Exam 2: Analyzing and Recording Transactions

Exam 1: Accounting in Business245 Questions

Exam 2: Analyzing and Recording Transactions201 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements227 Questions

Exam 4: Completing the Accounting Cycle177 Questions

Exam 5: Accounting for Merchandising Operations189 Questions

Exam 6: Inventories and Cost of Sales194 Questions

Exam 7: Accounting Information Systems166 Questions

Exam 8: Cash and Internal Controls195 Questions

Exam 9: Accounting for Receivables162 Questions

Exam 10: Long-Term Assets208 Questions

Exam 11: Current Liabilities and Payroll Accounting178 Questions

Exam 12: Accounting for Partnerships141 Questions

Exam 13: Accounting for Corporations210 Questions

Exam 14: Long-Term Liabilities158 Questions

Exam 15: Investments and International Operations156 Questions

Exam 16: Statement of Cash Flows173 Questions

Exam 17: Analysis of Financial Statements182 Questions

Exam 18: Managerial Accounting Concepts and Principles199 Questions

Exam 19: Job Order Cost Accounting165 Questions

Exam 20: Process Cost Accounting172 Questions

Exam 21: Cost Allocation and Performance Measurement173 Questions

Exam 22: Cost-Volume-Profit Analysis190 Questions

Exam 23: Master Budgets and Planning166 Questions

Exam 24: Flexible Budgets and Standard Costs178 Questions

Exam 25: Capital Budgeting and Managerial Decisions153 Questions

Select questions type

The three general categories of accounts in a general ledger are _________________, ________________, and _________________________.

(Essay)

4.8/5  (43)

(43)

For each of the following (1) identify the type of account as an asset, liability, equity, revenue, or expense, and (2) identify the normal balance of the account.

(Essay)

4.8/5  (35)

(35)

Generally, the ordering of accounts in a trial balance typically follows their identification number from the chart of accounts, that is, assets first, then liabilities, then owner's capital and withdrawals, followed by revenues and expenses.

(True/False)

4.8/5  (35)

(35)

The higher a company's debt ratio is, the higher the risk of a company not being able to meet its obligations.

(True/False)

4.9/5  (35)

(35)

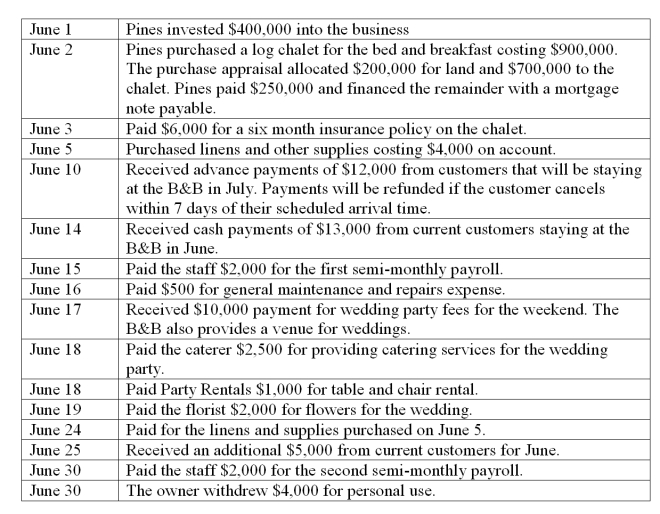

Tom Pines decided to open a bed and breakfast in his hometown. Prepare journal entries to record the following transactions.

(Essay)

4.7/5  (30)

(30)

A transaction that increases an asset and decreases a liability must also affect one or more other accounts.

(True/False)

4.8/5  (38)

(38)

Analyze each transaction and event from source documents.

2. Record relevant transactions and events in a journal.

3. Post journal entry information to ledger accounts.

4. Prepare and analyze the trial balance.

(Essay)

4.7/5  (36)

(36)

All of the following statements regarding a sales invoice are except:

(Multiple Choice)

4.7/5  (33)

(33)

On February 5, Textron Stores purchased a van that cost $35,000. The firm made a down payment of $5,000 cash and signed a long-term note payable for the balance. Show the general journal entry to record this transaction.

