exam 4: Economic Efficiency, Government Price Setting, and Taxes419 Questions

Exam 5: Externalities, Environmental Policy, and Public Goods266 Questions

Exam 6: Elasticity: the Responsiveness of Demand and Supply295 Questions

Exam 7: The Economics of Health Care334 Questions

Exam 8: Firms, the Stock Market, and Corporate Governance278 Questions

Exam 9: Comparative Advantage and the Gains From International Trade379 Questions

Exam 10: Consumer Choice and Behavioral Economics302 Questions

Exam 11: Technology, Production, and Costs330 Questions

Exam 12: Firms in Perfectly Competitive Markets298 Questions

Exam 13: Monopolistic Competition: the Competitive Model in a More Realistic Setting276 Questions

Exam 14: Oligopoly: Firms in Less Competitive Markets262 Questions

Exam 15: Monopoly and Antitrust Policy271 Questions

Exam 16: Pricing Strategy263 Questions

Exam 17: The Markets for Labor and Other Factors of Production286 Questions

Exam 18: Public Choice, Taxes, and the Distribution of Income258 Questions

Exam 19: GDP: Measuring Total Production and Income266 Questions

Exam 20: Unemployment and Inflation292 Questions

Exam 21: Economic Growth, the Financial System, and Business Cycles257 Questions

Exam 22: Long-Run Economic Growth: Sources and Policies268 Questions

Exam 23: Aggregate Expenditure and Output in the Short Run306 Questions

Exam 24: Aggregate Demand and Aggregate Supply Analysis284 Questions

Exam 25: Money, Banks, and the Federal Reserve System280 Questions

Exam 26: Monetary Policy277 Questions

Exam 27: Fiscal Policy303 Questions

Exam 28: Inflation, Unemployment, and Federal Reserve Policy257 Questions

Exam 29: Macroeconomics in an Open Economy278 Questions

Exam 30: The International Financial System262 Questions

Select questions type

A Lorenz curve summarizes the information provided by a Gini coefficient.

(True/False)

4.7/5  (36)

(36)

Suppose the government imposes an 8 percent sales tax on clothing items and the tax is levied on sellers. Who pays for the tax in this situation? (Assume that the demand curve is downward sloping and that the supply curve is upward sloping.)

(Multiple Choice)

4.8/5  (38)

(38)

Absolute poverty measures vary from country to country. For example, in 2013, the poverty line in the United States for a family of four with two children was an annual income of $23,550 but economists often use a much lower threshold income of $1 per day when calculating the rate of poverty in poor countries. How is this absolute poverty measured?

(Multiple Choice)

4.9/5  (38)

(38)

In the United States, the federal income tax is an example of a

(Multiple Choice)

4.9/5  (35)

(35)

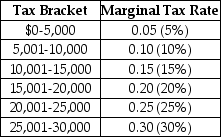

Last year, Anthony Millanti earned exactly $30,000 of taxable income. Assume that the income tax system used to determine Anthony's tax liability is progressive. The table below lists the tax brackets and the marginal tax rates that apply to each bracket.

a. Draw a new table that lists the amounts of income tax that Anthony is obligated to pay for each tax bracket, and the total tax he owes the government. (Assume that there are no allowable tax deductions, tax credits, personal exemptions or any other deductions that Anthony can use to reduce his tax liability).

b. Determine Anthony's average tax rate.

(Essay)

4.9/5  (39)

(39)

In 2012, which type of tax raised the most revenue for the U.S. federal government? Which type of tax raised the most revenue for state and local governments?

(Essay)

4.7/5  (38)

(38)

The Gini coefficient for the United States in 1980 was 0.403. In 2011, the coefficient was equal to 0.477. This means that

(Multiple Choice)

4.8/5  (38)

(38)

From 1970 to 2006, the poverty rate in East Asia rose slightly, but the level of poverty in sub-Saharan Africa fell dramatically.

(True/False)

4.8/5  (38)

(38)

Holding all other factors constant, income earned from capital is more unequally distributed than income earned from labor.

(True/False)

4.8/5  (37)

(37)

If you pay $2,000 in taxes on an income of $20,000, and a tax of $2,700 on an income of $30,000, then over this range of income the tax is

(Multiple Choice)

4.8/5  (37)

(37)

Between 1970 and 2006, the poverty rate in East Asia declined dramatically from about 60 percent to less than 2 percent, while the poverty rate in Sub-Saharan Africa decreased from 40 percent to only 32 percent. The main reason for this is that

(Multiple Choice)

4.8/5  (24)

(24)

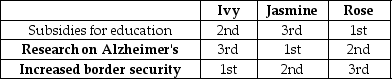

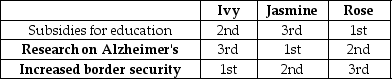

Table 18-1

Suppose $1 billion is available in the budget and Congress is considering allocating the funds to one of the following three alternatives: 1) Subsidies for education, 2) Research on Alzheimer's or 3) Increased border security. Table 18-1 shows three voters' rankings of the alternatives.

-Refer to Table 18-1. Suppose a series of votes are taken in which each pair of alternatives is considered in turn. The first pair considered is between subsidies for education and research on Alzheimer's. The second pair considered is between Alzheimer's research and increased border security. The third pair considered is between education subsidies and increased border security. In this case, the collective preferences of the voters

Suppose $1 billion is available in the budget and Congress is considering allocating the funds to one of the following three alternatives: 1) Subsidies for education, 2) Research on Alzheimer's or 3) Increased border security. Table 18-1 shows three voters' rankings of the alternatives.

-Refer to Table 18-1. Suppose a series of votes are taken in which each pair of alternatives is considered in turn. The first pair considered is between subsidies for education and research on Alzheimer's. The second pair considered is between Alzheimer's research and increased border security. The third pair considered is between education subsidies and increased border security. In this case, the collective preferences of the voters

(Multiple Choice)

4.8/5  (22)

(22)

The proposition that the outcome of a majority vote is likely to represent the preferences of the voter who is in the political middle is called

(Multiple Choice)

5.0/5  (39)

(39)

Table 18-1

Suppose $1 billion is available in the budget and Congress is considering allocating the funds to one of the following three alternatives: 1) Subsidies for education, 2) Research on Alzheimer's or 3) Increased border security. Table 18-1 shows three voters' rankings of the alternatives.

-Suppose $1 billion is available in the budget and Congress is considering allocating the funds to one of the following three alternatives: a. subsidies for education

B. research on Alzheimer's

C. increased border security

If voters prefer a to b and b to c, then if preferences are transitive,

Suppose $1 billion is available in the budget and Congress is considering allocating the funds to one of the following three alternatives: 1) Subsidies for education, 2) Research on Alzheimer's or 3) Increased border security. Table 18-1 shows three voters' rankings of the alternatives.

-Suppose $1 billion is available in the budget and Congress is considering allocating the funds to one of the following three alternatives: a. subsidies for education

B. research on Alzheimer's

C. increased border security

If voters prefer a to b and b to c, then if preferences are transitive,

(Multiple Choice)

4.9/5  (29)

(29)

Rent-seeking behavior, unlike profit-maximizing behavior in competitive markets, wastes society's scarce resources.

(True/False)

4.9/5  (37)

(37)

Showing 81 - 100 of 258

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)