(Essay)

4.8/5  (31)

(31)

Hal Smith opened Smith's Repairs on March 1 of the current year. During March, the following transactions occurred and were recorded in the company's books: 1. Smith invested $25,000 cash in the business.

2) Smith contributed $100,000 of equipment to the business.

3) The company paid $2,000 cash to rent office space for the month.

4) The company received $16,000 cash for repair services provided during March.

5) The company paid $6,200 for salaries for the month.

6) The company provided $3,000 of services to customers on account.

7) The company paid cash of $500 for monthly utilities.

8) The company received $3,100 cash in advance of providing repair services to a customer.

9) Smith withdrew $5,000 for his personal use from the company.

Based on this information, net income for March would be:

(Multiple Choice)

4.9/5  (33)

(33)

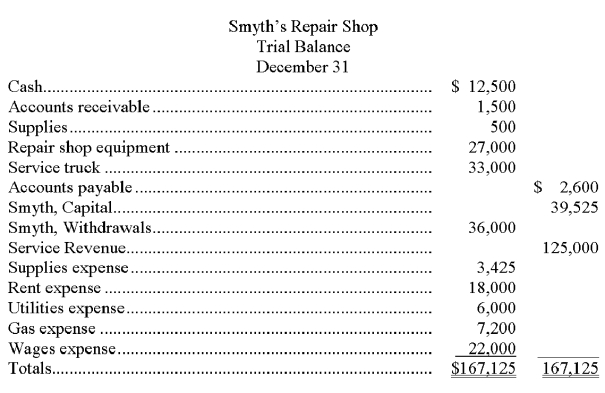

Based on the following trial balance for Smyth's Repair Shop, prepare an income statement, statement of owner's equity, and a balance sheet. Smyth made no additional investments in the company during the year.

(Essay)

4.9/5  (28)

(28)

_______________ is the process of transferring journal entry information to the ledger.

(Essay)

5.0/5  (36)

(36)

Indicate whether a debit or credit entry would be made to record the following changes in each account.

a. To decrease Cash.

b. To increase Owner, Capital.

c. To decrease Accounts Payable.

d. To increase Salaries Expense.

e. To decrease Supplies.

f. To increase Revenue.

g. To decrease Accounts Receivable.

h. To increase Owner, Withdrawals.

(Essay)

4.7/5  (32)

(32)

A formal promise to pay (in the form of a promissory note) a future amount is a(n):

(Multiple Choice)

4.9/5  (36)

(36)

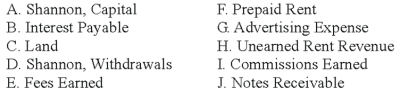

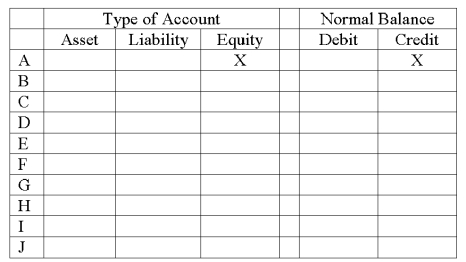

The following is a list of accounts and identification letters A through J for Shannon Management Co.:

Use the form below to identify the type of account and its normal balance. The first item is filled in as an example.

(Essay)

4.9/5  (31)

(31)

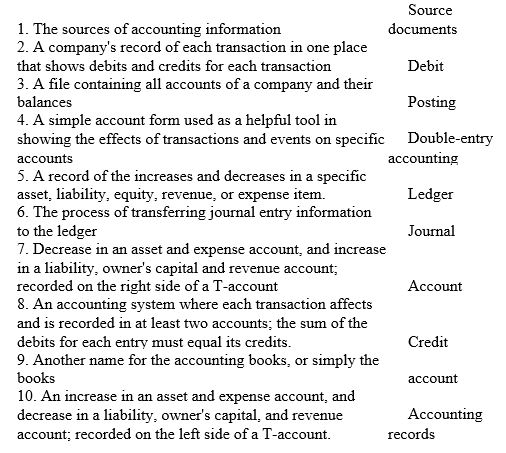

Match the following definitions and terms by placing the letter that identifies the best definition in the blank space next to the term.

(Essay)

4.8/5  (32)

(32)

Showing 41 - 60 of 201

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)